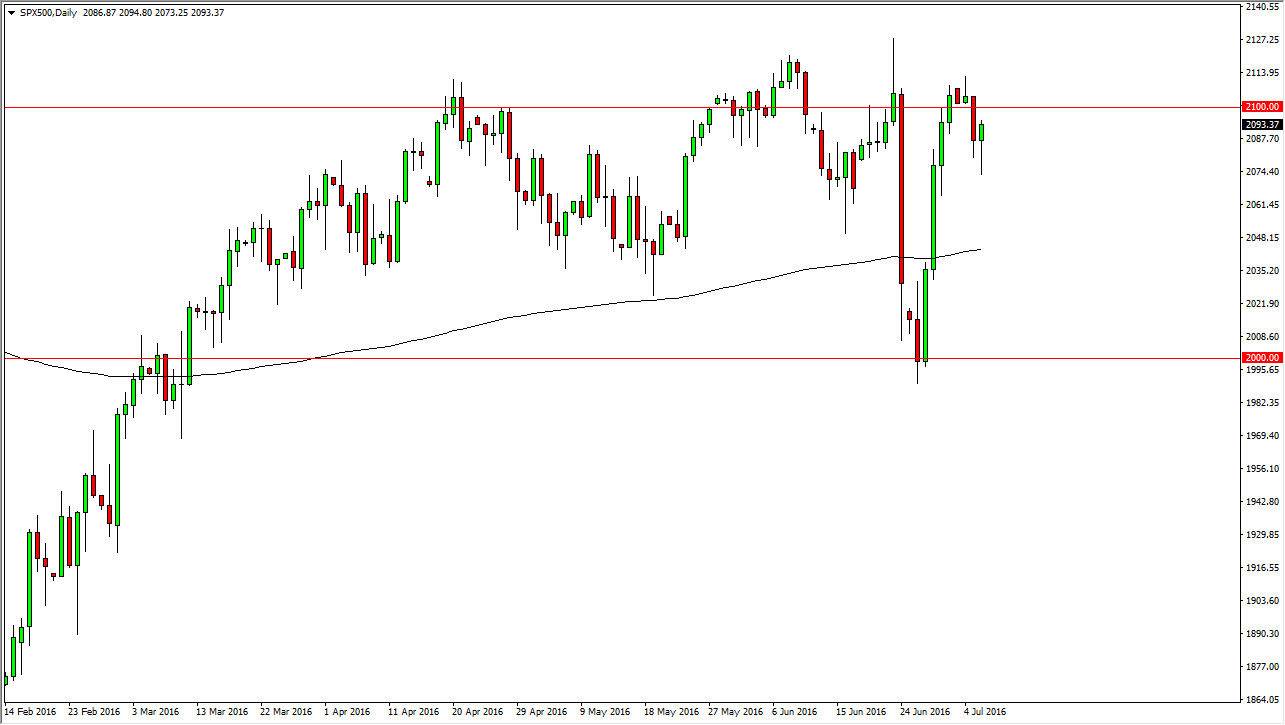

S&P 500

The S&P 500 initially fell during the course of the session on Wednesday, but turned right back around to form a nice-looking hammer. The hammer is just below the 2100 level, which has been important in the past. I believe that the market continues to find plenty of buyers below, and the hammer of course does nothing to dissuade that type of thinking. Yes, we are towards the top of the overall consolidation area, but I do think that we are building up momentum to finally break out to the upside. As you can see on the chart, I have a 200 day exponential moving average market, and it is below but I think that it is essentially going to be the “floor” in this market.

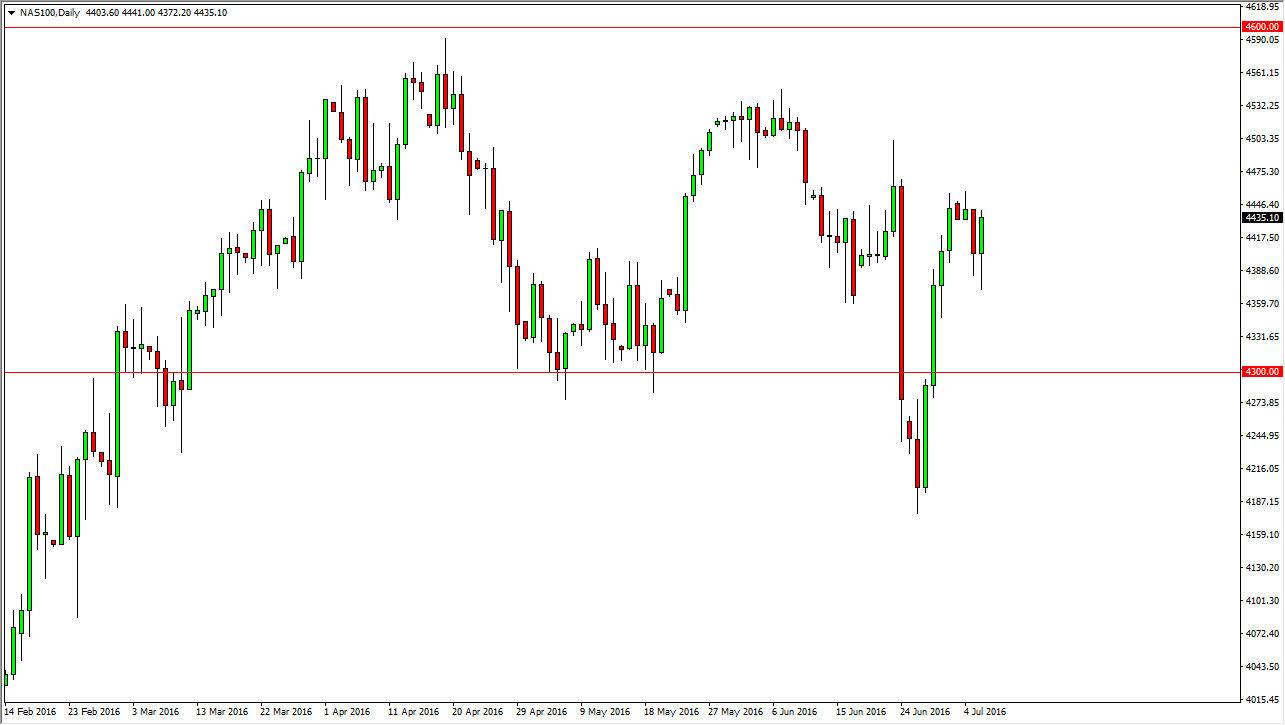

NASDAQ 100

The NASDAQ 100 initially fell during the course of the day but turned right back around to form a candle that looks very positive. It’s not really a hammer, but it does look very important. If we can break above the 4450 handle, I feel that we could continue to go higher. Pullbacks at this point in time should continue to be very supportive, as there is quite a bit of support near the 4400 level.

Ultimately, I do believe that the “floor” in this market is the 4300 level, so it’s going to be difficult to imagine that the markets are going to sell off significantly. At this point in time, every time we sell off I think that we will find people looking for value, as stock markets in general have continued to perform fairly well. That’s not to say that it won’t be choppy or difficult to deal with at times, but given enough time it’s more than likely going to be bullish overall. With this, the NASDAQ 100 has been a laggard when it comes to the US indices on the whole. With this, I feel that this market needs to catch up.