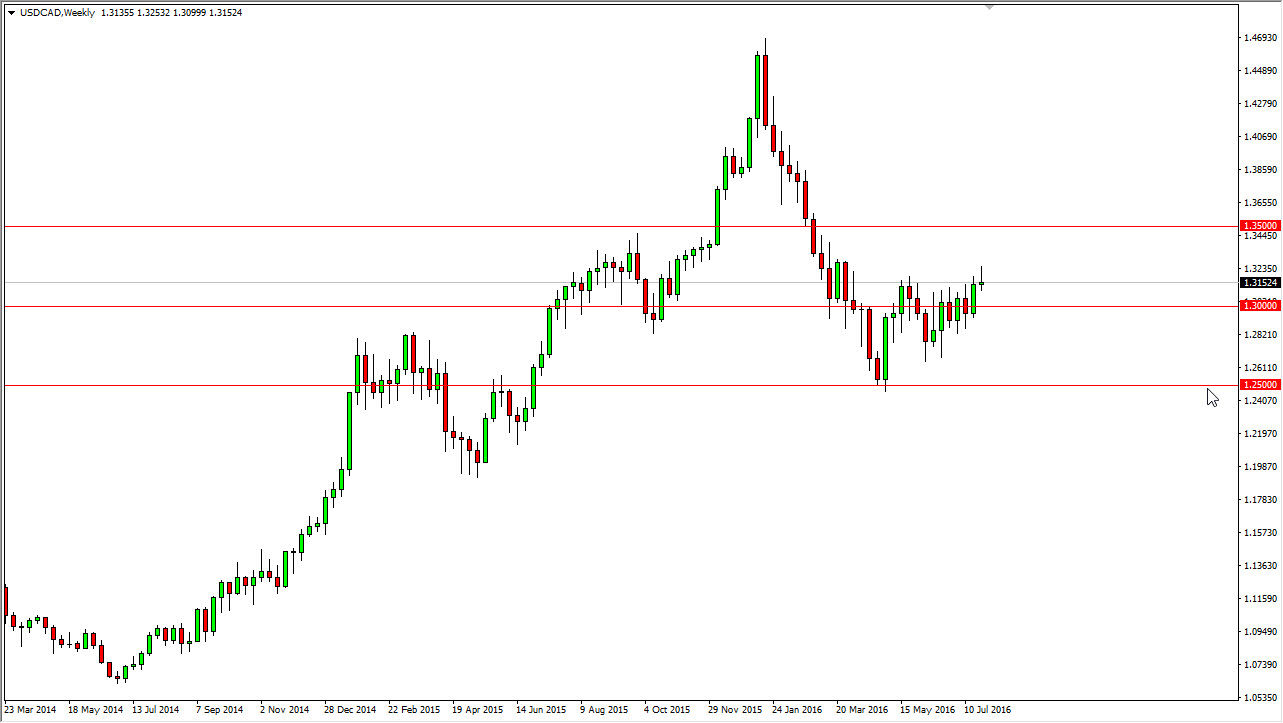

The USD/CAD pair has been grinding higher for some time now, and as a result I think we are eventually going to try to break out to the upside. The Canadian dollar is obviously highly influenced by the crude oil markets, which of course have been fairly negative as of late. I believe that the oil markets will continue to fall going forward, so this should continue to push quite a bit of pressure on the Canadian dollar itself. With this, I believe that over the course of the next several weeks, we could very well grind our way to the 1.35 handle. With this, I believe that grind is the key word here. With this being the case, the market will probably offer short-term buying opportunities time and time again, or you could hang onto the trade to the upside if you can do with that type of volatility.

Oil markets

Oil markets are suffering due to a lack of demand, and of course the strengthening US dollar in general. With this being the case, I believe that the only way you can go as higher in this market but I also recognize that it might be very difficult to hang onto. The 1.30 level below should be massively supportive, and as a result it’s very likely that we will be able to go to this market again and again.

I do not anticipate that the 1.35 level above will get broken, at least not this month. This is a fairly quiet month, but as long as the crude oil markets look fairly soft, it seems very unlikely that the Canadian dollar will fall against most currencies, not just the US dollar. With this, I believe that sooner or later you will be rewarded on short-term buying opportunities. We are more than likely going to see real momentum after August is done, but we could be setting up for the move higher over the next several weeks.