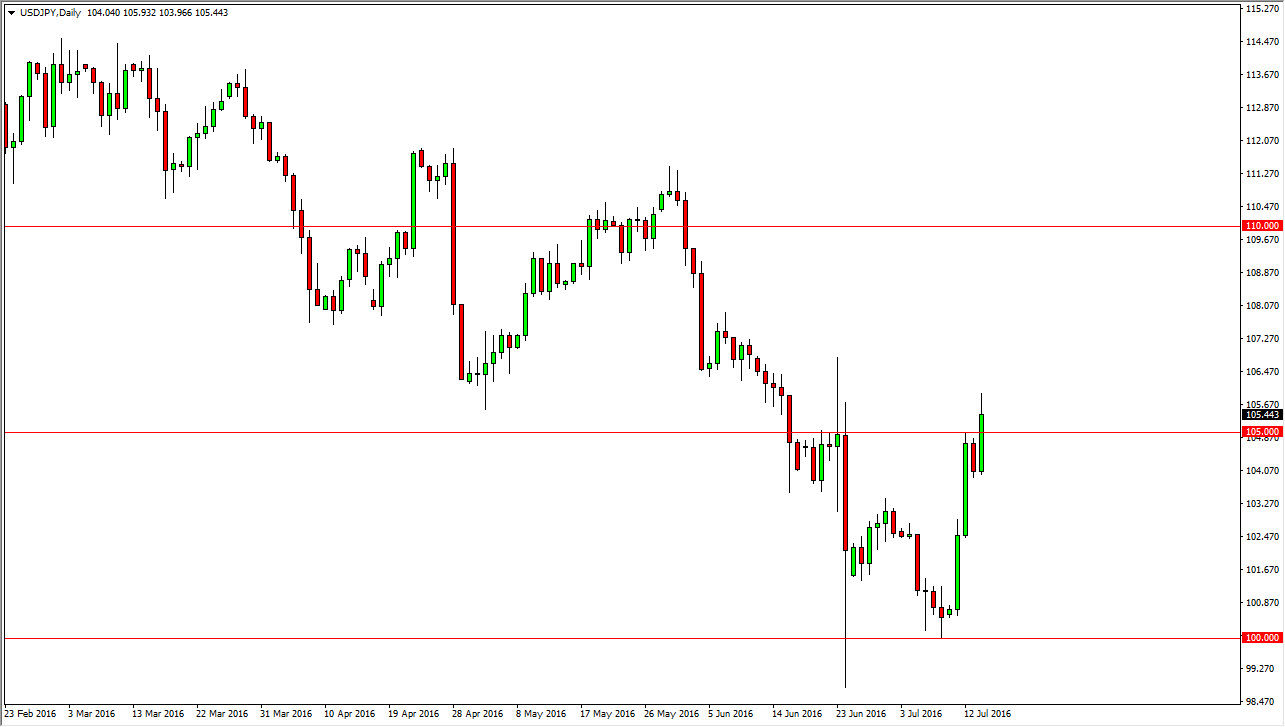

USD/JPY

The USD/JPY pair broke higher during the course of the day on Thursday, finally getting above the 105 level. This is an area that has been resistive in the past, and the fact that we can break above there again is an encouraging sign. However, I believe that waiting until we can break above the top of the range for the day on Thursday to start going long is probably prudent as there should be a lot of noise above. I am not looking for a straight shot higher, but realize that fear of the Bank of Japan has taken over the markets, as there is the possibility of stimulus or even worse, currency intervention if we fall too far. With this in mind, I have no interest in selling at this point in time I believe the pullbacks could very well offer buying opportunities on signs of support below as well.

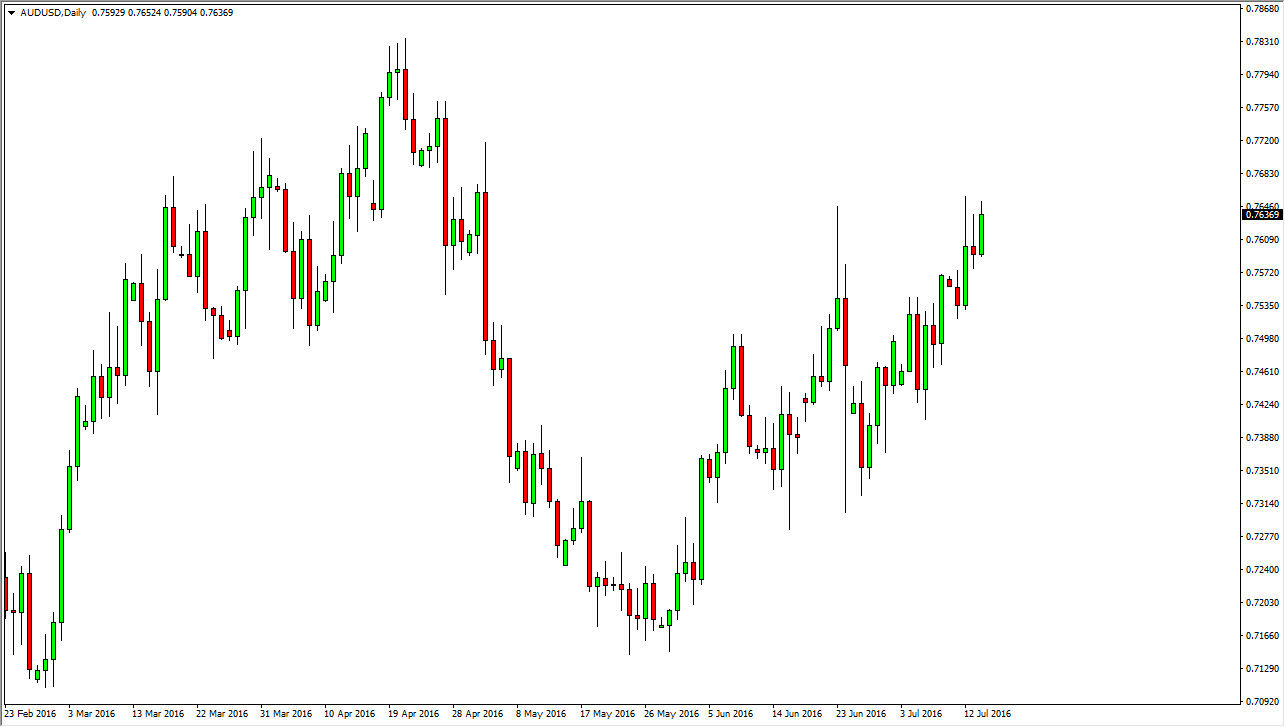

AUD/USD

The Australian dollar continues to grind higher during the session on Thursday, and quite frankly that’s the key word here: grind. I don’t think that were going to go higher with any sense of urgency, because although the gold markets have look fairly healthy, the reality is that the Australian dollar tends to be a bit of a “risk asset.” At this point in time, there are a lot of concerns about what’s going on in Asia, and of course the Australian dollar is a bit of a proxy for that region. Also, you have other commodities that the Australian dollar is very sensitive to, namely copper. Although copper has rallied recently, it is still historically low and therefore demand for the Australian dollar is been affected by that as well.

With this, I believe that we will eventually go higher, and that there could be a bit of a soft floor at the 0.75 level, but I’m not willing to hang onto a trade for any real length of time here that has considerable size to it.