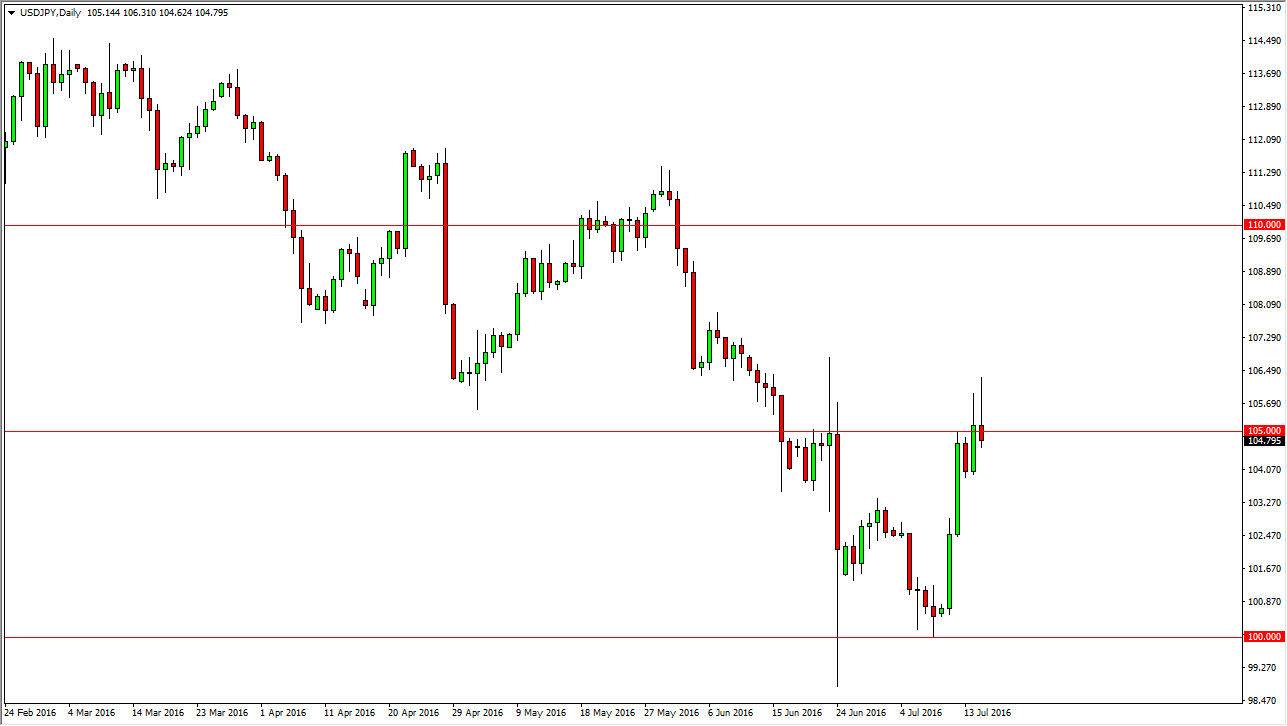

USD/JPY

The dollar rose well above the 105 level against the Japanese yen during the day on Friday, but as you can see turned right back around to form a shooting star. I believe this means that we are not ready to go higher, and that we will more than likely pullback a little bit. I don’t necessarily think that the trend is going to change to the downside again, but I do recognize that we could very easily fall to the 103 level in the short-term. On a break below the bottom of the shooting star I think that the sellers will take over for a moment, and quite frankly that’s probably needed after this knee-jerk reaction that had occurred early in the week. On the other hand, if we break above the top of the shooting star for the session on Friday, I think the buyers will jump in and start pushing even harder.

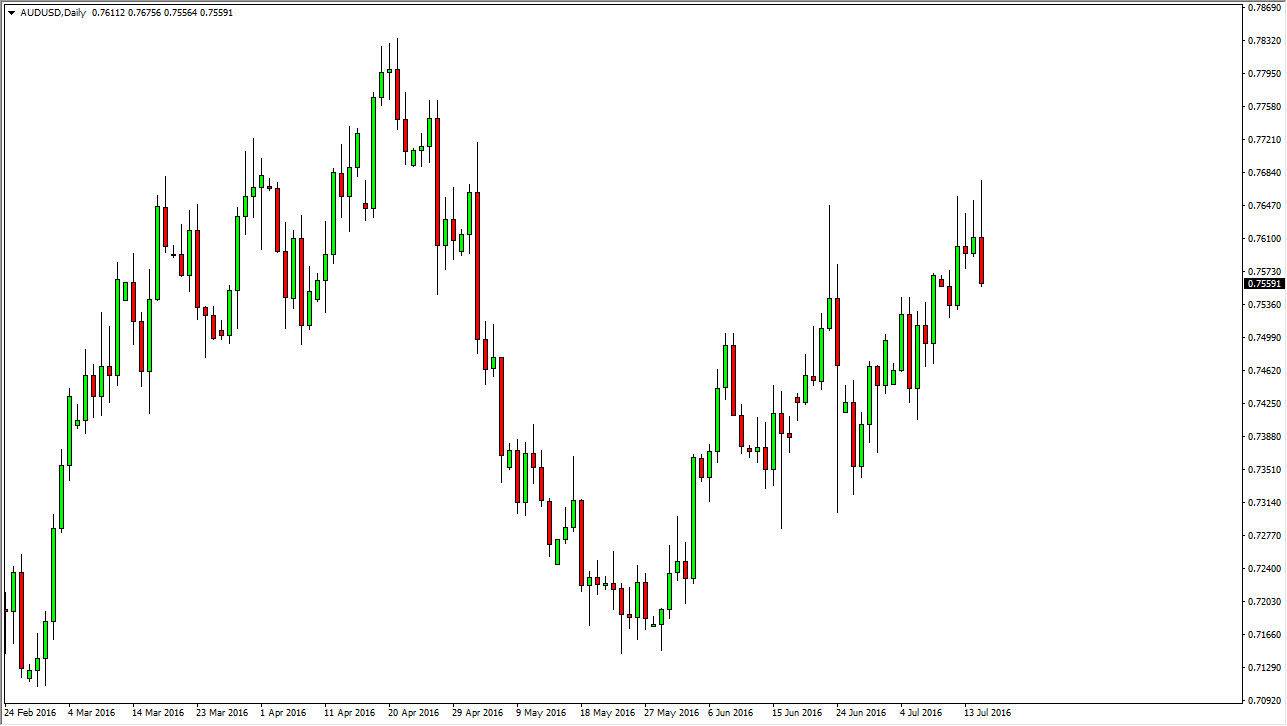

AUD/USD

The AUD/USD pair initially rallied during the day on Friday but turned back around to form a rather negative looking candle. Preceded by a couple of shooting stars, this isn’t necessarily a huge surprise. However, I do feel that there will be a little bit of a soft at the bottom at the 0.75 level that could cause a little bit of support. I’m not saying that we can go below there, quite frankly I don’t think it would take much but I would anticipate that there will be some buyers in that region.

Gold markets looks somewhat healthy lately and this of course can have a positive influence on the Aussie dollar as well. Because of this, I bit hesitant to sell this market for any real length of time, but quite frankly I don’t have any reason to buy it either. I believe that short-term selling is possible, but I would be very quick to take profits if I find myself selling.