USD/JPY

The USD/JPY pair fell slightly during the course of the day on Friday, but quite frankly I don’t have any interest in selling this pair. I believe that the Bank of Japan is going to continue to monitor this pair, and quite frankly will probably draw a bit of a “line in the sand” near the 100 handle. I believe that if we get below that level for any significant amount of time, the Bank of Japan will intervene. With that, this is essentially a “buy only” pair, but we don’t have the signal to do so quite yet.

I think that you can’t buy this pair, but you have to treat it as an investment and not a trade. It will be a lot of volatility, and quite frankly there’s a lot of concerns as to the fact that this pair seems to be very sensitive to risk appetite. So having said that, I would keep small positions in play if you feel the need to go long.

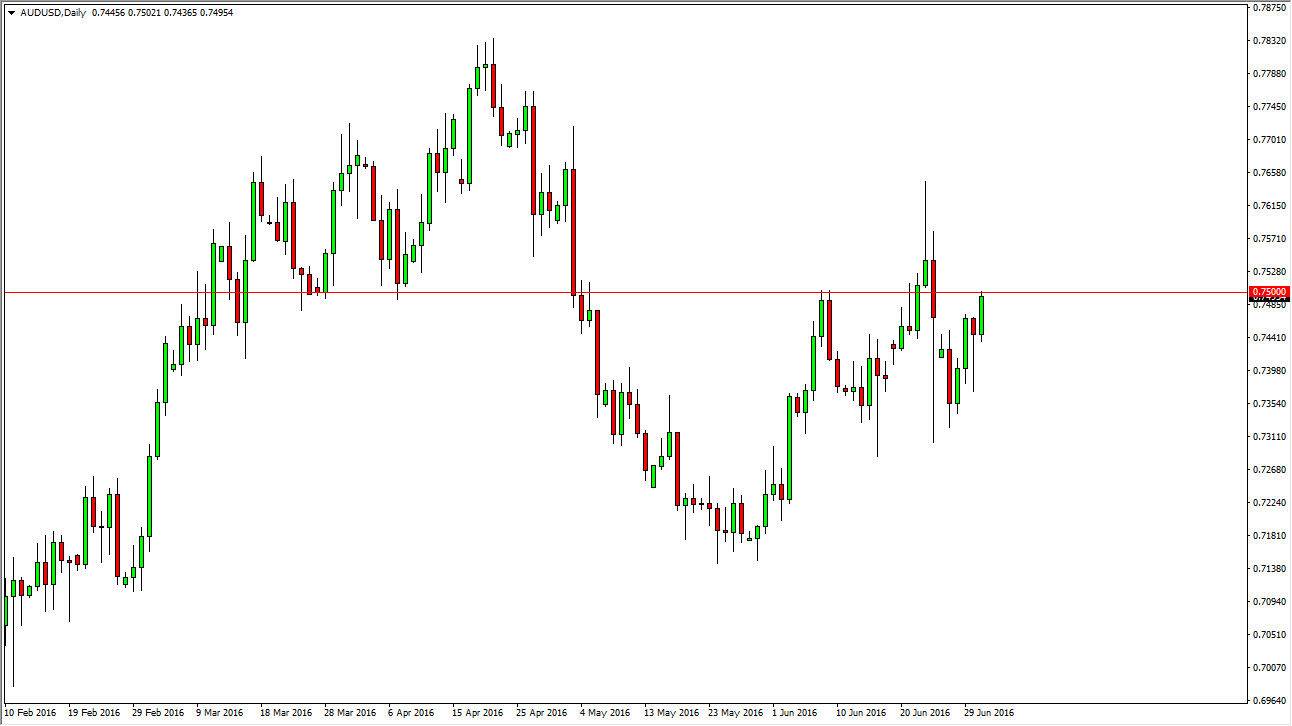

AUD/USD

The AUD/USD pair rallied during the day on Friday, slamming into the 0.75 handle. This is a large, round, psychologically significant number that should attract a lot of attention, and as a result I believe that traders will more than likely take quite a bit of attention. However, I do see a massive shooting star from last week that I think will continue to offer a bit of resistance so having said that I expect a lot of choppy action in this general vicinity. The 0.75 level has been significant historically anyway, so I think it’s only a matter of time before traders get involved.

At this point, I suspect we will get a lot of back and forth type of volatility and a clear trade probably won’t be found right away. I will of course continue to monitor this pair, and I am very cognizant of the fact that gold going higher and that can drive the Aussie higher as well.