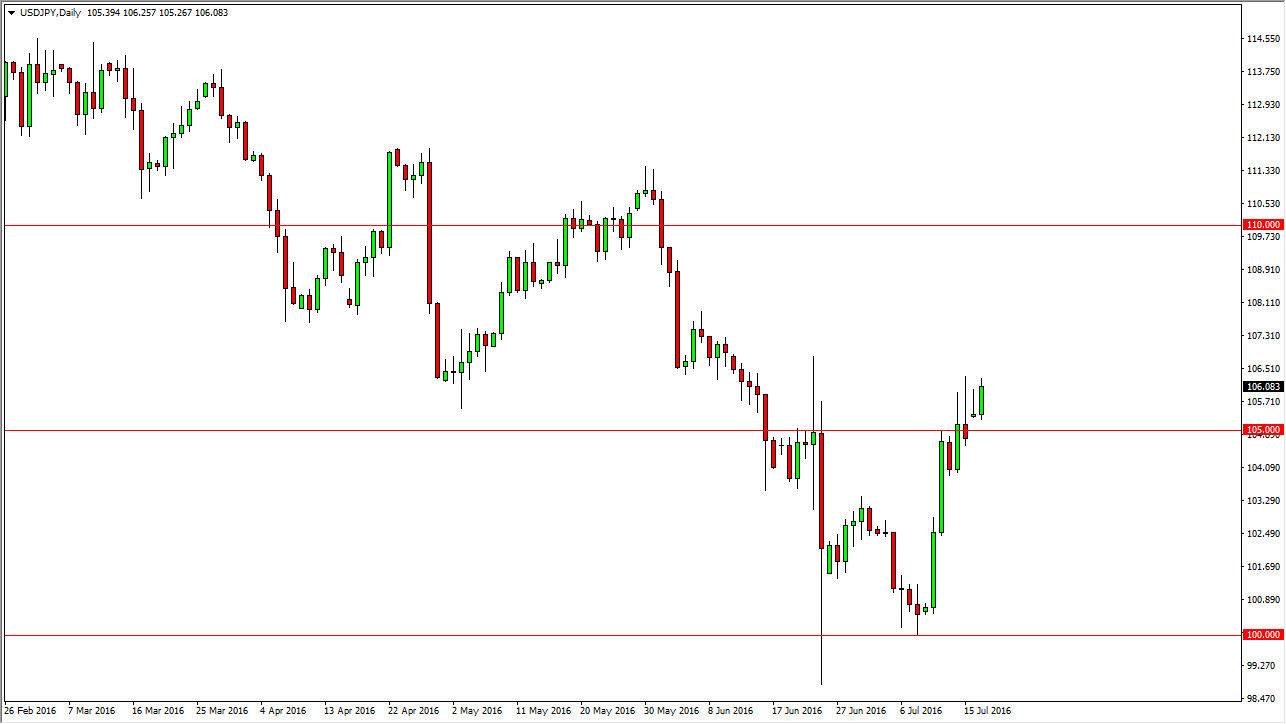

USD/JPY

The USD/JPY pair broke higher during the course of the session here on Monday, testing the top of the shooting star from the Friday session. If we can break above there, I feel that the market will continue to go much higher as it shows a real break of resistance by the bullish traders out there. This is a market that of course has to deal with the Bank of Japan and its displeasure of an extraordinarily strong Yen, so I believe that we will continue to see buyers in this market as there is a real threat of the Bank of Japan doing something if we fall. With this, the market looks as if it is one that you can only buy, and a pullback could offer value on signs of support that you can take advantage of.

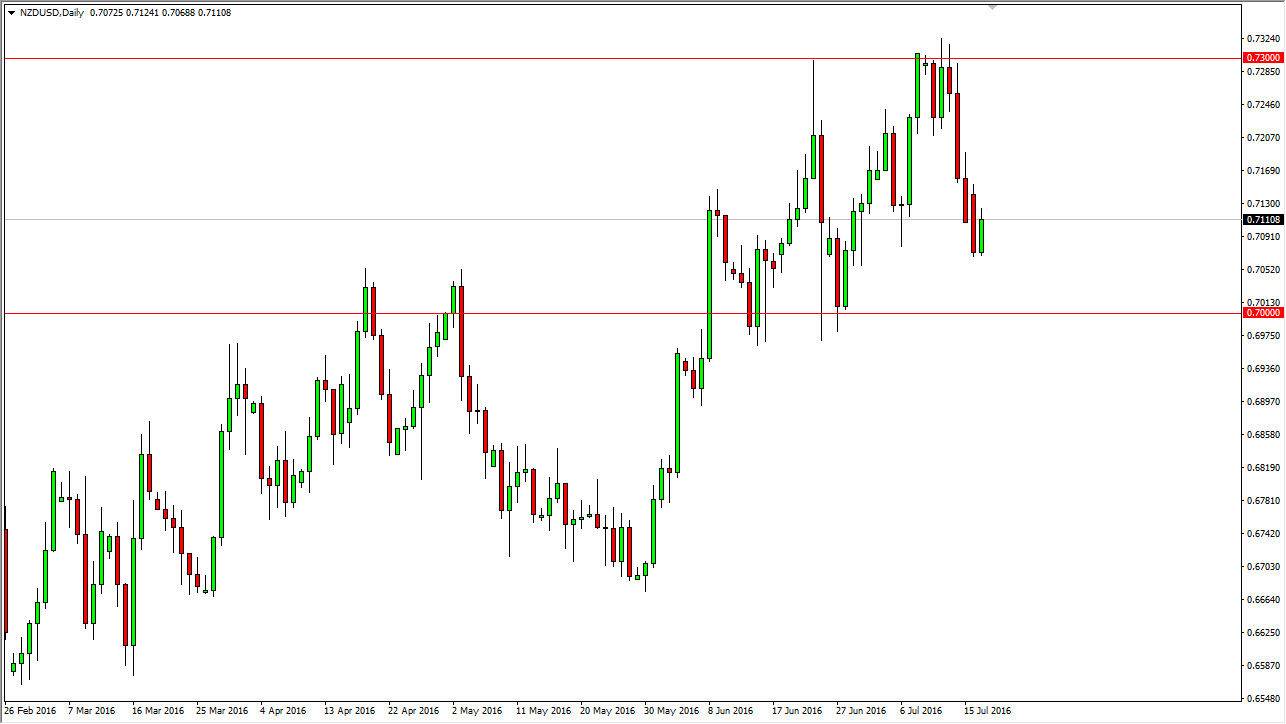

NZD/USD

The NZD/USD pair bounced slightly during the course the day on Monday, but at the end of the day I am a bit leery of buying this pair because we are not near the bottom support level. There is the possibility of a potential uptrend line, but I am not convinced of it quite yet. With this, I feel that the market finds real support at the 0.70 level, and a supportive candle in that area would be much more enticing for me. I do recognize that a break above the top of the range for the session on Monday would be a bullish sign as well, perhaps reaching towards the 0.73 level given enough time. Ultimately though, this is a market that will of course continue to be volatile as we continue to debate on whether or not the global economy is showing signs of strength. After all, there are a lot of mixed signals at the moment, and this will continue to play havoc with the slightly less liquid New Zealand dollar. I don’t have any interest in selling though, so I’m simply looking for supportive candle below in order to take advantage of.