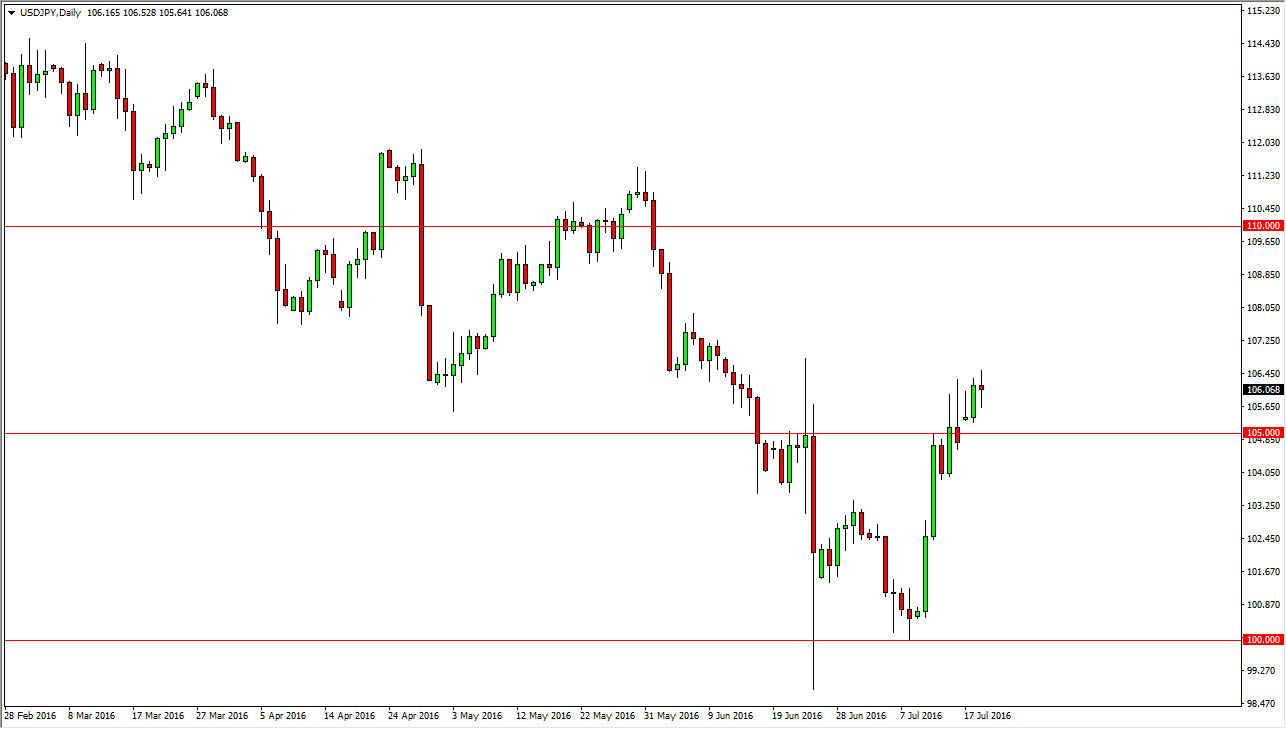

USD/JPY

The USD/JPY pair went back and forth during the course of the day on Tuesday, as we have shown quite a bit of neutrality during the day. The 105 level below was previously resistive, so it should now be supportive. On top of that, the Bank of Japan has been talking about the over valuation of the Japanese yen, so having said that it makes sense that the trading community will shy away from buying the Japanese yen. On top of that, we got a fairly strong jobs number, and that of course is normally pretty good for this pair as well. Ultimately, we should try to reach the 108 level, and then eventually the 110 level given enough time. I am selling this market at the moment.

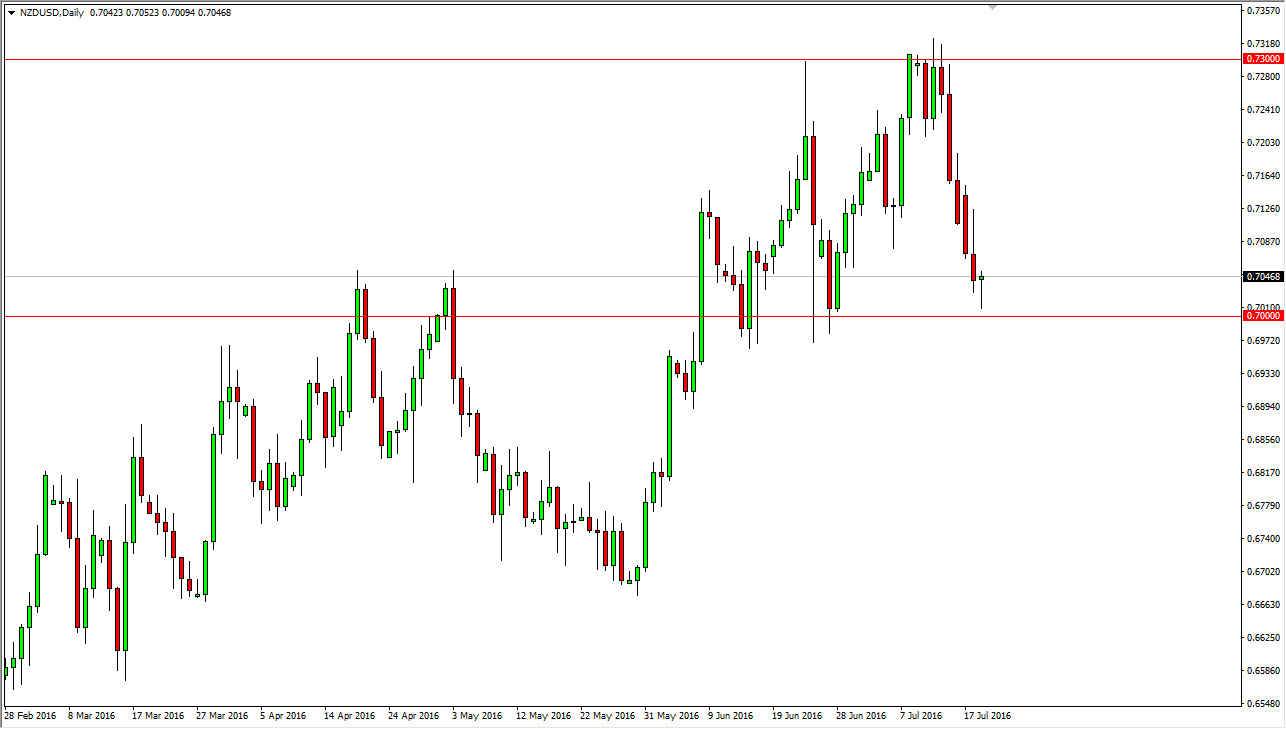

NZD/USD

The NZD/USD pair fell slightly during the course of the session on Tuesday, testing the 0.70 level. That’s an area that has been supportive in the past, so it makes sense that we bounce from there and ended up forming a hammer. The hammer of course is a very bullish sign, but we have a shooting star proceeding that from the Monday session. Because of that, it makes quite a bit of sense that we might have quite a bit of volatility in this area, and as a result you will have to be able to deal with this type of noise.

Nonetheless, I am a buyer on that break above the top of the hammer, and don’t have any real interest in selling. If we broke down below the 0.69 level though, that would be enough to get me to start selling again as the market will certainly have had quite a bit of bearish pressure showing up as it would be a significant breakdown of a massive support area. At this point though, it does look like it is going to go higher in the short-term.