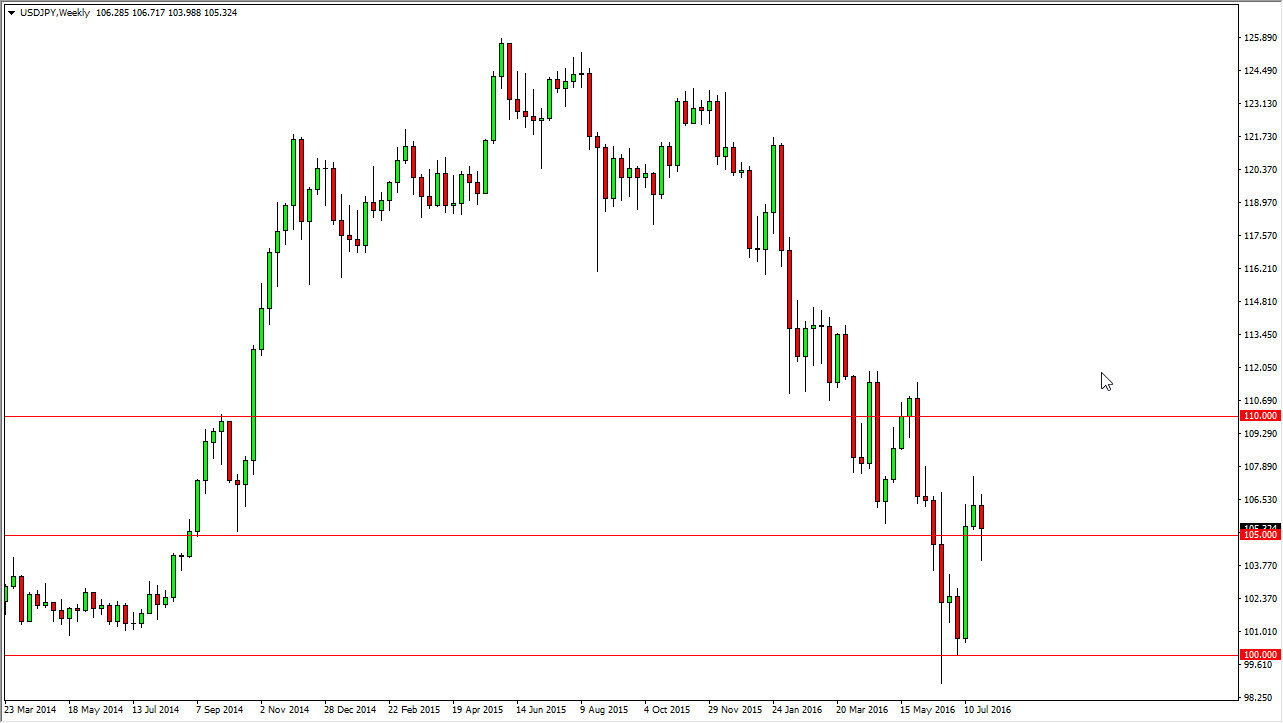

The USD/JPY pair fell during the last week of August, but found quite a bit of buying pressure just below the 105 level. We’ve recently seen a very impulsive weekly candle as the market skyrocketed from the 100 handle to roughly the 105 handle. I think this should continue to add buying pressure into this market, although I recognize that there is a lot of noise above. This is based mainly upon fear of the Bank of Japan and what they may or may not be able to do. At this point, it’s a pretty safe bet to think that the parity level, which in this pair is actually the 100 level, is probably about where the Bank of Japan loses its sense of humor. At that point, they will not hesitate whatsoever to intervene in the currency markets.

Bank of Japan

There is also talk of more quantitative easing so it’s likely that they will do what it takes to drive down the value of the yen, because quite frankly the Japanese economy essentially demands it as it is so export driven. The United States is one of its largest markets, and with that this is the pair that the Japanese paying the most attention to.

I think this month will be fairly difficult to deal with, because it will be very volatile. However, I do think that eventually we get strength and therefore I am more willing to buy dips than anything else going forward, and have no interest whatsoever in selling as it appears that the trend is trying to change again. One thing about this market that I do know is that every time we changed trends, it’s normally a very volatile affair. If you look back at historic charts, every time we get close to this area the Bank of Japan has acted and things have gotten very messy before eventually going higher. I think that’s what’s about to happen, but it’s going to be volatile this month.