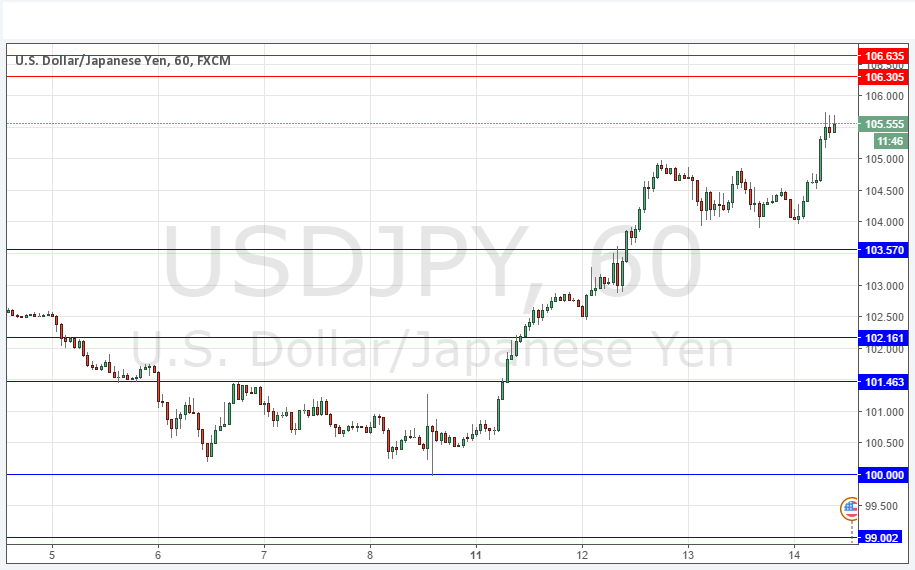

USD/JPY Signal Update

Yesterday’s signals were not triggered as the price never reached 103.57.

Today’s USD/JPY Signals

Risk 0.75%

Trades may only be entered from 8am New York time to 5pm Tokyo time.

Short Trades

Short entry following a bearish price action reversal on the H1 time frame immediately upon the next touch of 106.30 or 106.64.

Place the stop loss 1 pip below the local swing low.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

Long Trade 1

Long entry following a bullish price action reversal on the H1 time frame immediately upon the next touch of 103.57 or 102.16.

Place the stop loss 1 pip below the local swing low.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

USD/JPY Analysis

I suggested yesterday that 104.00 was probably going to act as a floor with a further immediate fall being unlikely and that was a correct approach, with the price now breaking up above its previous high just short of 105.00. The announcement of new QE for the JPY has sent its price falling sharply, calling the long-term bullish JPY trend into question.

There is finally a crucial resistance level not far away at 106.30. After such a strong upwards move, it would be a surprise if there was not some kind of bearish pullback if and when that level is reached

There is nothing due today concerning the JPY. Regarding the USD, there will be a release of PPI and Unemployment Claims data at 1:30pm London time.