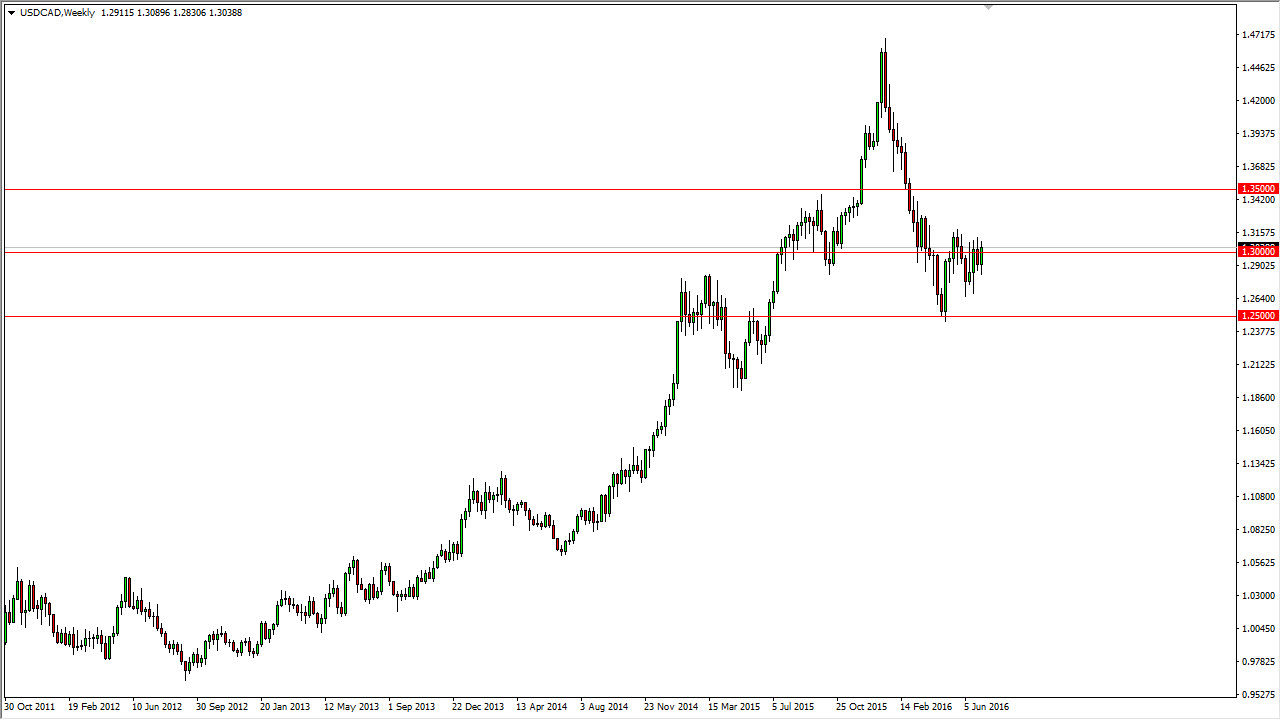

USD/CAD

The USD/CAD pair should continue to meander around the 1.30 level, and as a result I believe that this market is going to be very choppy. However, we can finally break above the 1.32 level, I think that this market will be very bullish and perhaps reach towards the 1.34 level, if not the 1.35 handle. Pullbacks at this point time should continue to find support though, so overall and bullish but I recognize that it is very choppy.

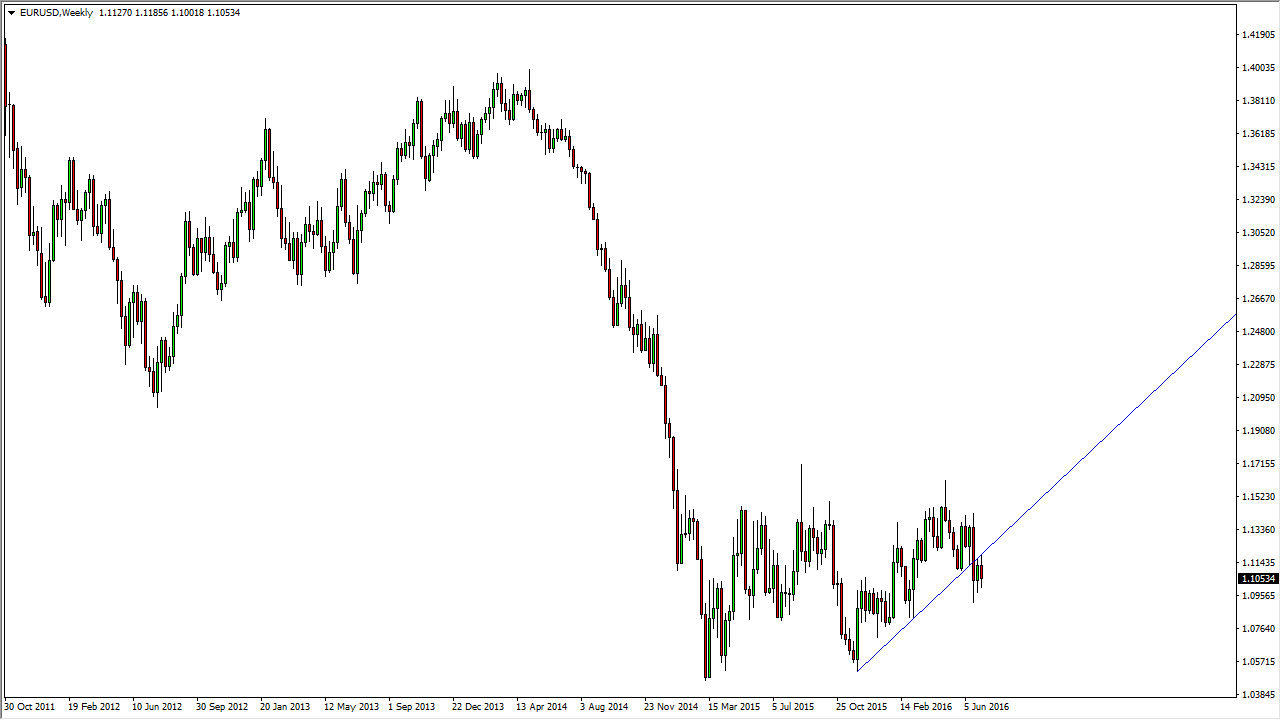

EUR/USD

The EUR/USD pair tried to rally during the course of the week but then found the uptrend line from the previous move higher to be resistive enough to turn the market back around. I believe ultimately that we will continue to go lower, and therefore I am a seller of rallies as they appear. There are far too many issues in the European Union right now to think that this market would go higher.

AUD/USD

The AUD/USD pair initially tried to fall during the course the week and then shot higher. I believe we will try to go higher, perhaps reaching towards the 0.78 handle. That being the case, I think that short-term pullbacks could be buying opportunities on short-term charts. If we pullback at this point in time, I think that selling will be very difficult to do.

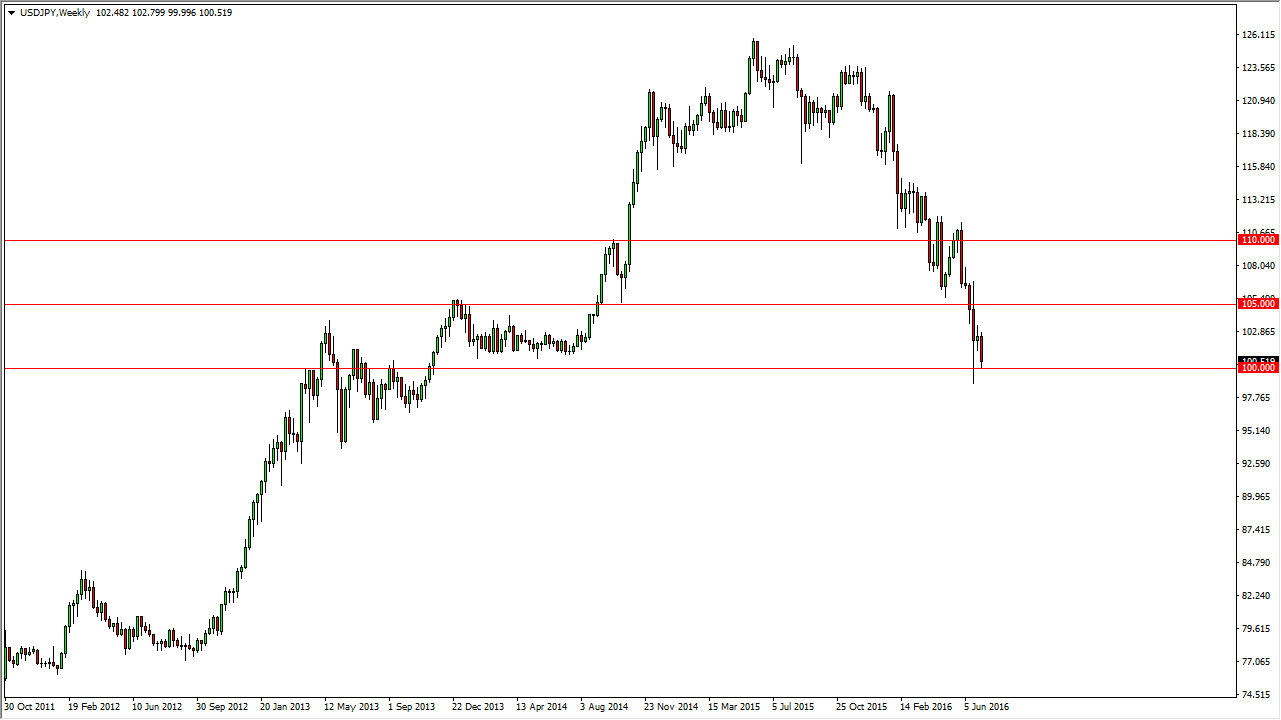

USD/JPY

The USD/JPY pair fell significantly during the course of the week, reaching towards the 100 level. The 100 level is of course a large, round, psychologically significant number. The 100 level of course would often cause quite a bit of consternation for sellers as the Bank of Japan could very well start intervening just below this area. I expect a bounce for the short-term, and as a result this could be a slightly positive week for this particular market. We are oversold and there is a massive amount of support just below.