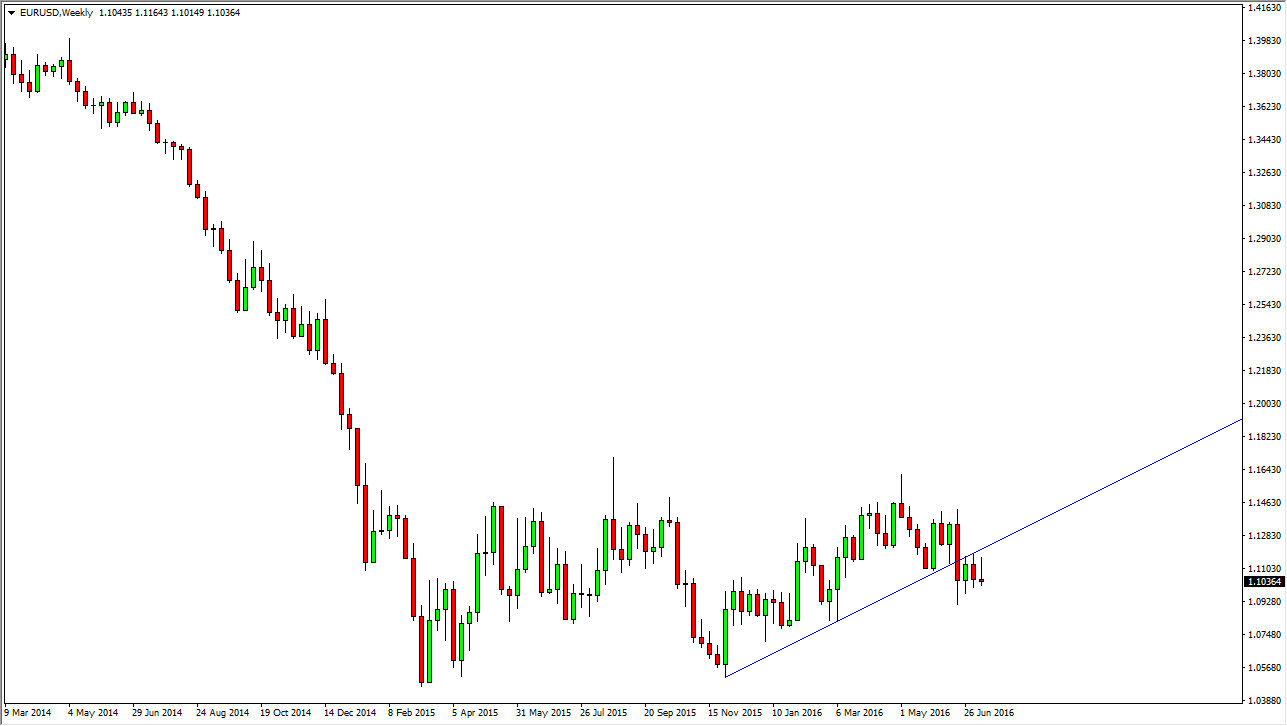

EUR/USD

The EUR/USD pair tried to rally initially during the course the week but turned right back around and up forming a shooting star. The shooting star during the course of the week suggests that we are going to go lower and perhaps even break down below the 1.10 level. With this, I feel that sooner or later we will see selling opportunities in this market on signs of exhaustion as I believe the European Union and its problems will continue to weigh upon the Euro itself.

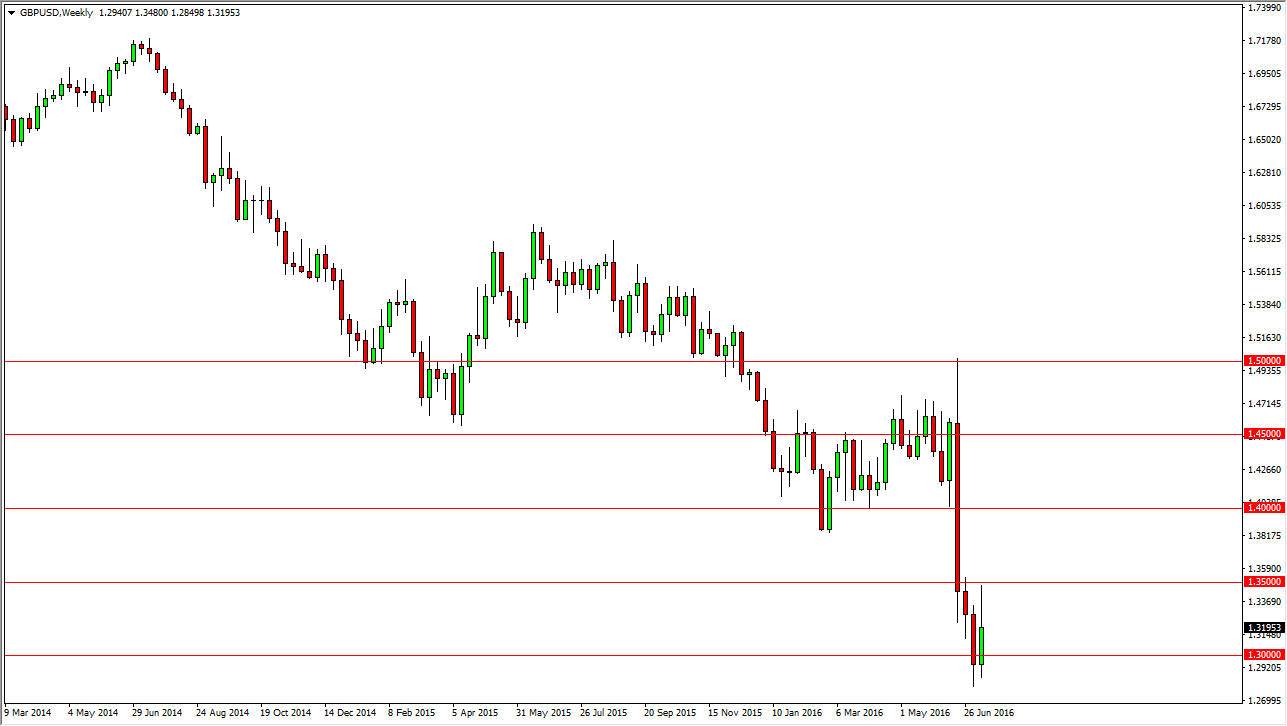

GBP/USD

The GBP/USD pair initially rallied during the course of the week, but as you can see gave back quite a bit of the gains. I believe that the British pound continues offer selling opportunities every time we get a short-term rally. Signs of exhaustion will be sold again and again, and I also believe that eventually the British pound will drop from there. I have no interest whatsoever in buying this pair at this moment in time.

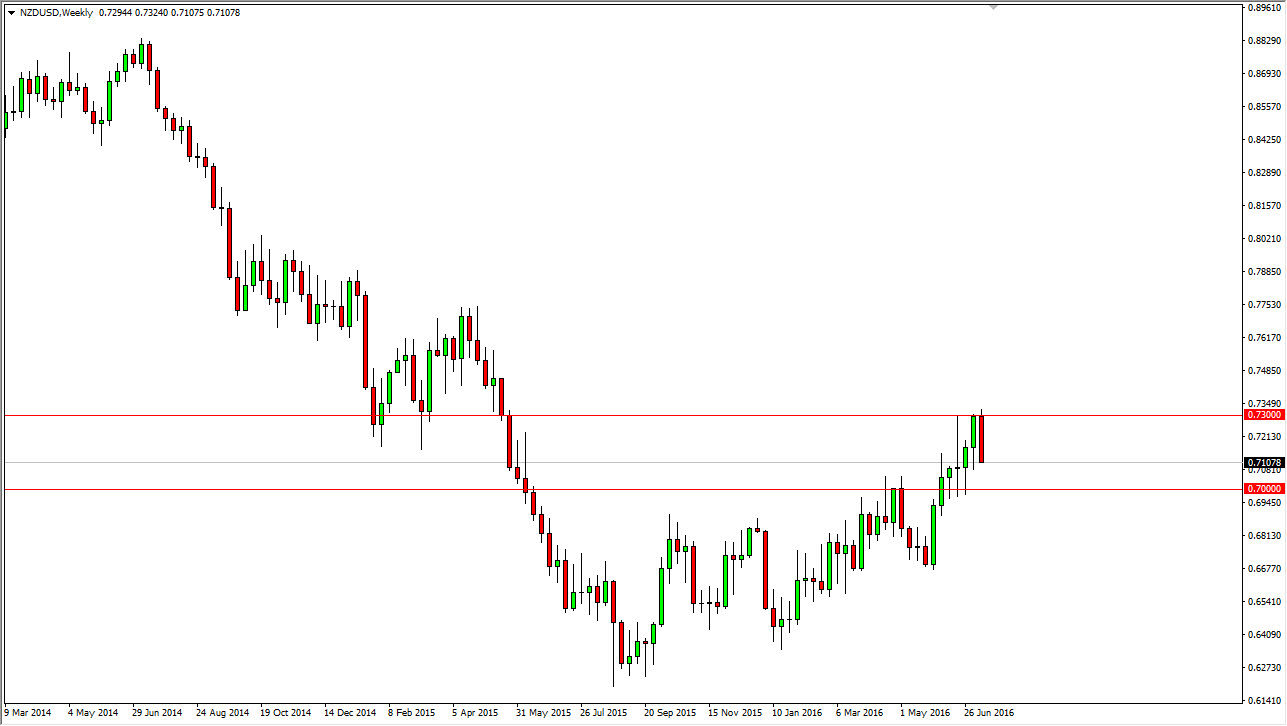

NZD/USD

The NZD/USD pair broke down during the course of the sessions that make up the week, but as you can see most importantly we still have the 0.70 level below, and it’s very likely that buyers will return in that general vicinity. I believe that a short-term selling opportunity probably exists, but it’s only a matter time before the buyers return to start buying yet again in a bullish market.

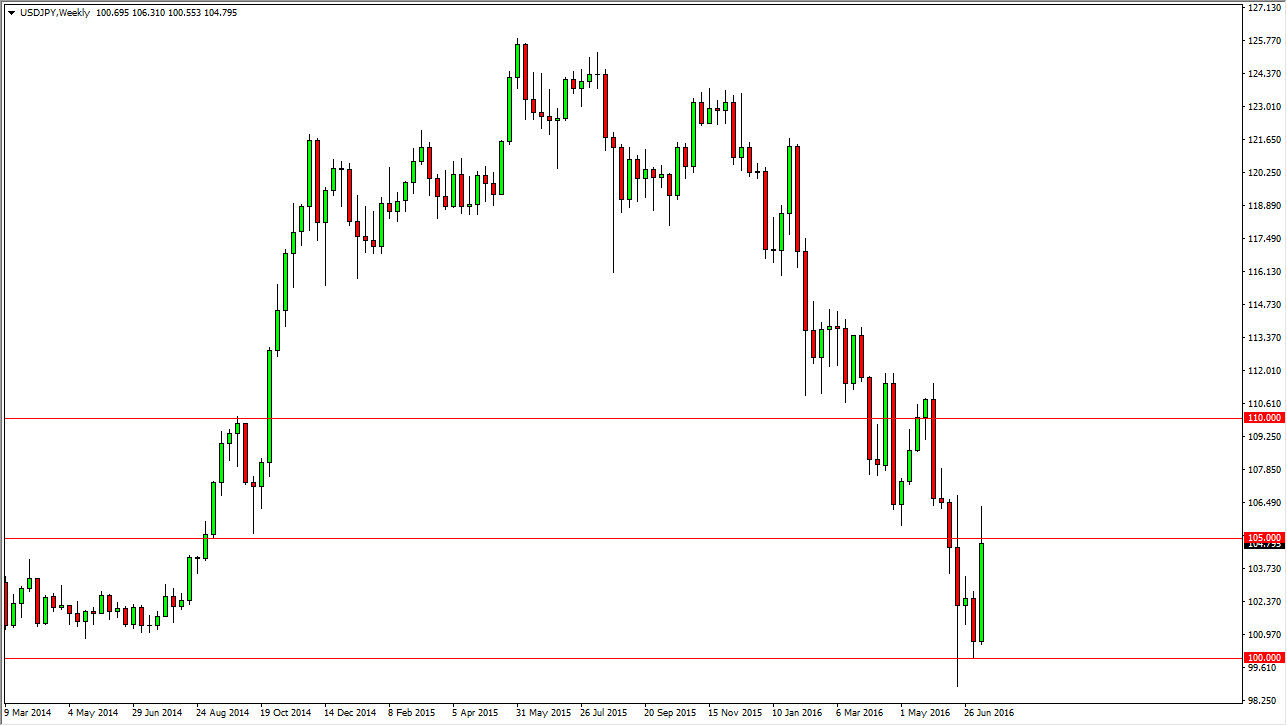

USD/JPY

The USD/JPY pair broke higher during the course of the week, testing the 105 level. However, we turn right back around to form a shooting star on Friday. The shooting star of course is a negative sign, and as a result I believe that we will initially pulled back during the course of the week but I think there is a fair amount of support somewhere near the 103 handle. Expect a lot of volatility no matter what happens next.