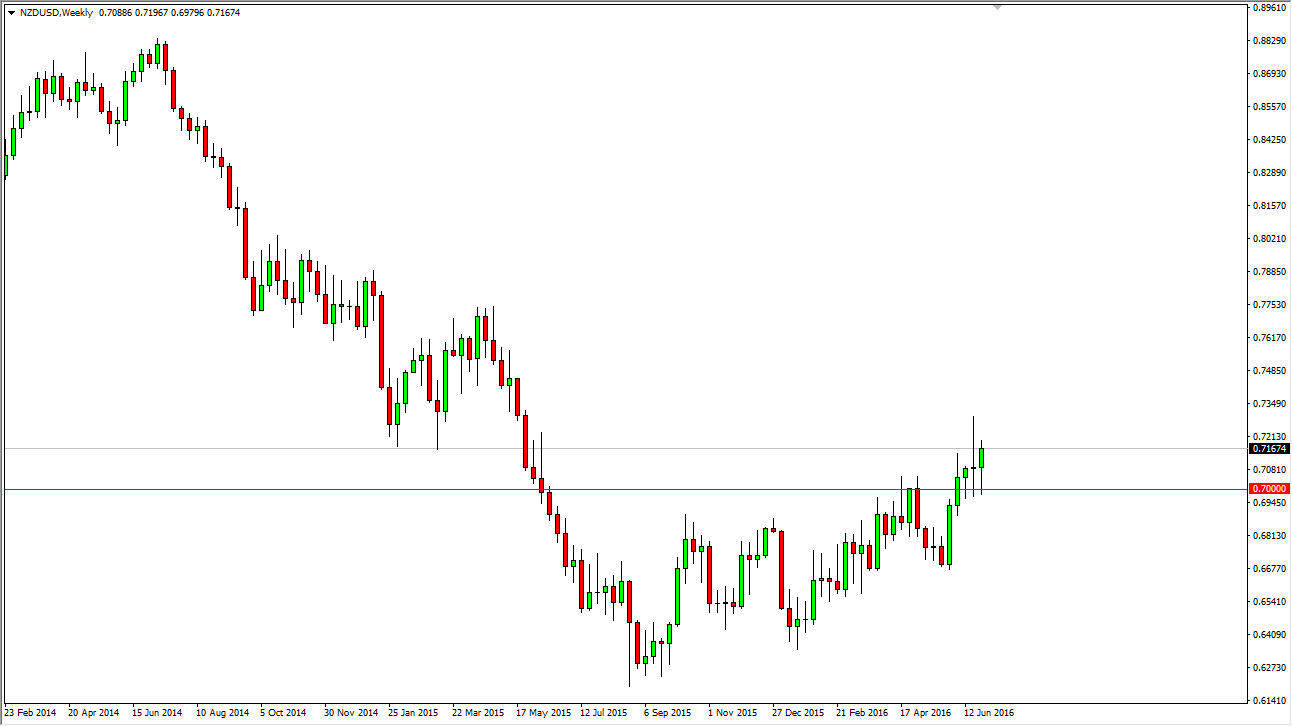

NZD/USD

The New Zealand dollar initially fell during the course of the week but seems to be fighting quite a bit of support at the 0.70 level. Unfortunately, there is a shooting star from the previous week which of course offers quite a bit of resistance. I believe that this market goes higher, but it isn’t necessarily going to be an easy buy. Expect choppy conditions but with a slightly positive tone.

USD/JPY

The USD/JPY pair went back and forth during the course of the week, and as a result has shown a very neutral candle. The 100 level below should be considered a bit of a “line in the sand”, as I believe the Bank of Japan will get involved if we get below that level. Because of this, I believe there will be a slightly upward bias in this pair, but it’s going to be a grind and it should be thought of more or less as an investment, not a trade.

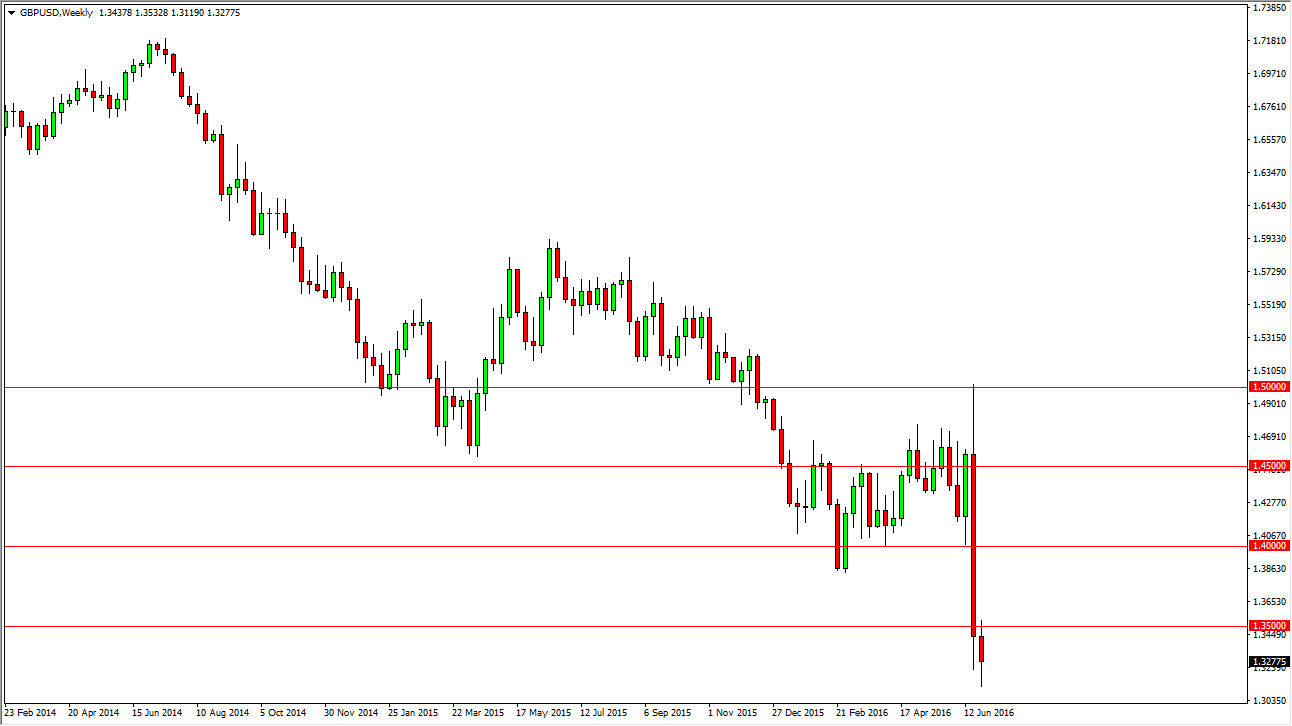

GBP/USD

The GBP/USD pair fell a bit during the course the week but we did get back about half the gains. By doing so, we ended up forming a bit of a hammer like candle, and I think if we can break above the top of that we could get a bit of a “snapback rally”, which would make quite a bit of sense as we have seen such an oversold condition recently. At this point though, I would look at those rallies as selling opportunities, and would look for exhaustion above

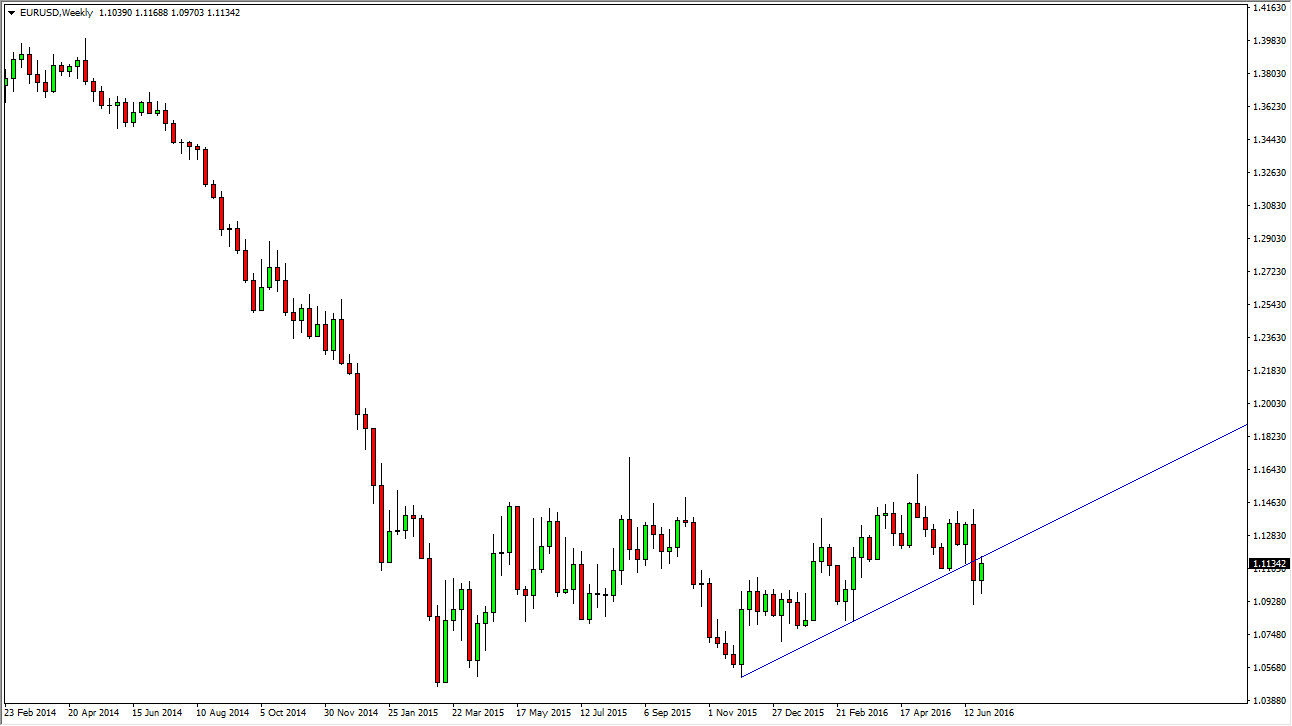

EUR/USD

The EUR/USD pair did rally during the course of the week but it is currently testing and if so far has failed to break above the top of the previous uptrend line. With that being the case, I think it’s only a matter of time before we have to make a decision, and quite frankly I prefer to short the Euro in general, because there is a lot of uncertainty in the European Union.