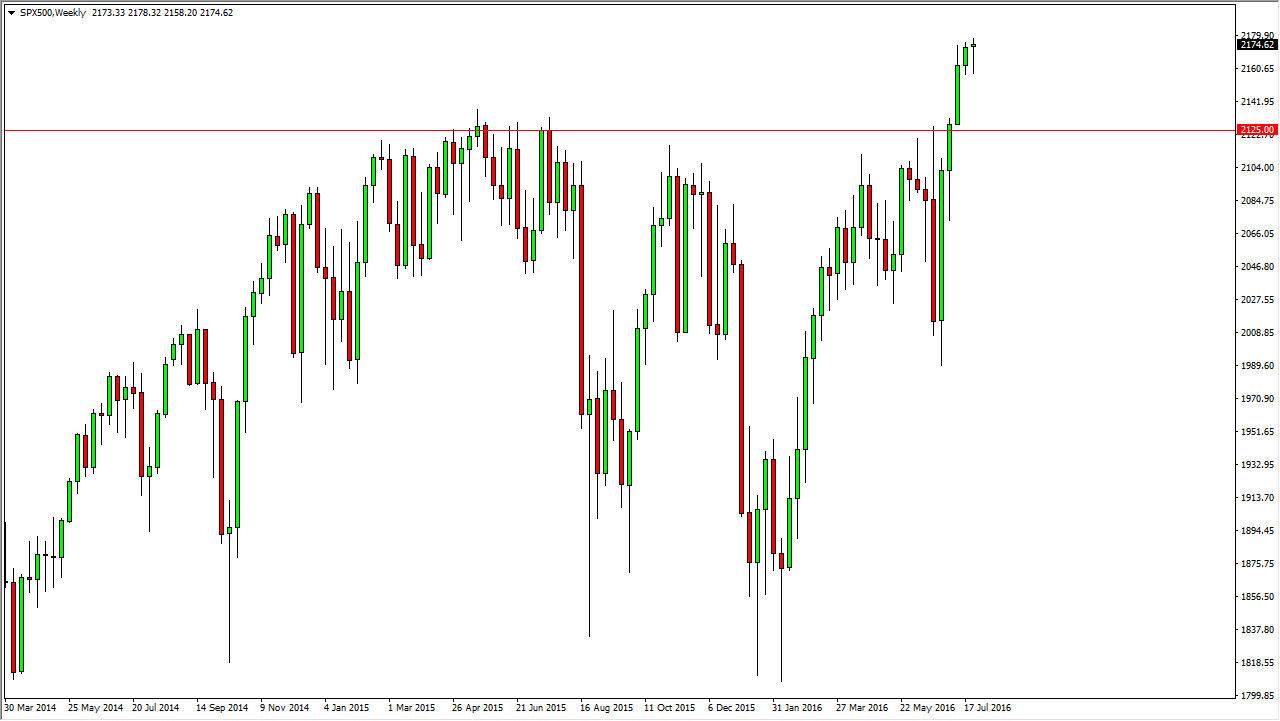

S&P 500

While I normally focus only on currencies in this article, I have to point out that the S&P 500 looks extraordinarily bullish. During the previous 5 sessions that made up the past week, we have seen hammers print for each day. With this, I believe that the combination of this and the hammer that formed for the week should send buyers into this market and I do believe that the S&P 500 will be rather bullish.

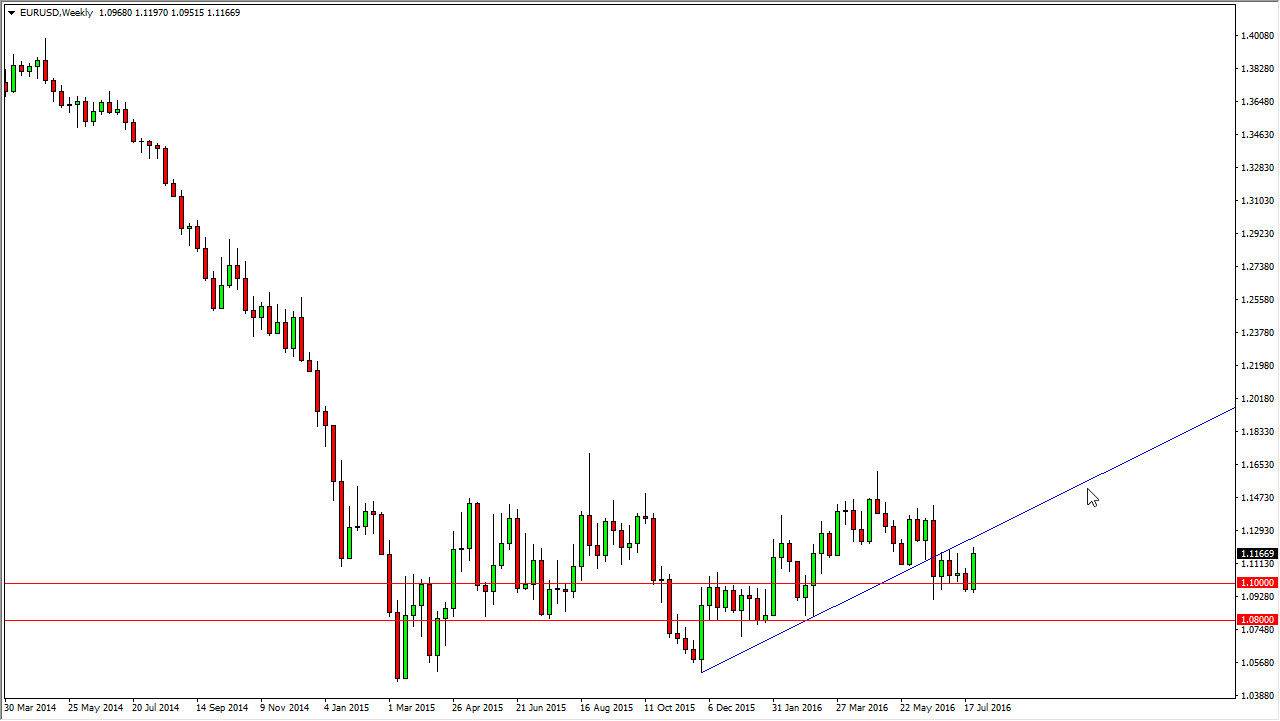

EUR/USD

The Euro rose rather drastically during the course of the week, but I still see an uptrend line that previously had been so supportive and should now be resistive. I think sooner or later we will get a bit of exhaustion and we should start selling off again. With this, I am cautiously bearish, but not willing to put money into this market until we get at least a daily exhaustive candle.

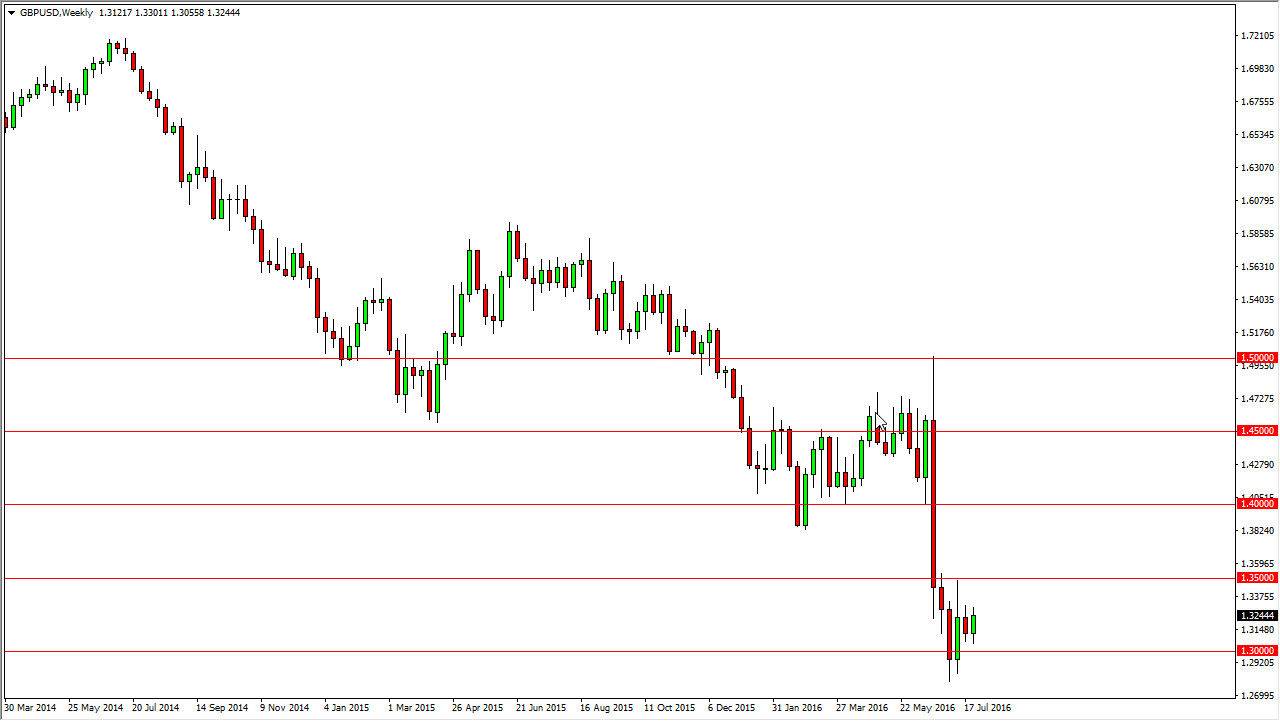

GBP/USD

The British pound continues to grind back and forth, I think this will probably be the case for this week as well. I think that short-term rallies offer selling opportunities, as there is a bit of a “ceiling” in this market at the 1.35 level. I also feel that the 1.3 level below is essentially the “floor” in this market as well. Certainly this is a market that has more negative bias than not.

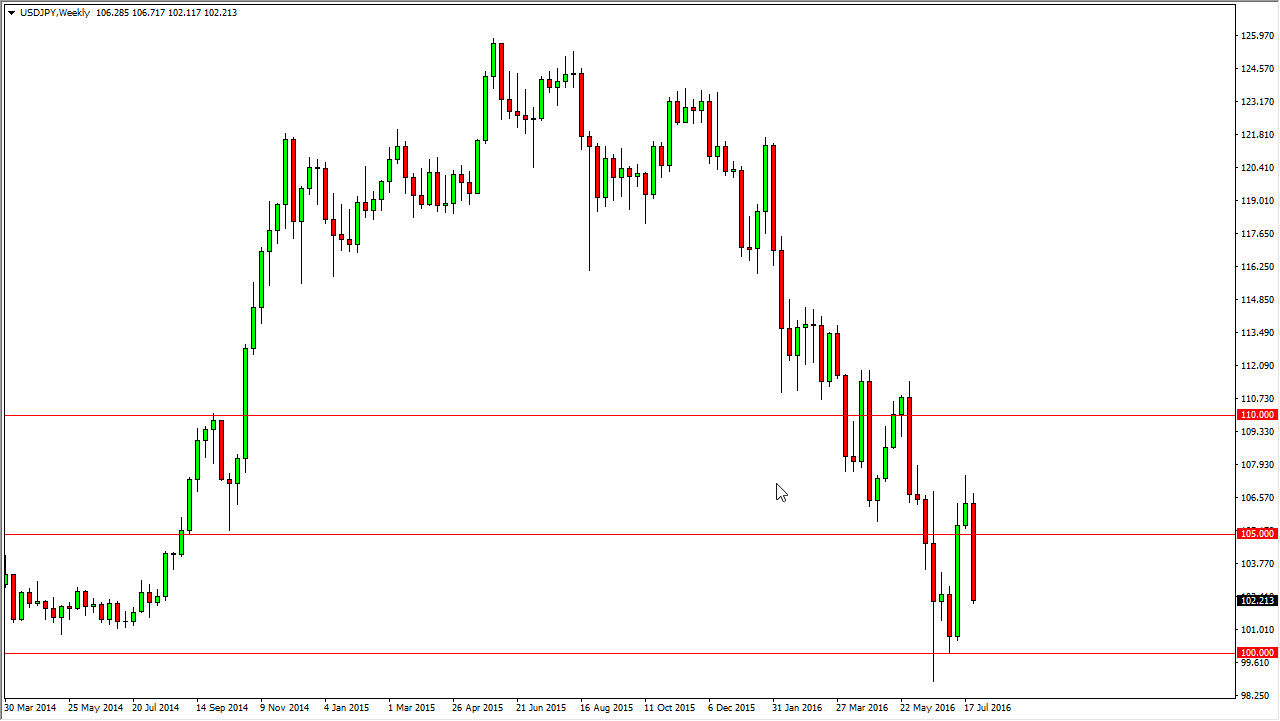

USD/JPY

The USD/JPY pair broke down significantly during the day on Friday, slicing through the 105 level and quite a bit of support. With this though, I think that the 100 level will be a bit of a floor in this market and very likely catch the eye of the Bank of Japan. I don’t know if they will intervene, but they certainly will say something. Look for bounces later in the week in my estimation, as we continue to see quite a bit of volatility.