WTI Crude Oil

The WTI Crude Oil market initially tried to rally during the day on Tuesday, but turn right back around for a bit of a shooting star. We are currently sitting at the $44.50 level, an area that has been supportive. Because of this, I believe that the market should continue to go lower. Keep in mind that the 200 day exponential moving averages just below, so that could cause a little bit of noise but I believe that the market is going to try to reach down to the $43 level. At this point, I believe that any rally at this point in time should be a selling opportunity on signs of exhaustion, and the previous the bottom of the descending triangle, at the $46 level, should be pretty resistive.

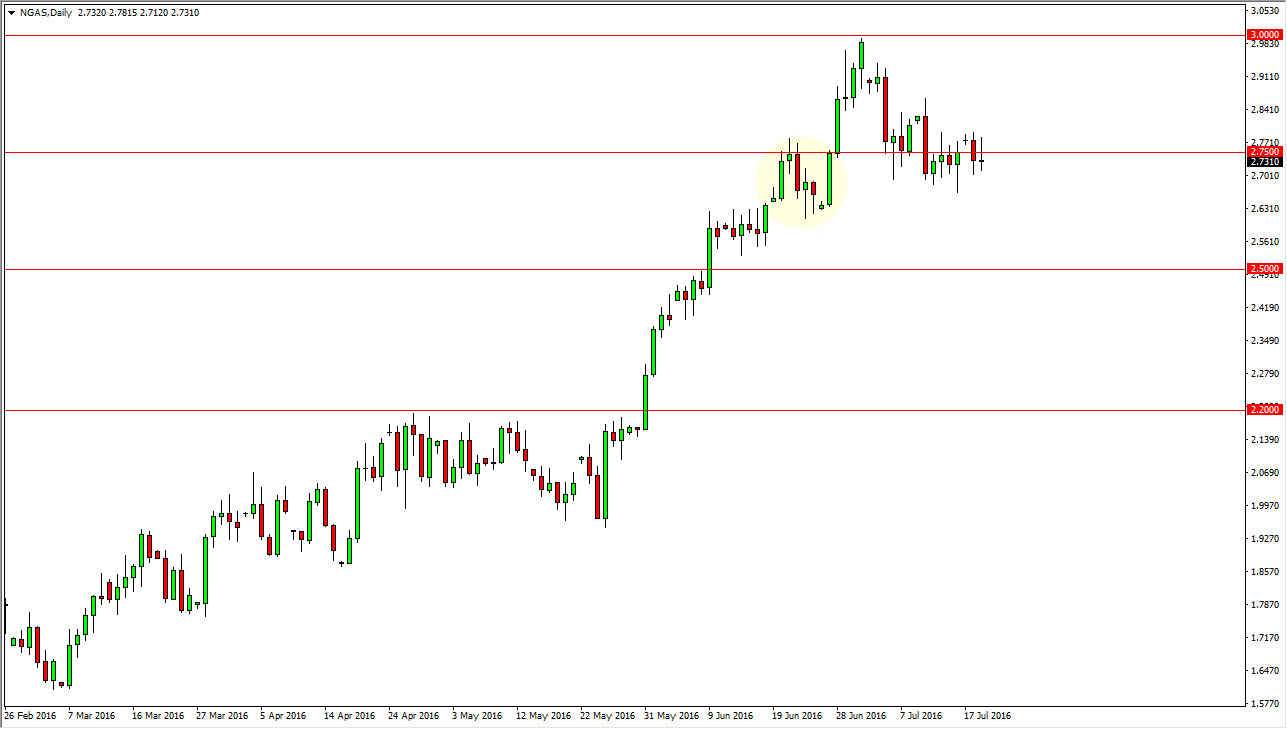

Natural Gas

Natural gas markets initially tried to rally during the course of the day as we broke above the $2.75 level, but we turn right back around to form a bit of a shooting star. This of course means that the market has a bit of a negative bias to it at the moment, but I believe that there is a significant amount of support just below as well. With this, I feel much more comfortable buying this market and selling it, but we need to break above the top of the shooting star in order to do so. Once we do, I feel the market will probably grind its way closer to the $3 level, especially over the longer term, as the market seems to be very interested in that area, and of course that should attract quite a bit of attention.

If we break down from here, the $2.60 level below offers quite a bit of support, just as the $2.50 level does. If we can break down below there, the market should continue to go even lower. In the meantime though, I think there are more than enough buyers below to keep this market afloat for at least the time being.