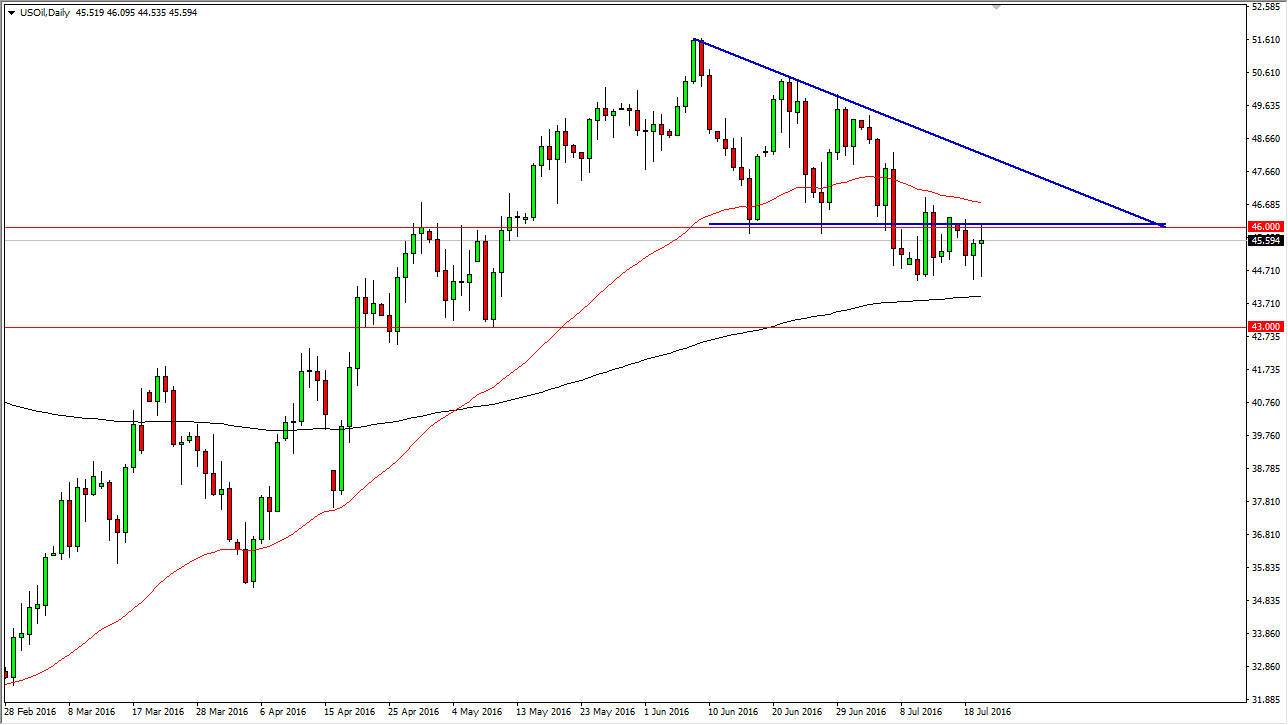

WTI Crude Oil

The WTI Crude Oil market had a very volatile session on Wednesday, as we went back and forth. With this, the market is banging against the $46 level above, which was previously supportive. It should now be resistance, and as a result I believe that this market will continue to struggle overall. I also believe in selling short-term exhaustion off of short-term charts.

When you look at the attached chart, you can see clearly there was a bit of a descending triangle that I had marked on this chart, and we also have the 50 day exponential moving average, marked in red, just above. With this, I should also point out that we have the 200 day exponential moving average just below in black. In other words, we are essentially stuck between 2 very important moving averages. Because of this, it would not surprise me at all to see this market continue to go sideways for the short-term. However, I do believe that eventually we start falling again.

Natural Gas

Natural gas markets had a negative session during the day on Wednesday as we reached the $2.65 level. This is an area that features quite a bit of volatility, and I do think that there is quite a bit of support at the $2.60 level. I also believe that there is a massive amount of support at the $2.50 level, so I am not comfortable selling this market at the moment, even if it does look a bit soft. I believe that given enough time we will see this market find buyers, as we have seen such a bullish move recently.

Hotter than anticipated temperatures in the northeastern part of the United States of course has driven of demand for natural gas, so that could be part of the reason that we are starting to see some bullishness. Ultimately though, we will return to a bearish market due to the laws of supply and demand, but at this point in time I still feel that the buyers have one more attempt at the $3 level in them.