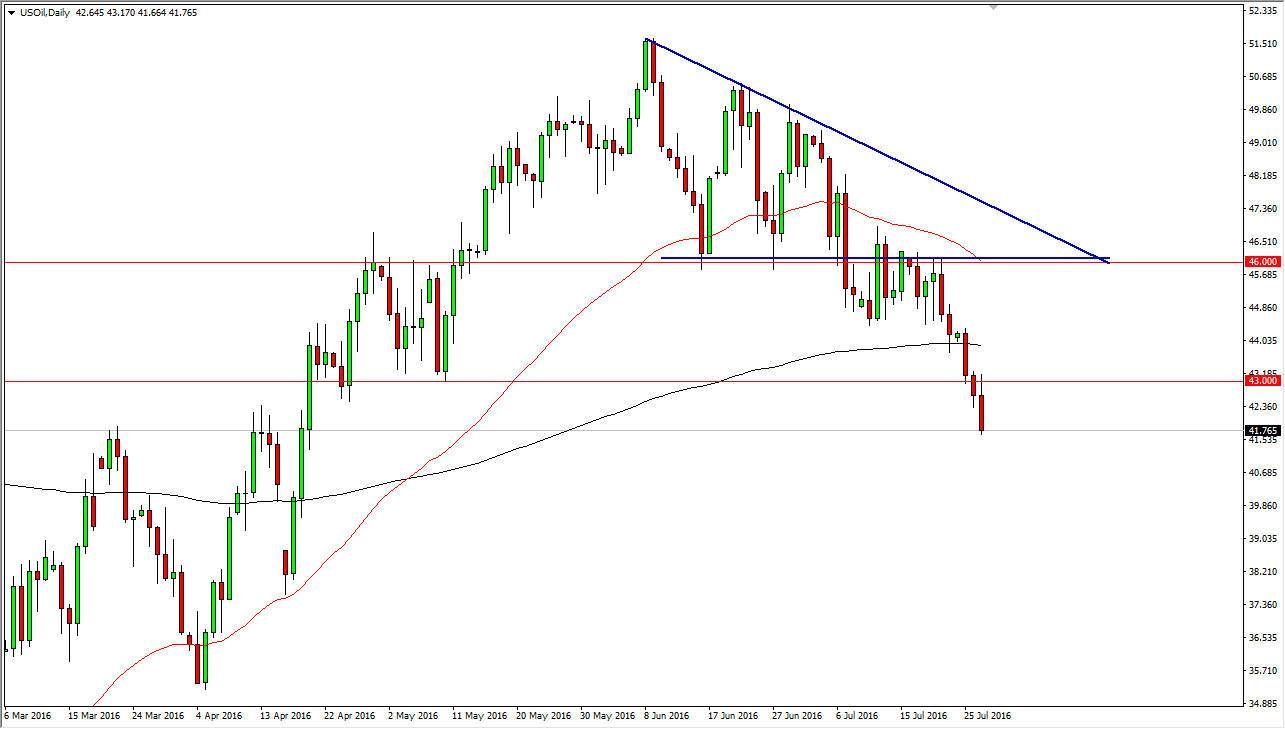

WTI Crude Oil

The WTI Crude Oil market initially tried to rally during the course of the session on Wednesday, but found the $43.00 level to be far too resistive. This being the case, the market fell after that, and as you can see we crashed into the $42 level. A break down below there should send this market looking for the $40 level below. I believe this does happen, and any rally at this point in time should offer an exhaustive candle on short-term charts that we can start selling. The 200-day exponential moving average above pictured in black should continue to attract long-term sellers into this market as well. Keep in mind that the US dollar is strengthening, but we are running out of demand when it comes to crude oil.

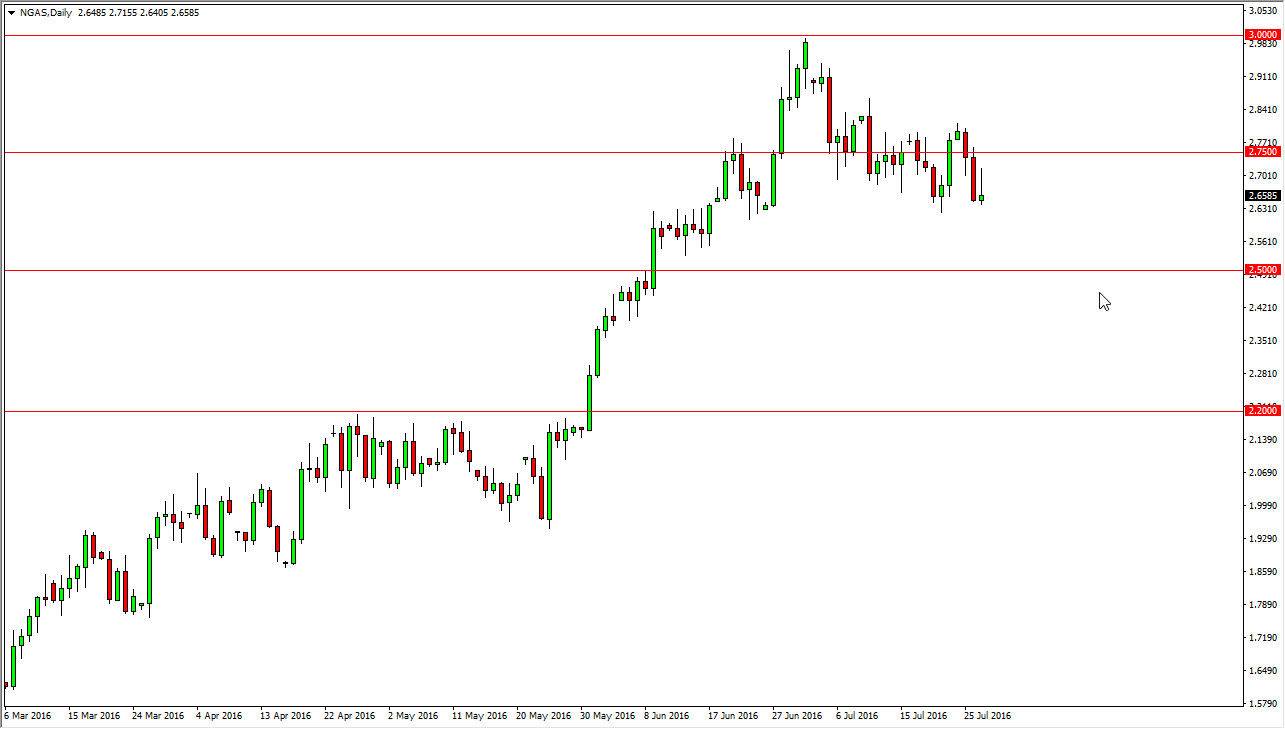

Natural Gas

Natural gas markets rallied during the course of the day on Wednesday, but turned around to form a shooting star. The shooting star of course is a negative sign and with that being the case I believe that we will probably try to grind lower from here. I think that the actual “line in the sand” is the $2.50 level. If we can break above the $2.75 level, we could continue to see bullish pressure in this market, but right now looks like we are not ready to do so and therefore we should continue to grind lower. With that being the case, the market will probably favor selling, even though I believe that we will probably get a decent bounce at one point or another. Longer-term I believe that this market does break down due to the longer-term oversupply of natural gas, but in the meantime I believe that we will find buyers returning to this market again and again as the bullish pressure will have most certainly buyers.