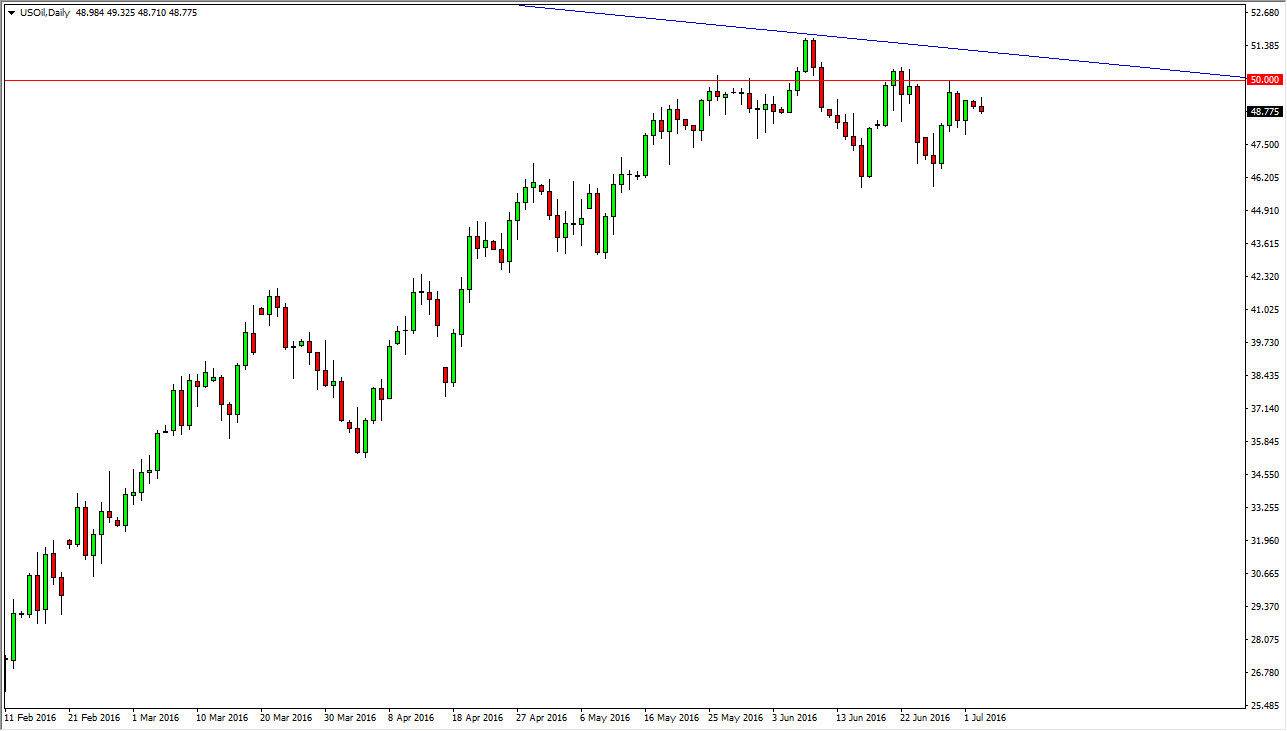

WTI Crude Oil

The WTI Crude Oil markets did very little during the day on Monday, as American traders were away for the holiday. However, it does continue to show a bit of bearishness, and I believe that we are going to continue to drift a little bit lower. Ultimately, the market should try to reach down to the $46 handle, which of course is a supportive “floor” in this market. A break down below there would send this market much lower. Any rally at this point in time should be a selling opportunity unless of course we can make a fresh, new high, something that could be a bit difficult. A break above the downtrend line should be a buying opportunity as well. However, if we break down below the $46 level, this market should fall apart completely.

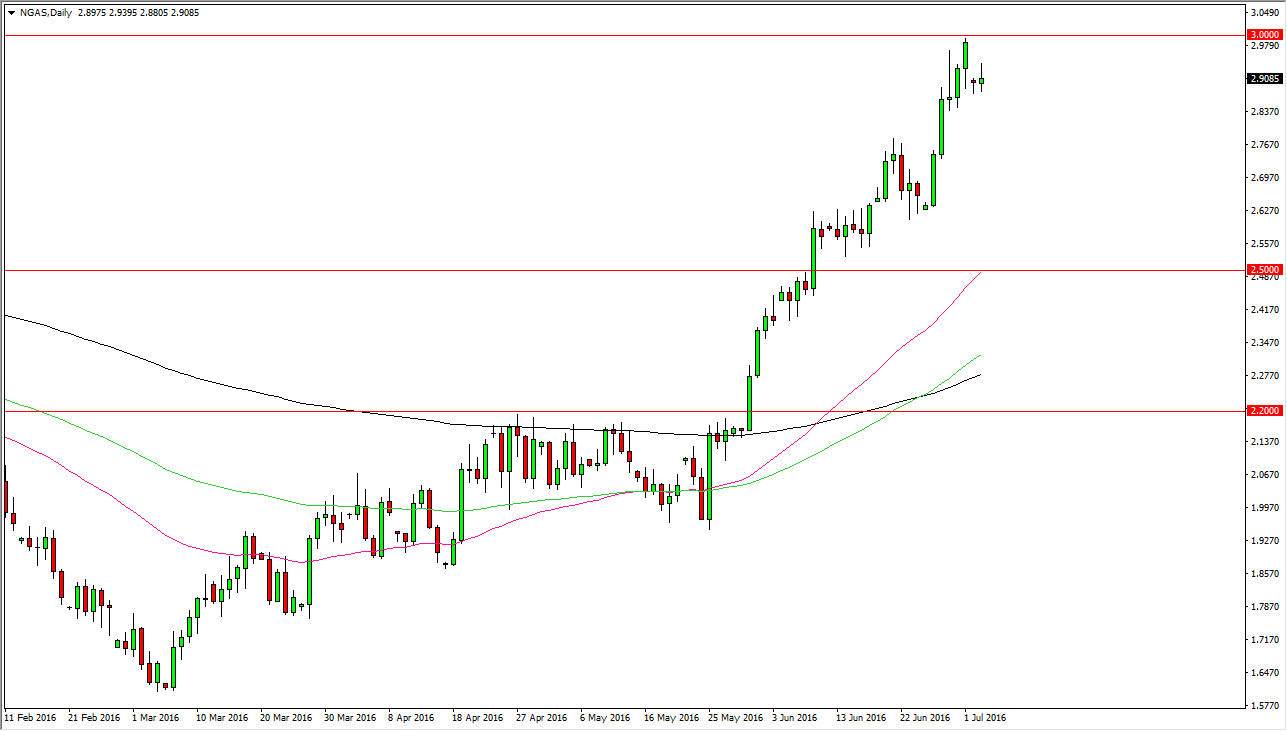

Natural Gas

Natural gas markets gapped lower at the open on Monday, but quite frankly there isn’t much to deal with as the $3.00 level is a massive barrier due to the psychological nature of that level. Pullbacks at this point in time should find plenty of buying opportunities, especially near the $2.75 level and of course the $2.60 level. Below there, I have the 50 day exponential moving average in red, the 100 day exponential moving average in green, and of course the 200 day exponential moving average in black. They are all pointing upwards, and I believe at this point in time we will continue to go higher given enough time. Ultimately, this is a market that I think eventually the sellers will return to, but right now it’s obvious that the buyers certainly run the show.

In fact, I’m going to need some type of negative candle on a higher timeframe. A negative candle on a weekly chart would be what I’m looking for in order to start selling, which of course we don’t have at the moment.