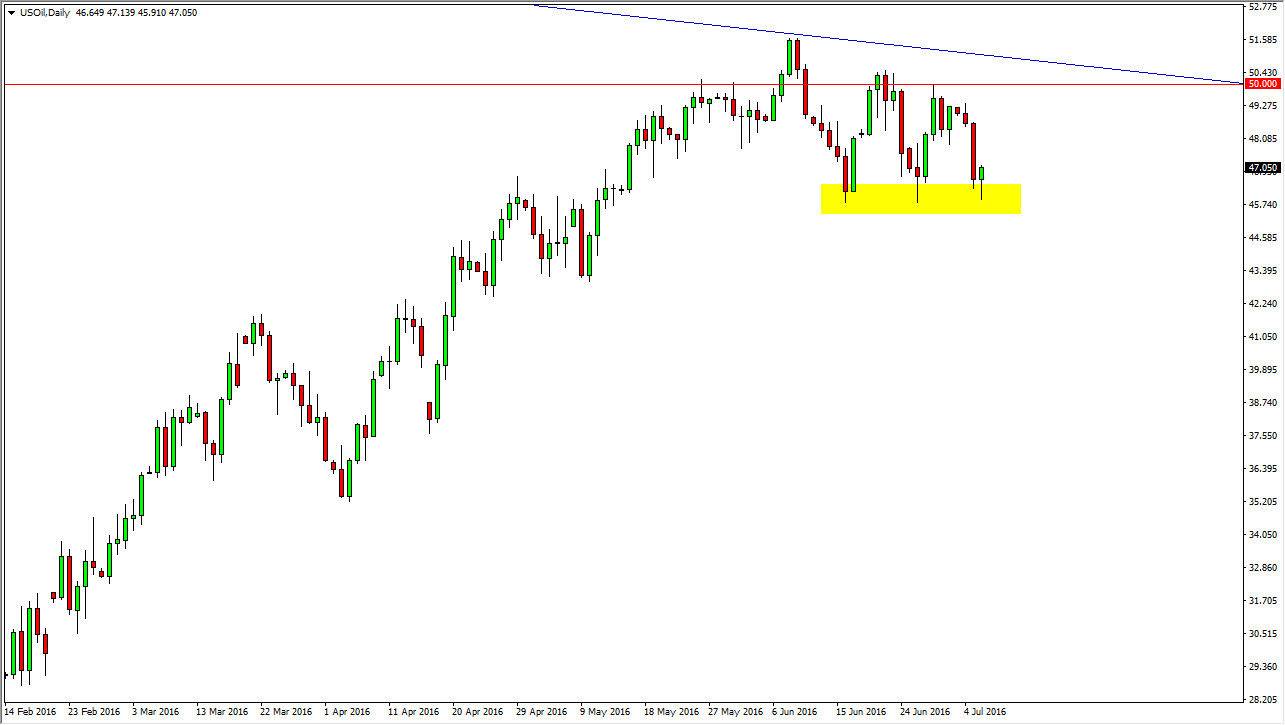

WTI Crude Oil

The WTI Crude Oil market initially fell during the day on Wednesday, but as you can see we turned around to form a bit of a hammer. The $46 level below continues to be very supportive, and therefore it’s not a surprise that we bounced. However, we have seen quite a bit in the way of resistance above, as the highs keep getting lower. With this being the case, I think it’s only a matter of time before we break down but it appears based upon the hammer that form during the day on Wednesday that we are not quite ready to fall apart yet. Because of this, I believe that we are going to rally only to turn around and selloff yet again. If we do break down below the $46 level though, this market could continue down towards the $43 handle at this point in time. Currently, I believe that the $50 level above is massively resistive.

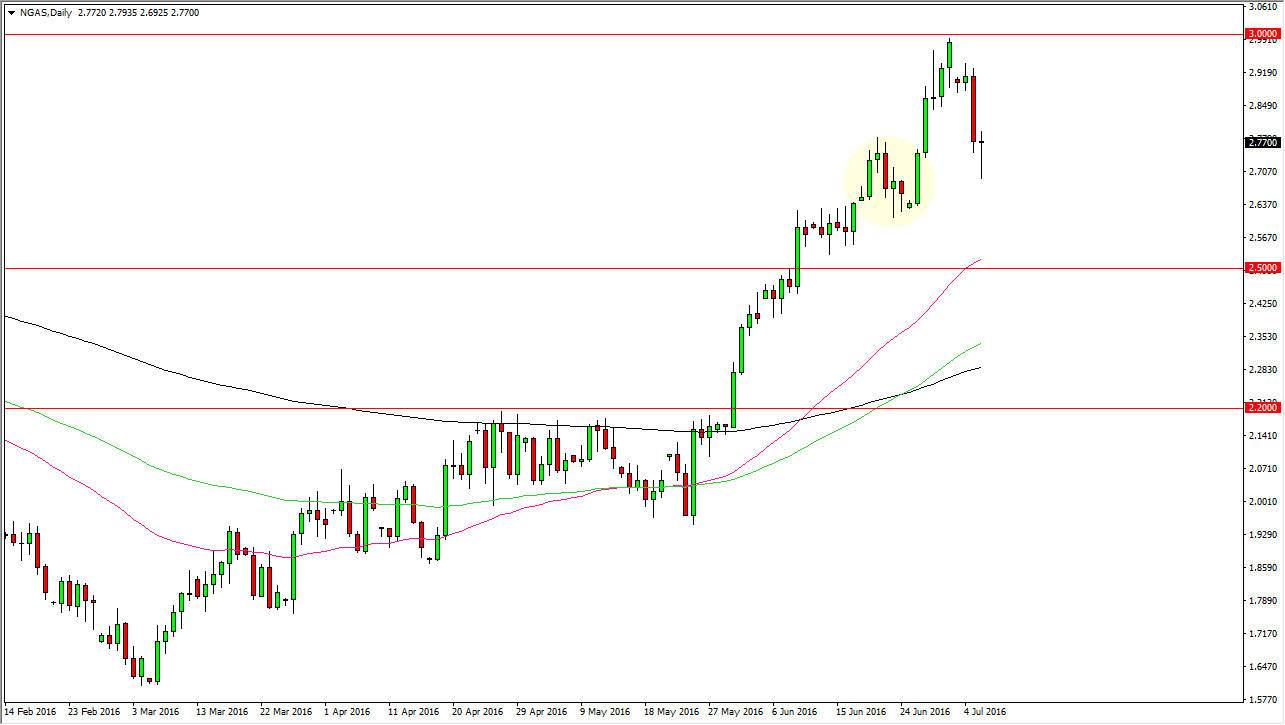

Natural Gas

The natural gas markets initially fell during the day on Wednesday as well, but also turned around to form a bit of a hammer like we saw in the WTI Crude Oil market. With this, it’s very likely that the market will try to rally and reach back towards the $3 handle. This is a nice-looking supportive candle at an area where I had been talking about the possibility of supportive pressure as denoted by the yellow ellipse on this chart. I believe that the buyers are going to continue to push, as we have seen so much in the way of an uptrend that we have to retest the $3 level again. If we can break above there obviously that’s a longer-term buy-and-hold situation, but at this point in time I think that traders are going to try to pick up value on pullbacks as they appear. It appears this is one of those times.