EUR/USD

The EUR/USD pair went back and forth during the course of the session on Tuesday, showing quite a bit of neutrality. Ultimately, this is a market that has recently seen quite a push higher, and the break above the 1.12 level was of course very bullish. Given enough time, the market will more than likely drop a bit from here as we try to build up momentum to go higher. Because of this, I think that the markets will offer value after that move, but we need to see some type of support after the pullback. If we break down below the 1.12 level, the market will more than likely sell off some more. The 1.1350 level above is a resistive barrier, and with that being the case I feel that the market will continue to chop around, but given enough time it’s likely that we will continue to see opportunities in both directions.

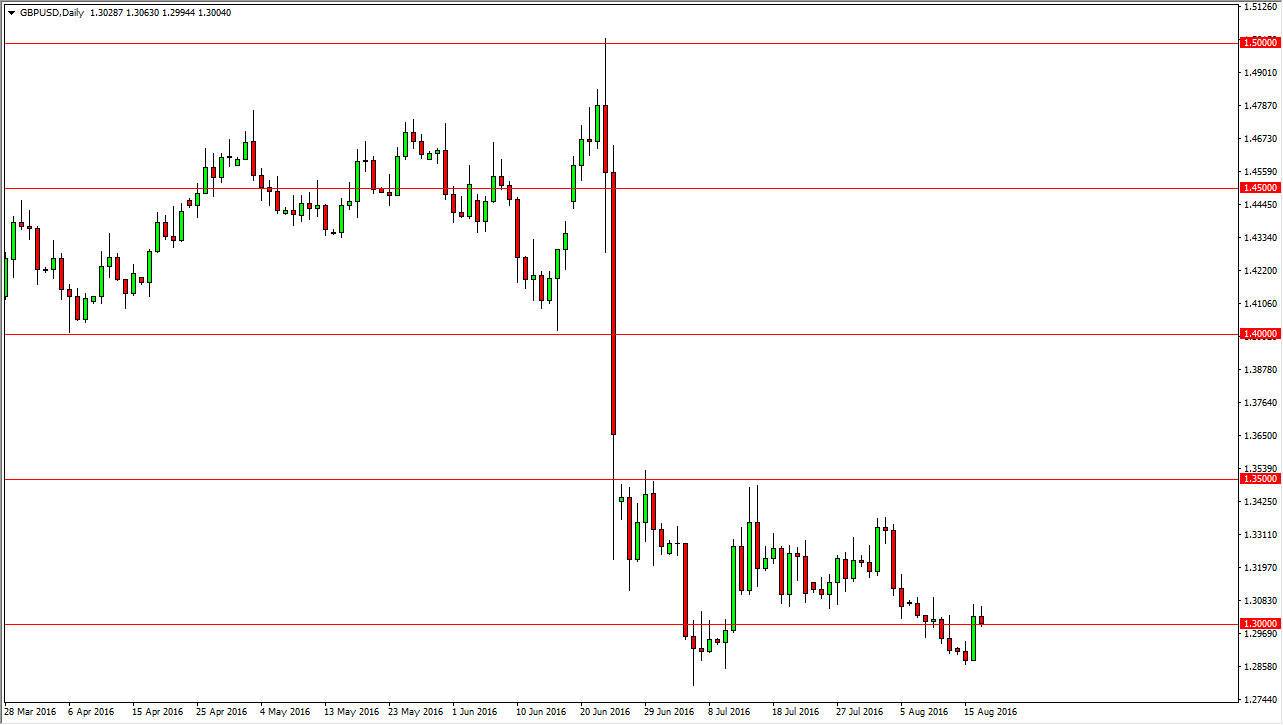

GBP/USD

The British pound initially tried to rally during the course the day on Tuesday, but turned right back around to form a bit of a shooting star. We are sitting just above the 1.30 level, and if we break down below there I feel that the market will probably reach towards the lows yet again. The 1.2850 level will be targeted, and a break down below there should send this market to the 1.25 handle given enough time.

A break above the top of the shooting star will have this market reaching higher, but given enough time there should be an exhaustive candle above that we could start selling as the market should very well continue to show that the British pound is suffering due to the fact that the British have voted to leave the European Union. Although the US dollar has struggled recently, it’s not the British pound and that’s all that matters.