EUR/USD

The Euro rose drastically during the session again on Thursday, breaking above the 1.1350 level. By doing so, it shows that we have real strength in this move and it’s only a matter time before we continue to go much higher, I believe that the first area that we are going to reach towards will be the 1.14 level above, and then eventually the 1.15 level. Quite frankly, I am a bit surprised that we have turned around this quickly, but I also recognize that breaking above the 1.12 level below should be massively supportive so therefore this is a “buy only” market at this point in time. I recognize that people are betting on the Federal Reserve not been able to raise interest rates anytime soon, so that’s essentially what this is all about.

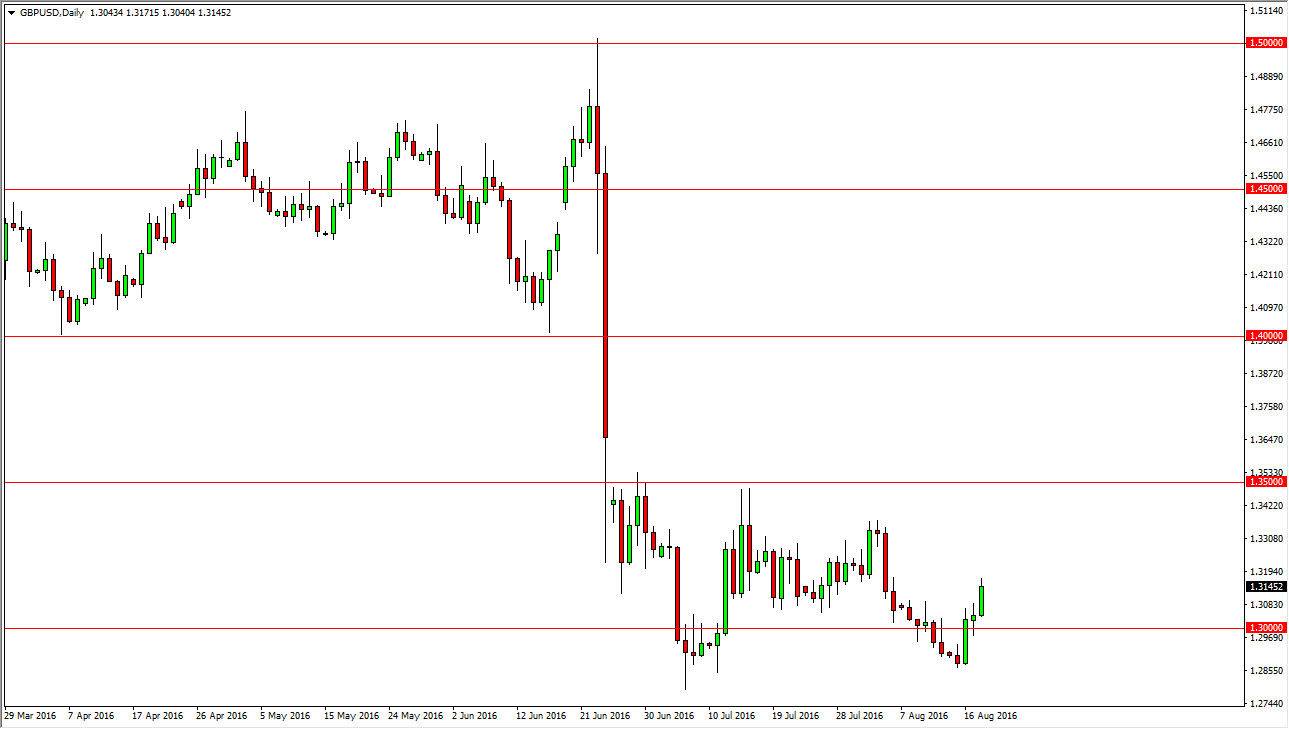

GBP/USD

The GBP/USD pair rallied during the session as well, and I think it’s for the same essential reason, the Federal Reserve and its inability to raise interest rates anytime soon. However, the British pound of course is going to continue to be beaten up upon by traders for leaving the European Union. I think it is only a matter of time before we find sellers above, and that the 1.35 level above is going to be a massive ceiling still. Because of this, I’m simply waiting to see some type of exhaustive candle that I can continue to sell after we’ve seen such a flush lower in this particular market.

With this being the case, I think that eventually we will reach down to the 1.25 handle, but we need to break down below the recent lows in order to make that move. In the meantime, it simply a matter of shorting this market again and again, off of short-term moves that show signs of exhaustion. We are also in a very low liquidity part of the year, so it’s likely that it will be difficult for this market to make significant moves over the next couple of weeks.