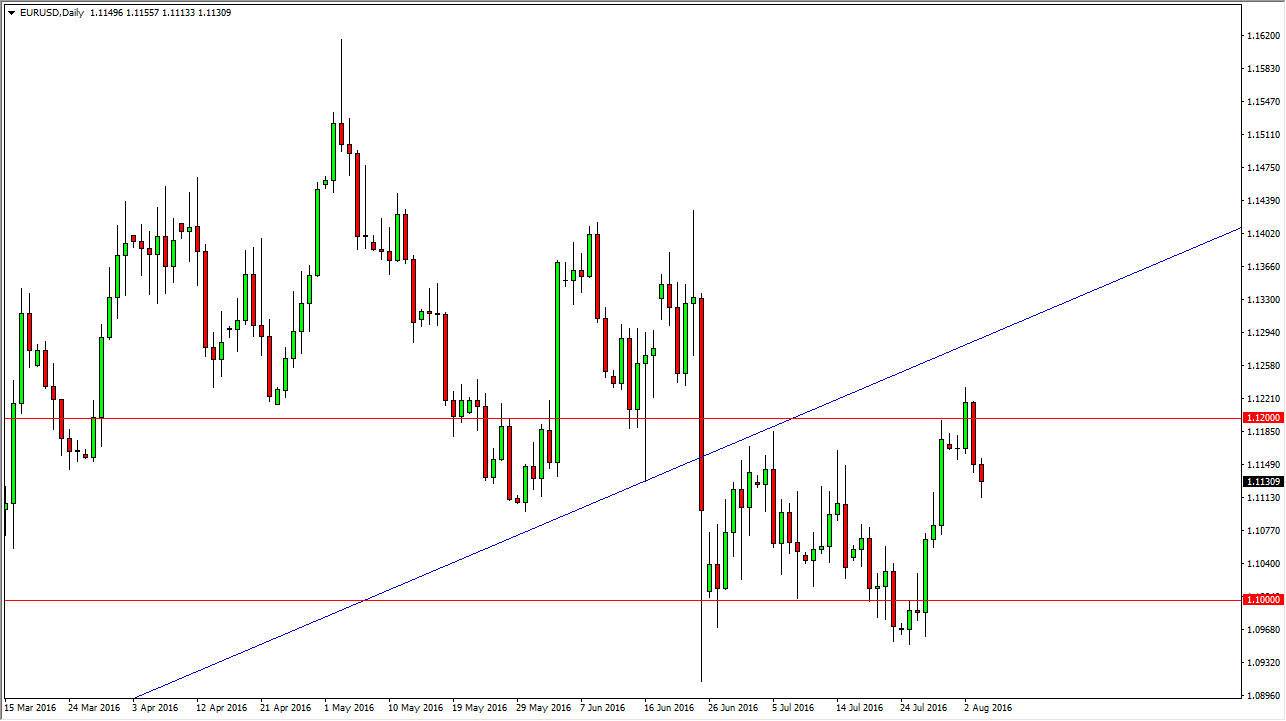

EUR/USD

The EUR/USD pair initially fell during the day on Thursday but bounced enough to form a little bit of a hammer. With the Nonfarm Payroll Numbers coming out of the United States today, it’s likely that we will get quite a bit of volatility. At this point in time, I do not think that it’s a good idea to trade this market during that session, but I do recognize that there are a couple of signal that could fire off during this trading day. For example, we could find yourselves breaking below the bottom of a hammer, and that’s a very negative sign. At that point we very well could try to reach down towards the 1.10 level over the next several days. Alternately, we could break above the top of a hammer and reach towards the 1.1225 handle above where we found quite a bit of resistance. My experience has been typically that the EUR/USD pair things around a lot during the employment announcement and later through the day, but ultimately inside fairly close to where it started. In other words, it’s a lot of noise.

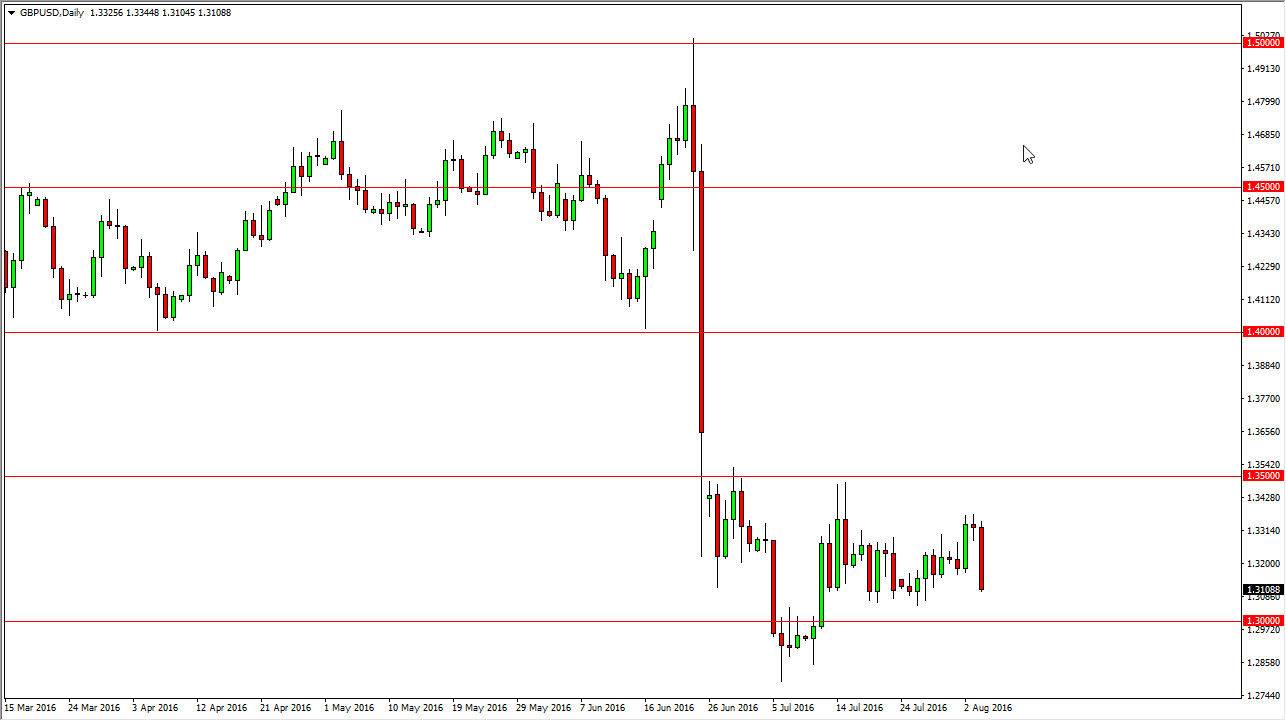

GBP/USD

The British pound of course has been falling over the longer term and had a very negative session on Thursday. We are getting close to the 1.30 level below which is massively supportive as far as I can tell, and that support even extends all the way down to the 1.28 handle. Even though we have formed a very negative candle, I think we are going to need something special today to break down. I think we will more than likely bang around and cause a lot of noise and probably wipeout a lot of accounts. With this being the case, I think that this is a market that is setting up for a very volatile and choppy trading day at best.