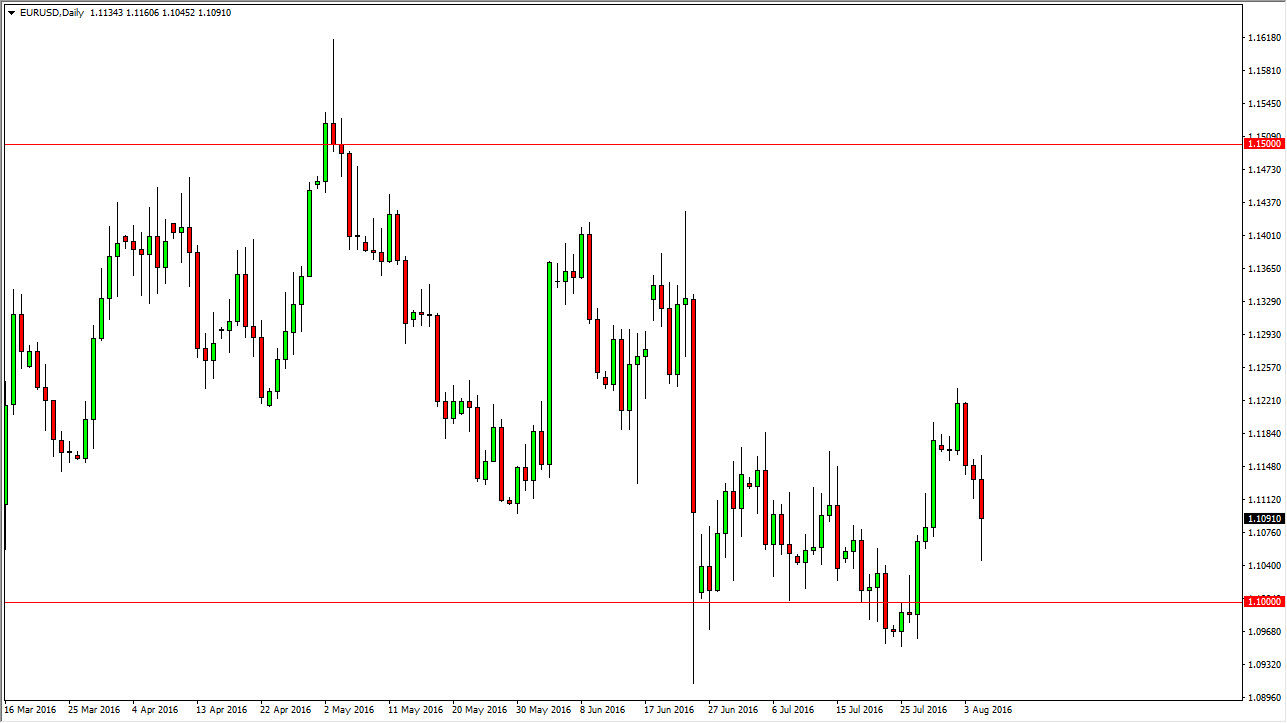

EUR/USD

The EUR/USD pair went back and forth during the course of the day, ultimately settling on a negative candle after we had a better than anticipated jobs number out of the United States. With this being the case, it looks as if the markets are trying to reach down to the 1.10 level below, which of course is fairly supportive. Ultimately though, I think this is a very choppy market, as there are a lot of concerns coming out of the European Union as well. With that being the case, I think short-term selling may be possible on rallies, but quite frankly I’m fairly content to sit on the sidelines at the moment as I believe the market has to shake itself out in order to figure out where it wants to go next.

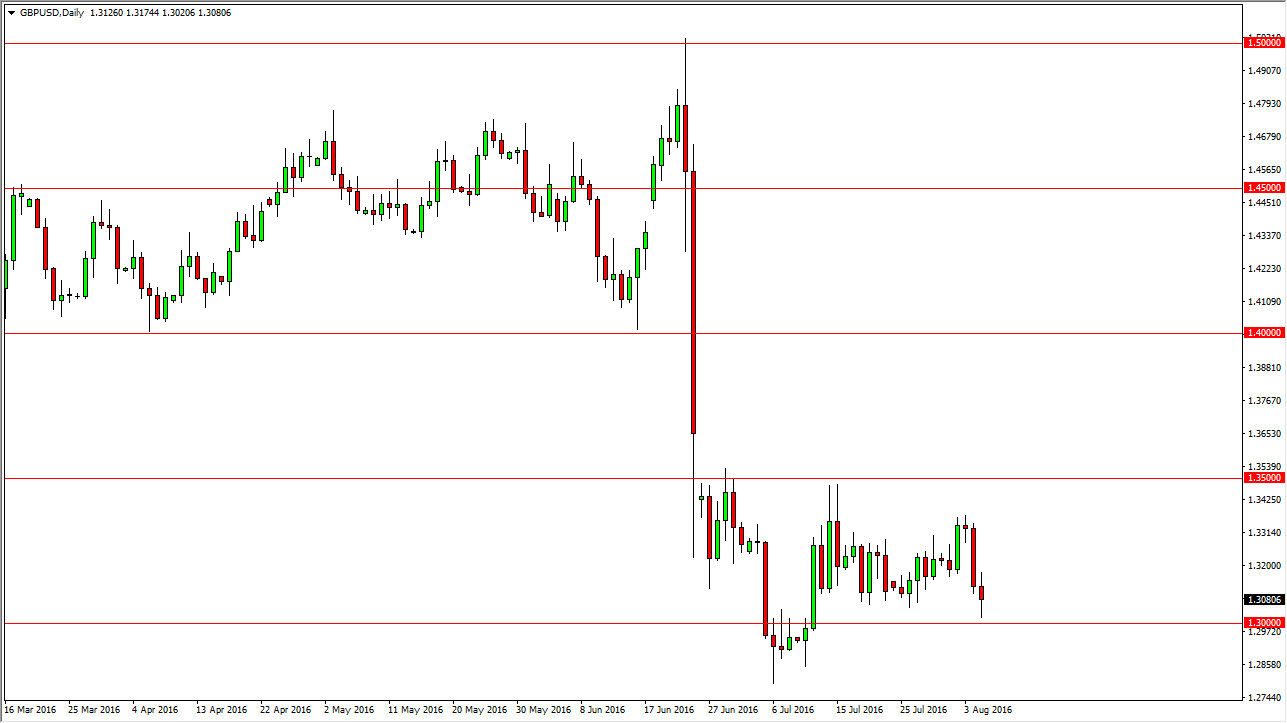

GBP/USD

The British pound fell during the day but did bounce off the 1.30 level as I anticipated. Quite frankly, there’s quite a bit of support all the way down to the 1.28 handle below, so a bounce from here would not be surprising at all to me in the least. I think an exhaustive candle after a rally is probably the best way to go, so with that being the case, I’m simply looking for an exhaustive candle in order to short this market yet again. On the other hand, if we break down below the 1.28 level, I would be more than willing to sell this market yet again. I have no interest in buying,at the moment. With this, I don’t see any way to go long and therefore I remain “sell only.”

I do believe that eventually the British pound does turn around, but it’s going to be a while before that happens. With that being the case, I think that short-term selling opportunities will present themselves again and again in this market for most certainly has turned negative.