The difference between success and failure in Forex trading is very likely to depend upon which currency pairs you choose to trade each week, and not on the exact trading methods you might use to determine trade entries and exits. Each week I am going to analyze fundamentals, sentiment and technical positions in order to determine which currency pairs are most likely to produce the easiest and most profitable trading opportunities over the next week. In some cases it will be trading the trend. In other cases it will be trading support and resistance levels during more ranging markets.

Big Picture 14th August 2016

Last week I predicted that the best trades for this week were likely to be short GBP against long USD and also long JPY. The results of these trades was an average win of 1.38% thanks to the weak performance by the British Pound.

The market may now become somewhat more bearish on the U.S. Dollar due to the poorer than expected consumer data released last Friday.

The British Pound continues to be seen as weakening.

As the GBP has the greatest long-term weakness of all the major currencies, I forecast that the best trade for this week will again be short GBP/USD and also probably short GBP/JPY.

Fundamental Analysis & Market Sentiment

Fundamental analysis is likely to be of little use this week with the exception of any poor data boosting the bearish trend in the British Pound.

Gold and Silver seem to have run out of momentum, at least for the time being.

The British Pound continues to weaken following downwards economic forecasts following the Brexit vote last June.

Technical Analysis

USDX

The U.S. Dollar was little changed last week, printing a small but slightly bullish candle which may be rejecting support at 11900. The price is still barely above its level of 13 weeks ago, suggesting that the downwards trend is over. There is a short-term upwards trend, but the price is still within an area of relative congestion, leading to choppy action.

GBP/USD

We had a meaningful downwards move this week following the weaker than expected British manufacturing data. The price closed the week near its low, which is only about 100 pips from making new 31 year lows.

The recent momentum suggests there is still immediate potential to the down side.

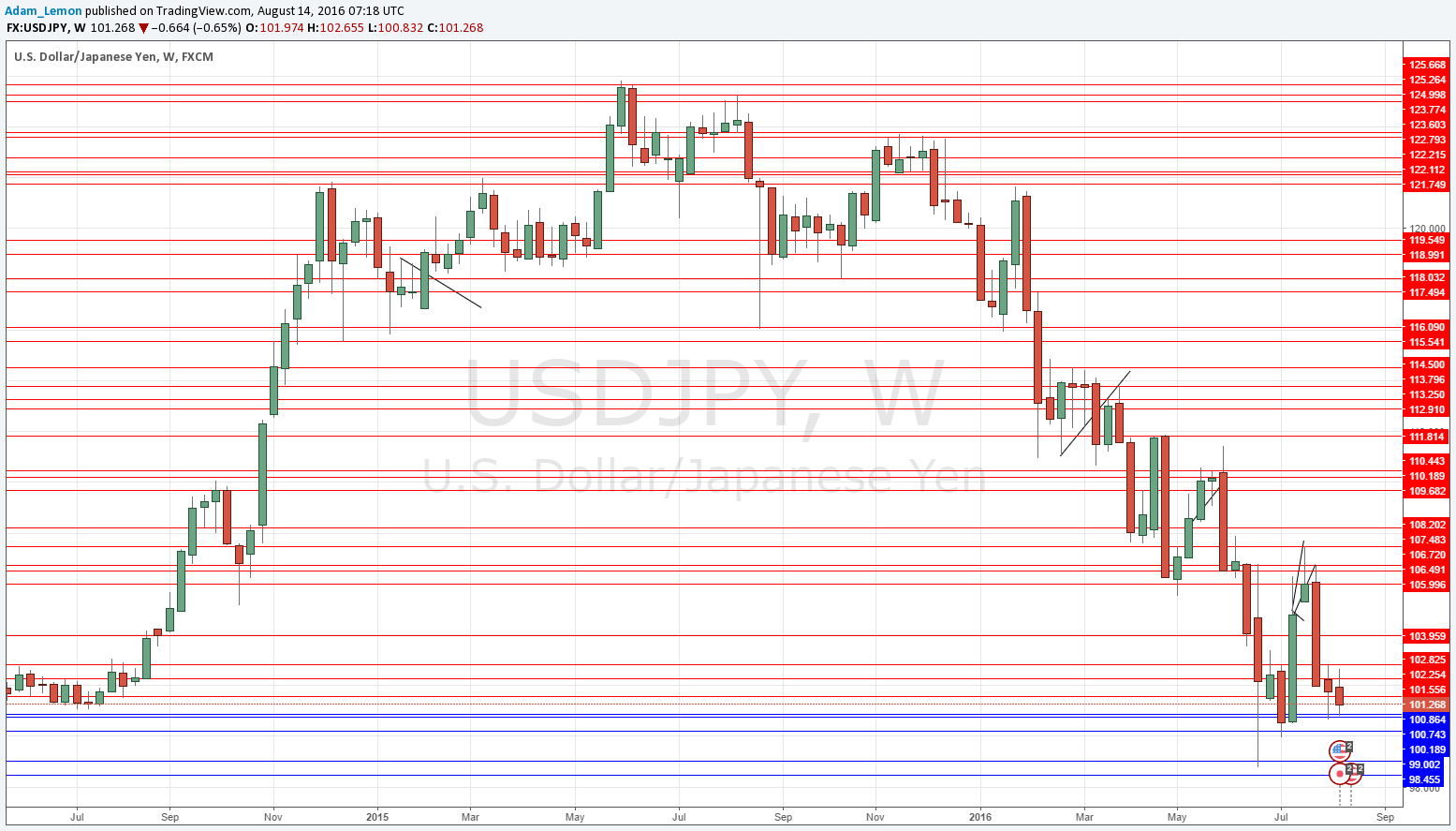

USD/JPY

Although I mentioned GBP/JPY, as we already looked at GBP/USD I prefer to examine the chart of USD/JPY as it is more important as a major pair than a cross such as GBP/JPY.

The chart below shows that this pair actually did not move a great deal from open to close last week. The lows are approaching the psychologically key 100.00 level, and so this area may prove to be supportive again. However, the action does look bearish, but it might be that the support that starts at around 101.00 begins to hold and push the price higher.

Conclusion

Bullish on the USD and JPY, bearish on the GBP.