The difference between success and failure in Forex trading is very likely to depend upon which currency pairs you choose to trade each week, and not on the exact trading methods you might use to determine trade entries and exits. Each week I am going to analyze fundamentals, sentiment and technical positions in order to determine which currency pairs are most likely to produce the easiest and most profitable trading opportunities over the next week. In some cases it will be trading the trend. In other cases it will be trading support and resistance levels during more ranging markets.

Big Picture 28th August 2016

Last week I predicted that the best trades for this week were likely to be short USD against long JPY and also long CHF. The results of these trades were not good, producing an average loss of 1.72% thanks to the relatively strong performance by the U.S. Dollar by the end of the week.

The market is difficult to forecast at the moment as the U.S. Dollar is choppy and turning bullish against its prevailing trend. This new bullishness was produced by Janet Yellen’s hints that a rate hike later in 2016 has become more likely after recent weeks.

The British Pound was quite strong over the past week, in spite of its long-term bearish trend. However, it does appear to be topping out against the U.S. Dollar, with Pound strength decreasing towards the end of the week.

It is difficult to pick a good trade this week, but I forecast that the best trade for this week will be short GBP/USD as it does seem to be turning bearish again back into the direction of its prevailing trend.

Fundamental Analysis & Market Sentiment

Fundamental analysis is likely to be of little use this week sentiment factors dominating, particularly with regards to the U.S. Dollar.

Gold and Silver seem to have run out of momentum, at least for the time being.

The Yen and Swiss Franc have weakened quite a lot this week, at the expense of the Pound and the U.S. Dollar. It is all sentiment although there has been some surprisingly positive U.K. data which has helped to drive up the British Pound.

Technical Analysis

USDX

The U.S. Dollar is still technically in a downwards trend, closing below its prices of both 13 and 16 weeks ago, but just barely. It is significant that the action of the past few weeks is beginning to look bullish, with wicks rejecting prices. A move upwards however small looks likely over the coming days, although next Friday’s Non-Farm Payrolls data could push the currency in any direction if the numbers are surprising.

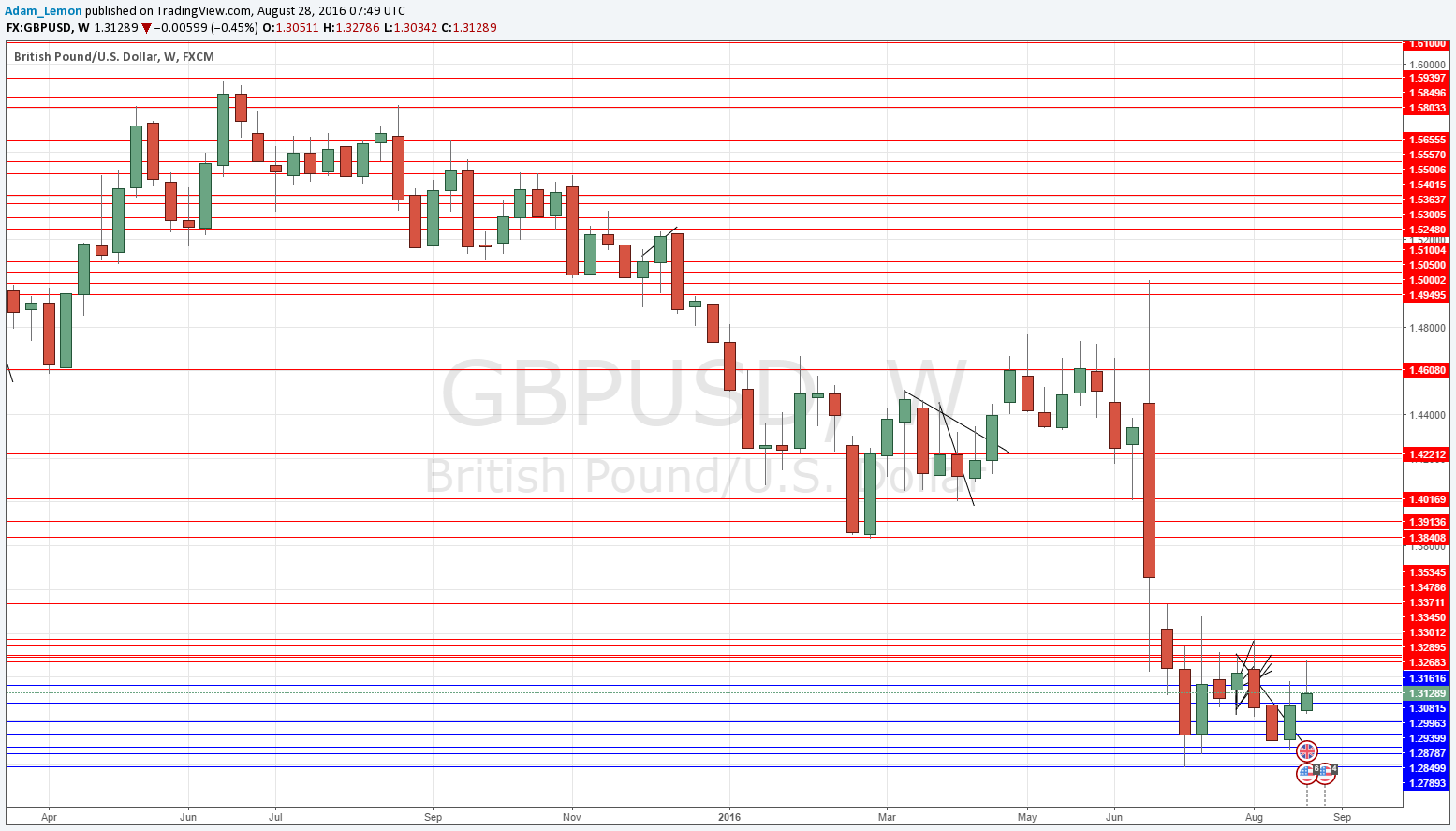

GBP/USD

The chart below shows that although this pair rose last week, it printed something of a pin candle with a long upper wick. The overall action is consolidating somewhat but still looks bearish overall. Note how the resistance areas beginning near 1.3300 have repeatedly produced wicks and closes below that area. It is unclear whether the price will fall much further in this swing, but this looks to be the clearest-cut case for directional movement of all the major pairs this week.

Conclusion

Bearish on the GBP/USD currency pair.