The difference between success and failure in Forex trading is very likely to depend upon which currency pairs you choose to trade each week, and not on the exact trading methods you might use to determine trade entries and exits. Each week I am going to analyze fundamentals, sentiment and technical positions in order to determine which currency pairs are most likely to produce the easiest and most profitable trading opportunities over the next week. In some cases it will be trading the trend. In other cases it will be trading support and resistance levels during more ranging markets.

Big Picture 7th August 2016

Last week I predicted that the best trades for this week were likely to be short GBP against long USD and also long JPY. The results of these trades was an average win of 1.29% thanks to the weak performance by the British Pound.

The focus of the market has shifted to become bearish on the U.S. Dollar following a much better than expected Non-Farm Payrolls data release last Friday.

The Bank of England cut its Base Rate as expected from 0.50% to 0.25%, but also introduced a somewhat stronger new element of additional quantitative easing that was greater than the market had been expecting.

As the USD looks strong and the GBP has the greatest long-term weakness of all the major currencies, I forecast that the best trade for this week will again be short GBP/USD and also probably short GBP/JPY.

Fundamental Analysis & Market Sentiment

Fundamental analysis may be of some use this week, as it points to a stronger U.S. Dollar, and we have seen that currency strengthen already, as well as seen the major U.S. equity index end the week at a new all-time high.

Gold and Silver seem to have run out of momentum, at least for the time being.

The British Pound continues to weaken following downwards economic forecasts following the Brexit vote last June.

Technical Analysis

USDX

The U.S. Dollar recovered last week, printing a small but bullish candle which may be rejecting support at 11900. The price is still above its level of 13 weeks ago, suggesting that the downwards trend is over.

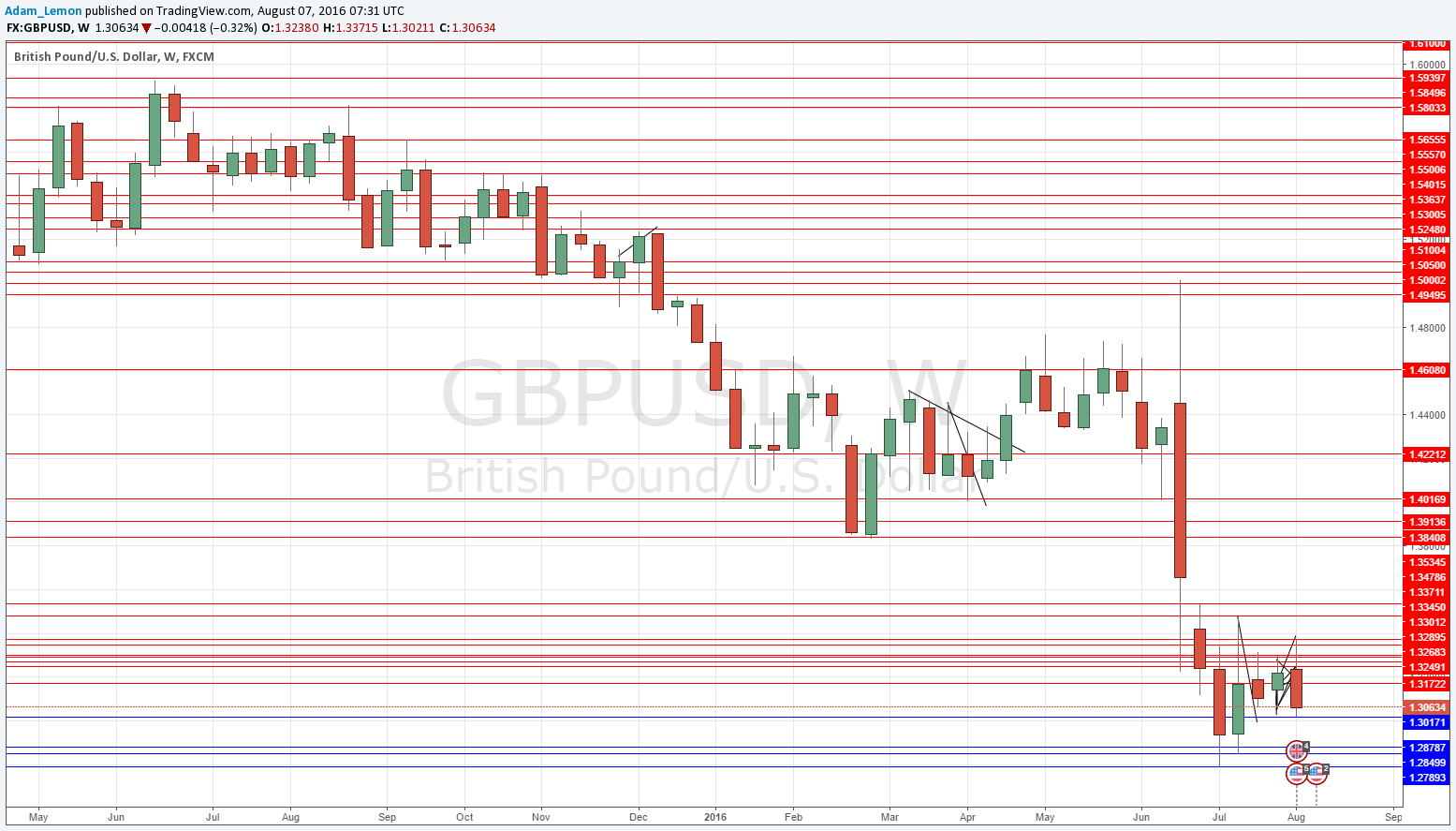

GBP/USD

We had a fairly strong downwards move this week following the British rate cut and the strong U.S> NFP numbers. However, it should be noted that the price could not break below 1.3000 and there was a seemingly strong bullish rejection close to that level.

The recent momentum suggests there is still immediate potential to the down side.

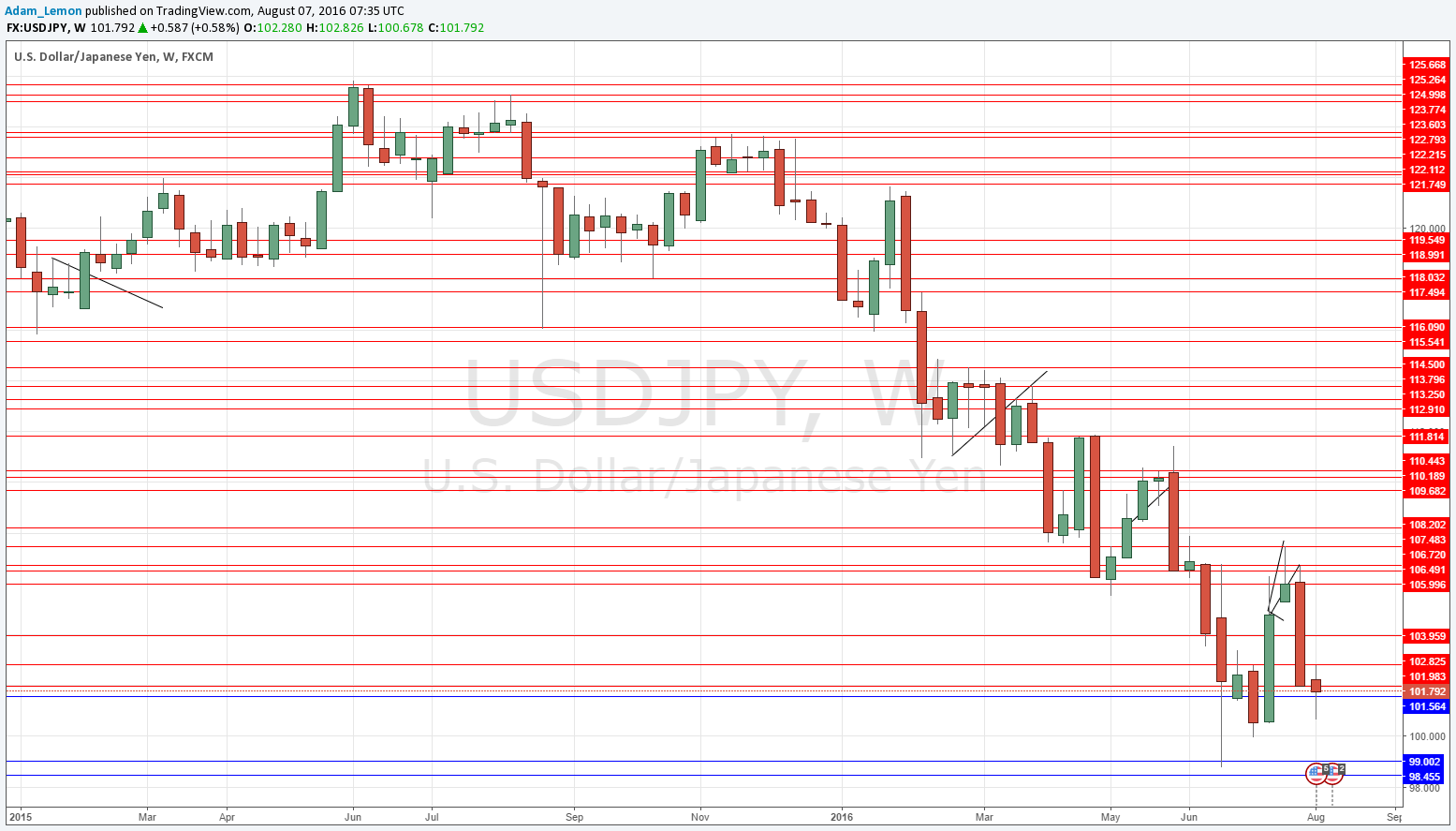

USD/JPY

Although I mentioned GBP/JPY, as we already looked at GBP/USD I prefer to examine the chart of USD/JPY as it is more important as a major pair than a cross such as GBP/JPY.

The chart below shows that this pair actually moved very little from open to close last week. There are several key resistance layers above not far away from the current price: at 101.98, 102.82 and 103.96. I see 102.82 as looking especially likely to produce a further strong move down. The lows are approaching the psychologically key 100.00 level, and so this area may prove to be supportive again.

Conclusion

Bullish on the USD and JPY, bearish on the GBP.