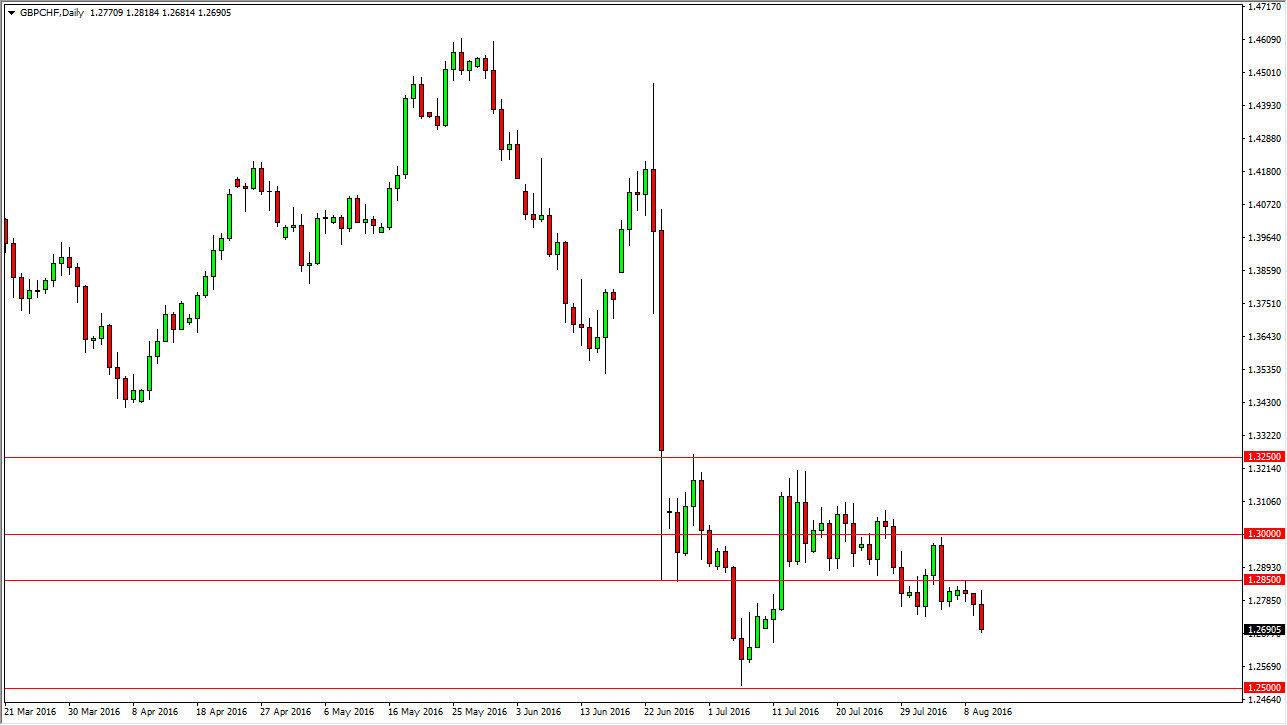

The GBP/CHF pair initially tried to rally during the day on Wednesday, but found enough resistance of the 1.2850 region to turn things around again, and form a very negative looking candle. Because of this, I believe that we will continue to go much lower, perhaps reaching towards the 1.25 level below. The British pound of course is struggling overall, and at this point in time it’s likely that the British pound will continue to be punished.

Swiss franc

The Swiss franc of course is considered to be a “safety currency”, having said that I believe that the market is simply running away from the concerns of the United Kingdom at the moment. With this being the case, it is short-term rallies will continue to offer selling opportunities going forward, and that there really is no way to go long of this pair right now. Because of this, I believe that we will reach towards the 1.25 level over the next several sessions, and then possibly even break down below there. Pay attention to the GBP/USD pair, because if it breaks down significantly, this pair will follow suit. I believe that a break down below the 1.28 level in the GBP/USD pair would be reason enough to start shorting this market as it should bring quite a bit of bearish pressure upon the British pound overall. Remember, it’s against the US dollar the most currencies are typically measured.

I have no interest in going long of this market until we can break above the 1.3250 level, which is massively resistive. We are nowhere near that, so I believe that unless we climb 600 pips, there’s really no point in worrying about going long. We could bounce off of the 1.25 level below as it is a large, round, psychologically significant number, and quite frankly I expect to. However, between here and there we should have plenty of selling opportunities.