GBP/USD Signals Update

Yesterday’s signals were not triggered as the level at 1.3023 was breached before the London session.

Today’s GBP/USD Signals

Risk 0.75% per trade.

Trades must be taken between 8am and 5pm London time today only.

Long Trades

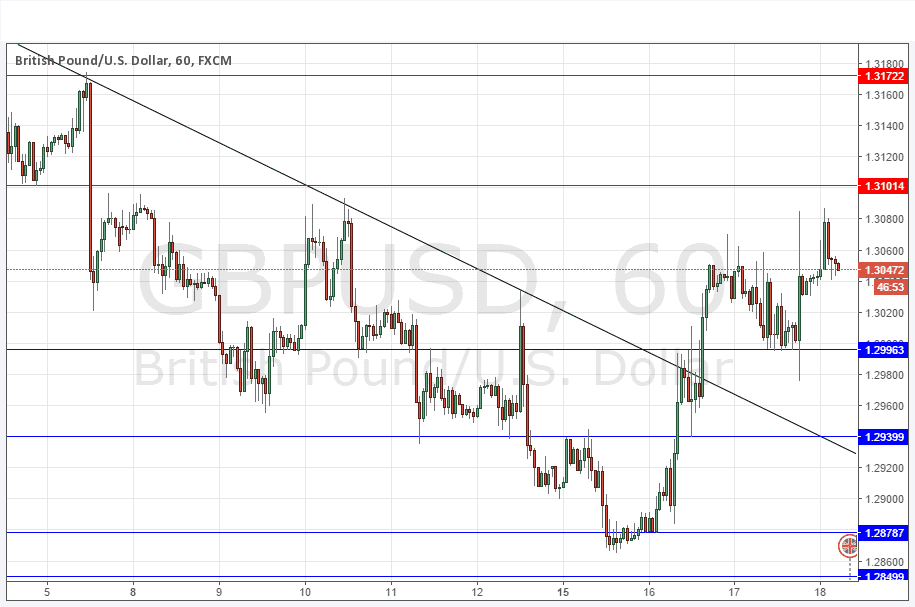

* Go long following a bullish price action reversal on the H1 time frame immediately upon the next touch of 1.2996 or 1.2940.

* Place the stop loss 1 pip above the local swing high.

* Move the stop loss to break even once the trade is 25 pips in profit.

* Take off 50% of the position as profit when the price reaches 25 pips in profit and leave the remainder of the position to ride.

Short Trades

* Go short following a bearish price action reversal on the H1 time frame immediately upon the next touch of 1.3101 or 1.3172.

* Place the stop loss 1 pip above the local swing high.

* Move the stop loss to break even once the trade is 25 pips in profit.

* Take off 50% of the position as profit when the price reaches 25 pips in profit and leave the remainder of the position to ride.

GBP/USD Analysis

The price was quite jittery and generally choppy all day until the FOMC release which sent the price up to make new highs but not quite reach support. It is telling that the price is finding difficulty in rising much further and so I think any recovery in the USD will make this pair fall quite strongly.

Technically, the most interesting note is that we now seem to have established 1.2996 – more or less the big round number at 1.3000 – as support.

Concerning the GBP, there will be a release of Retail Sales data at 9:30am London time. Regarding the USD, there will be releases of the Philly Fed Manufacturing Index and Unemployment Claims data at 1:30pm.