Gold prices ended slightly higher Monday as a retreat in the dollar took some pressure off the precious metal. The greenback suffered recently from weaker than expected economic data. A report released by the Federal Reserve Bank of New York showed that manufacturing activity in the region dropped to -4.2 from 0.6 a month earlier.

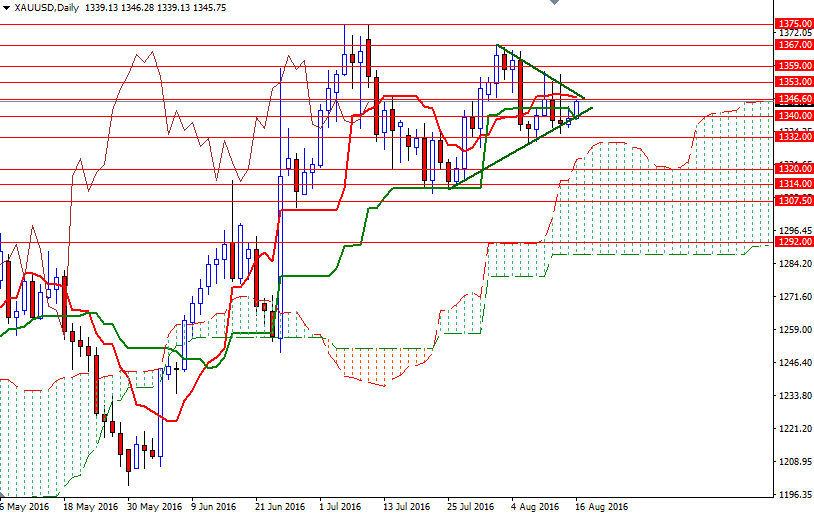

The XAU/USD pair continued to rise in Asia today, approaching the anticipated resistance in 1348-1346.60. If the market climb above 1348, then we could see a push up towards the 1353/1 region. The bulls have to push prices above the short term descending trend line (the upper line of the triangle shown on the daily chart) in order to regain their strength and march towards 1359. Once this resistance is cleared, XAU/USD might set sail to 1367.

On the other hand, in the short-term, we have to assume that the consolidation area holds. In other words, it is likely we will continue to go back and forth within the triangle for a while. If the dollar gets a boost from today's CPI data, keep an eye on the 1340/38 area. A break down below the 1338 level would open up the risk of a move towards 1332/0. Closing below 1330 on a daily basis could trigger a fall to 1320.