Gold prices ended Wednesday’s session up $2.22, marking the third consecutive rise, after minutes from the Federal Reserve’s July 26-27 policy meeting cast further doubt on the possibility of an imminent rate increase. The minutes showed that policy makers were generally upbeat about the U.S. economic outlook, though they agreed that more economic data is needed before taking another step in tightening monetary policy. The XAU/USD pair traded as high as $1356.02 an ounce before pulling back to the current levels.

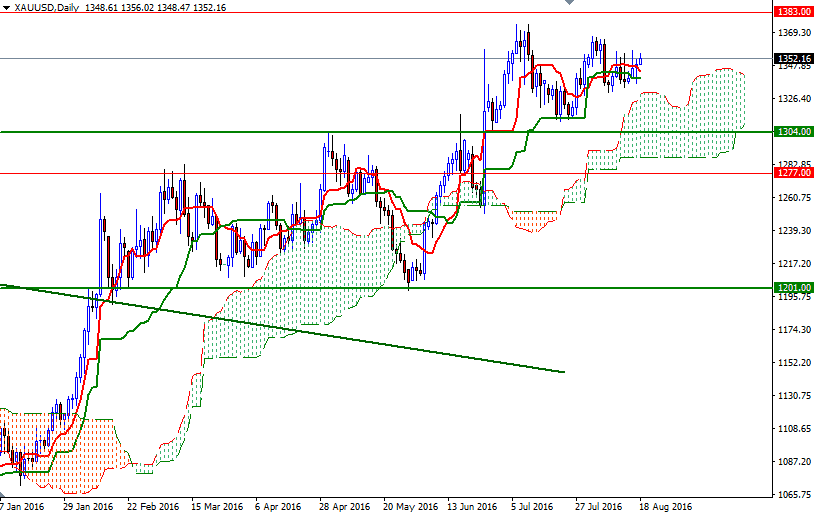

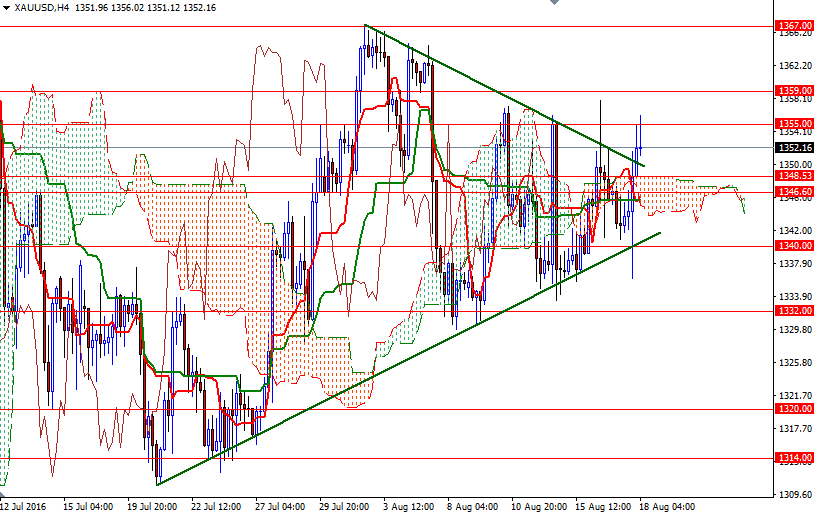

Gold's technical picture remains bullish, with prices above the Ichimoku clouds on the weekly, daily and 4-hourly charts - plus we have positively aligned Tenkan-Sen (nine-period moving average, red line) and Kijun-Sen (twenty six-period moving average, green line) lines on all three charts. However, as you can see, the area between the 1355 and 1359 levels has been resistive lately. Therefore, I think clearing this resistance is essential if the bulls want to win the battle expand their grounds.

In that case, it is technically possible to see a bullish continuation targeting the 1367 level. Anchoring somewhere beyond this strategic barrier could signal a run up to 1375. On the other hand, if the bulls fail to pass through 1359/5 and prices start to fall, we will probably heading back to the 4-hourly cloud. Down there, there is an anticipated support zone that stretches from 1348.53 to 1346.60 and bears have capture this area in order to drag the market to the 1342/0 region. A daily close below 1340 would open up the risk of a drop to 1332.