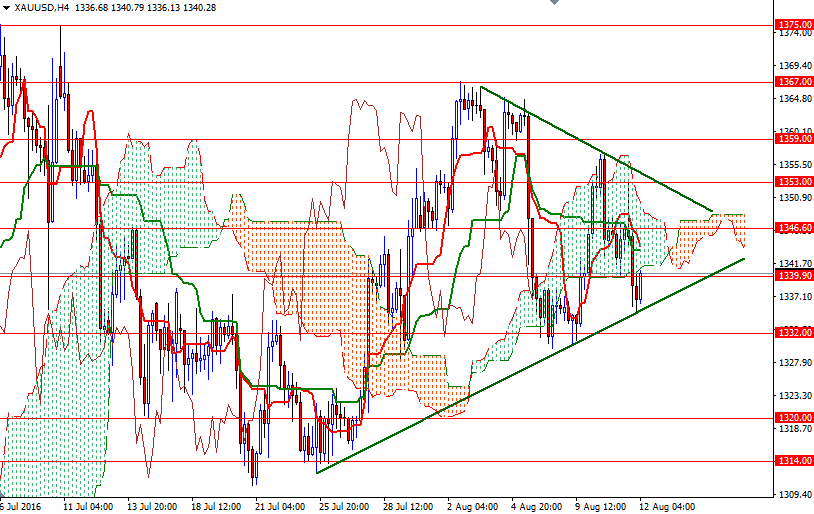

Gold prices dropped $7.61 an ounce yesterday, giving up all of the gains made in the previous session, as gains in the dollar dimmed the precious metal's appeal. The XAU/USD pair reached the $1354.50-1353 region after the bulls pushed prices above the $1348-1346.60 area but found significant amount of pressure and reversed its course. The market pulled back to the bottom of the triangle in early Asian session before bouncing back to the 4-hourly Ichimoku cloud.

Technically speaking, the Ichimoku cloud indicates an area of support or resistance and in our case clouds -which are right on top of us- are expected to offer resistance. Of course, thickness of the cloud is important as well because the thicker the cloud, the less likely it is that prices will manage a sustained break through it. The bulls have to break through the hourly cloud (1348-1346.60) if they intend to challenge the bears waiting in the 1354.50-1353 area. Since a horizontal resistance and the top of the triangle converge in this zone, breaching this barrier is essential for a bullish continuation towards 1359.

A break of the bottom of the triangle could send us back to the 1332/0 zone. If this support is broken, then 1326 will be the next port of call. Once below that, the bears will be targeting 1320. Closing below the 1320 level on a daily basis would make me think that we are heading back to the 1314 level.