Gold prices dropped $11.98 an ounce Wednesday to settle at their highest level in four weeks as a rebound in the dollar drew investors away from the market. Investors cautiously await Fed Chair Janet Yellen’s speech -which is expected to shed some light on the near-term plan for interest rates- at the central bank’s annual symposium in Jackson Hole. The hawkish tone of recent comments from Fed officials increased expectations for a rate hike this year.

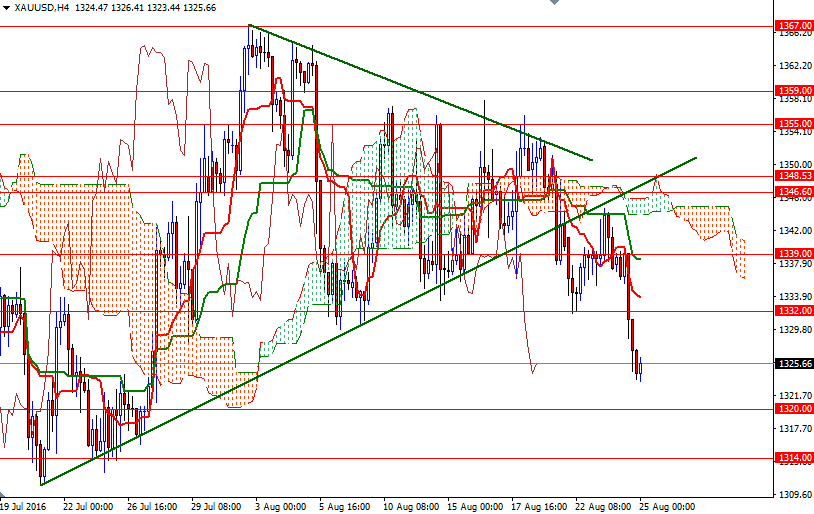

Technical selling was also behind the market's decline yesterday. A breach of a key support in the 1332/0 contributed further pressure on the market. As a result, the XAU/USD pair traded as low as 1323.27. The shorter-term charts turned bearish since prices broke out of the triangle and started moving below the Ichimoku clouds on the H4 chart.

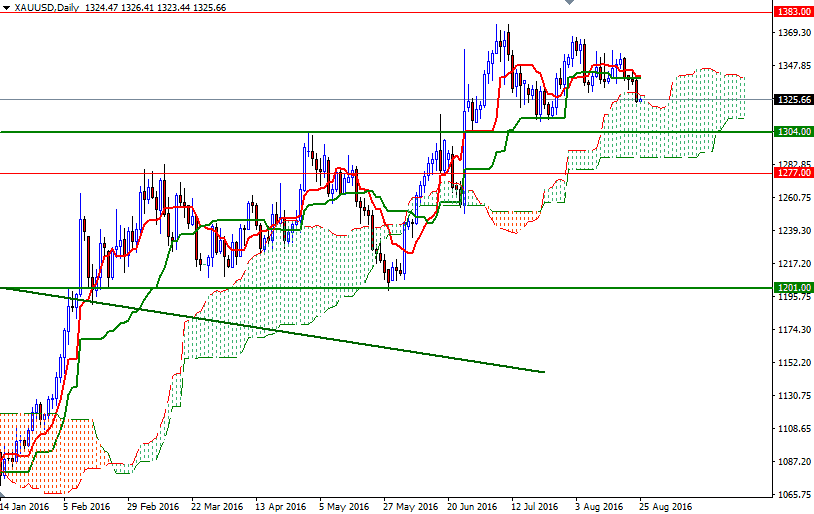

If prices can't climb back above the 4-hourly cloud, the market will have a tendency to visit the supports at 1314 and 1304. But of course, to confirm this, XAU/USD has to fall through 1320. A daily close below 1304 would imply that the bears are ready to march towards the bottom of the daily cloud at 1287.40. On its way down, support can be seen at 1292. To the upside, keep an eye on the 1332/0 zone broken yesterday. If the bulls push prices successfully beyond this barrier, they may have a change to challenge the 1340/39 resistance. Once above that, we could see a push up towards the 4-hourly cloud.