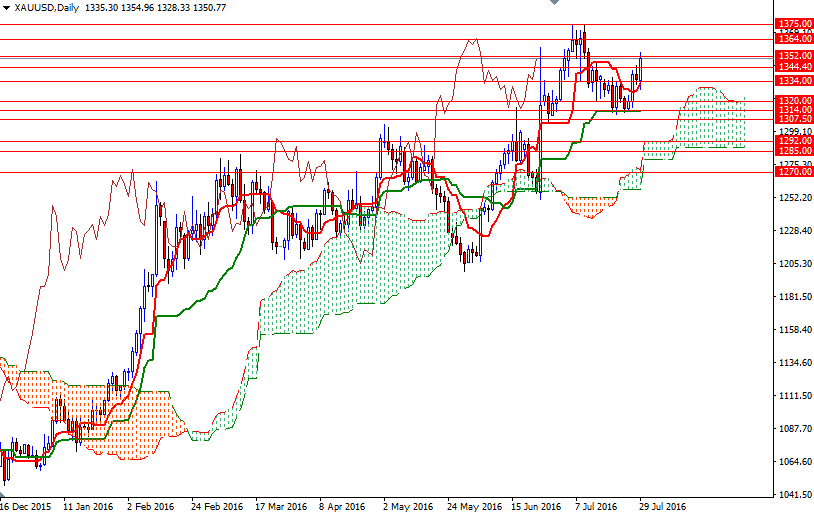

Gold prices settled at $1350.77 an ounce on Friday, rising 2.1% on the week and 2.2% over the month. The market initially went higher but encountered heavy resistance at $1375 as signs of strength in the U.S. economy stimulated speculation that a September rate hike is back on the table and prompted investors to lock in some of the gains of recent weeks. As a result, prices pulled back to the $1334/14 area and consolidated for some time. The XAU/USD pair rallied and broke out of this consolidation box after the Federal Reserve decided to stay steady at its latest meeting and U.S. growth data missed forecasts.

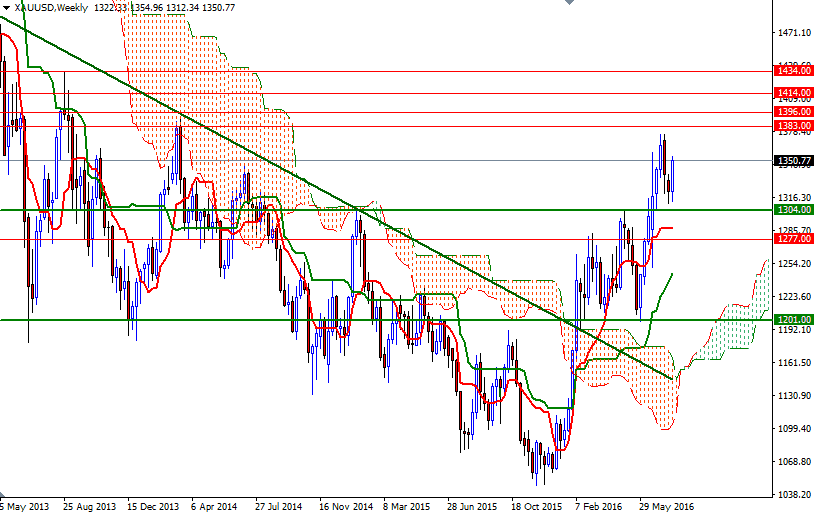

The Federal Open Market Committee said that near-term risks to the economic outlook have diminished, reflecting the recent easing in financial conditions and the improvement in economic data. But the Committee gave no clear insight into when it might lift rates, leaving investors to continue to focus on a December time frame as most likely. This should be supportive for gold, though some may argue that September is live especially if job growth in July comes out stronger than anticipated. I was bearish on gold since the market broke below the support at 1344, saying that the medium term outlook remained bullish but we could retreat towards the 1307.50-1304 zone before the next leg up.

As I noted a few days ago, the short-term technical picture for XAU/USD improved after prices climbed above the 1334 level. The market is trading above the 4-hourly Ichimoku cloud and the Tenkan-Sen (nine-period moving average, red line) and the Kijun-Sen (twenty six-period moving average, green line) lines are positively aligned. If XAU/USD convincingly breaks up above the 1356/2 area, then we are likely to proceed to 1364 (and then possibly to 1375). The bulls have to capture this strategic point in order to gain the extra momentum they need to challenge 1385/2 and 1396/3. On the other hand, if XAU/USD fails to make a sustained break above 1356/2, the market will have a tendency to retest the 1344-1342.90 and perhaps 1334. A break down below 1334 would imply that the bears will be targeting 1324/0. Once below that, look for further downside with 1314 and 1307.50-1304 as targets. If prices falls through 1304, it would be a sign of a serious weakness which could trigger a quick drop to 1292.