Gold prices rose for a second day on Tuesday as mixed U.S. economic data failed to give clarity on whether the Federal Reserve will raise interest rates next month. The XAU/USD pair traded as high as $1358 an ounce after the Labor Department reported that the consumer price index was unchanged in July, but gave up some of the gains on hawkish comments from Fed officials. New York Fed President William Dudley said "We're edging closer towards the point in time where it will be appropriate I think to raise interest rates further."

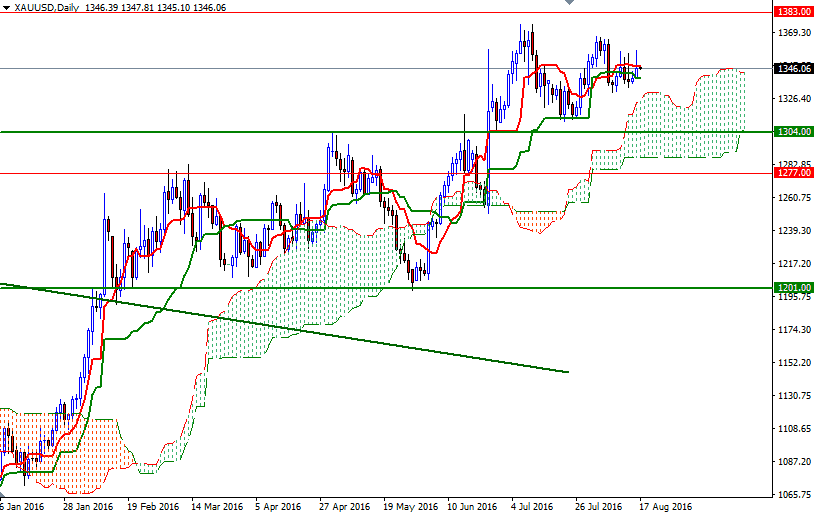

As a result, the market returned to the 4-hourly Ichimoku cloud, leaving another tall upper shadow on the daily candle. All eyes will be on the Federal Reserve today, with the release of the minutes of the most recent policy meeting. In the meantime, it appears that the market will remain range bound.

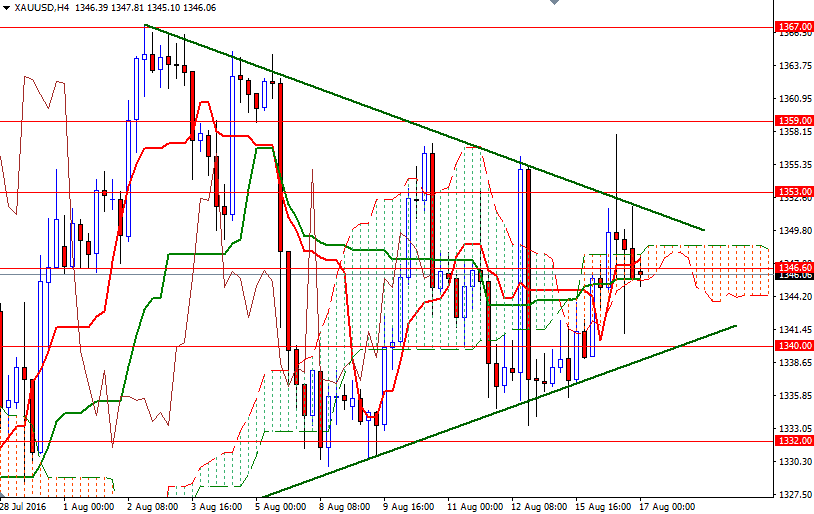

If prices drop below the cloud on the 4-hour chart, a retreat towards the 1340/38 area -where a horizontal support and an ascending trend line converge- seems reasonable. The bears will have to convincingly drag the market below 1338 so that they tackle the next support in the 1332/0. Breaking down below 1330 would pave the way towards 1320. To the upside, the first hurdle gold needs to jump is located in the 1348.53-1346.60 region. If this resistance is broken, XAU/USD may pay another visit to 1353/1. Once above 1353, we could possibly see the bulls make a run for 1359.