Gold prices dropped $12.24 an ounce on Friday, surrendering the majority of the gains made earlier in the week, as the Fed minutes and two Fed officials' comments raised traders' expectations of a U.S. rate hike this year. The weaker than expected inflation numbers initially drove the gold price higher but minutes from the US central bank's last meeting suggested a rate increase is a possibility as early as September. New York Fed President Dudley said "I think the labor market is going to continue to tighten, and in that environment I think we are getting closer to the day where we are going to have to snug up interest rates a little bit," while Atlanta Fed President Lockhart said "Now we have more data to come in in the next few weeks before the meeting. We’ll see what that tells us. But I would not rule out September, at least for a serious discussion."

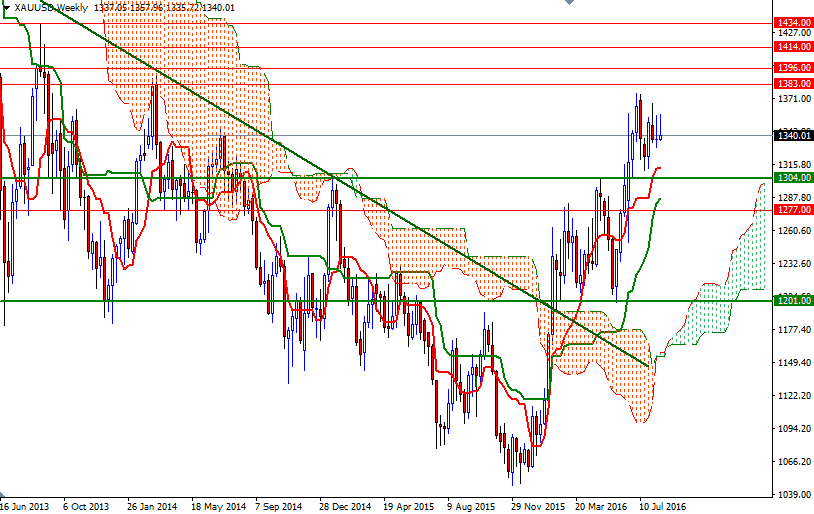

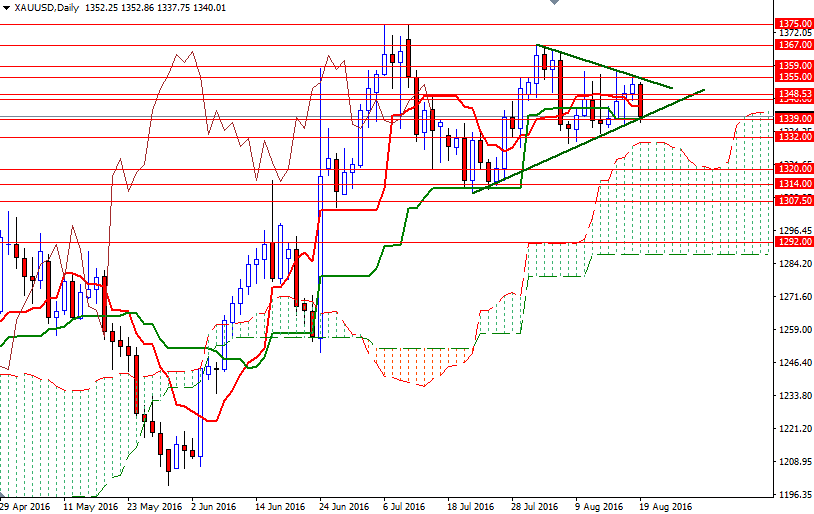

However, it appears that the majority of policy makers are divided over when the next rate rise should come and, with inflation continuing to miss to the downside, most people are not expecting the Fed to tighten policy in September. Aside from the uncertainty in the market, technicals also played an important role. Just a week ago I was telling that the XAU/USD pair could stay range-bound. Prices went back and forth as we came closer to the corner of the narrowing triangle.

Above, the bearish trend line, and the area between the 1355 and 1359 levels, could act as resistance. Below, the 1339/6 and 1332/0 areas could act as support. Technically, trading above Ichimoku clouds (on the weekly and daily time frames) suggest that gold is likely to maintain its bullish trend over the medium term, though I wouldn't rule out a trip back to the 1307.50-1304 area, if XAU/USD convincingly breaks down below 1332/0. On its way down, support can be seen at 1320 and 1314. As mentioned earlier, the 1359/5 zone has been blocking the bulls' way, so we need to break up above there in order to continue to the upside. Closing above 1359 on a daily basis would be a strong indication that the bulls are regaining the control and we are about to test the 1367 level. The next solid resistance beyond that is at 1375.