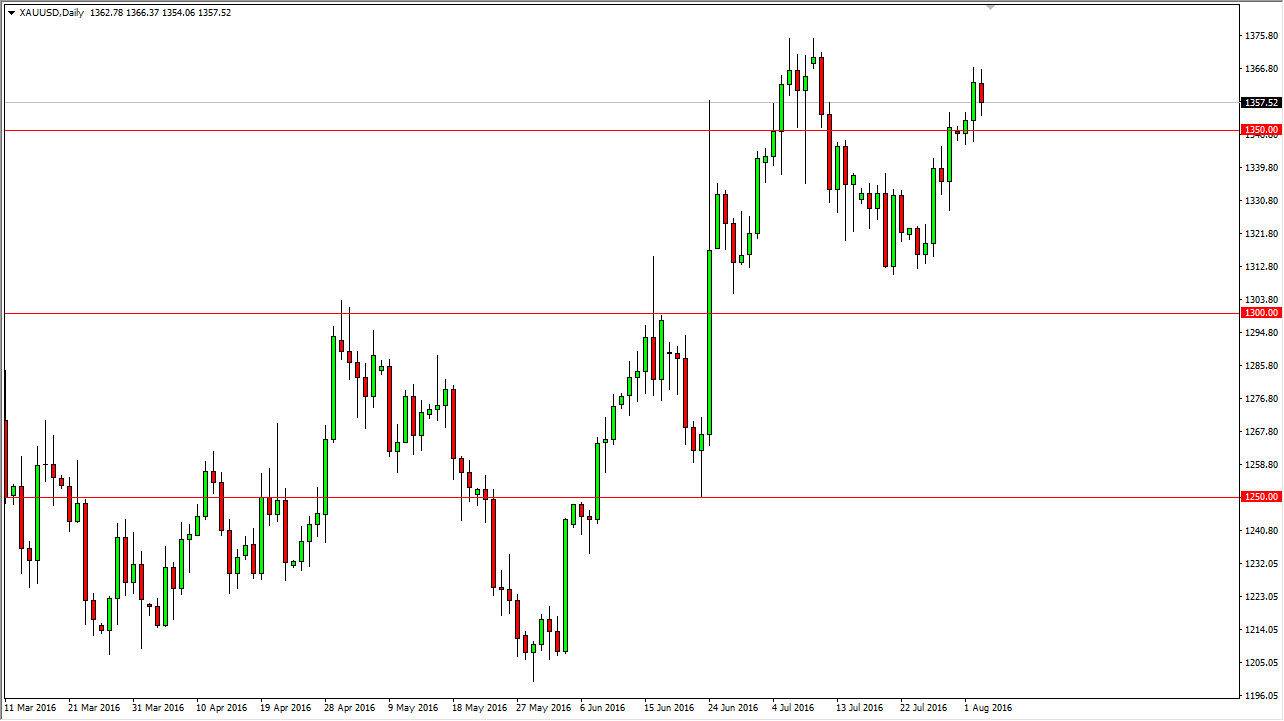

The gold markets went back and forth during the course of the day on Wednesday, ultimately settling on a slightly negative candle. However, you can see that I have the $1350 level marked on the chart. This is an area that previously had been resistant, and now looks to be very supportive. In other words, I think when we pullback from here, we need to find some type of support in that area to continue the longer-term uptrend. I believe we started to see that towards the end of the day, so therefore it’s probably only a matter of time before we break out to the upside and continue the longer-term trend higher.

Longer-term outlook

I believe that the longer-term outlook for gold is very bullish due to the concerns in the European Union, the United Kingdom, and quite frankly the fact that interest rates simply aren’t going anywhere anytime soon. Ultimately, this is a bit of a “safety trade”, as hard currency is much more attractive than the Euro, as the European Union looks so disastrous. After all, you don’t lose the second-biggest member of your club and not suffer from it. On the other hand, the United Kingdom could very well find itself in a lot of trouble going forward as well. I suspect that a lot of buying of gold is being done in both Euros and Pounds, which course has a bit of a knock on effect over here.

Even if we broke down below the $1350 level, I think that the $1330 level is massively supportive as well. I believe in a “buy-and-hold” type of strategy, because quite frankly this is a market that has a lot of things going forward at the same time. So with this, I continue to buy dips, and breakouts, and of course pullbacks and show signs of support. I have no scenario in which I’m willing to sell gold at this point in time.