NZD/USD Signal Update

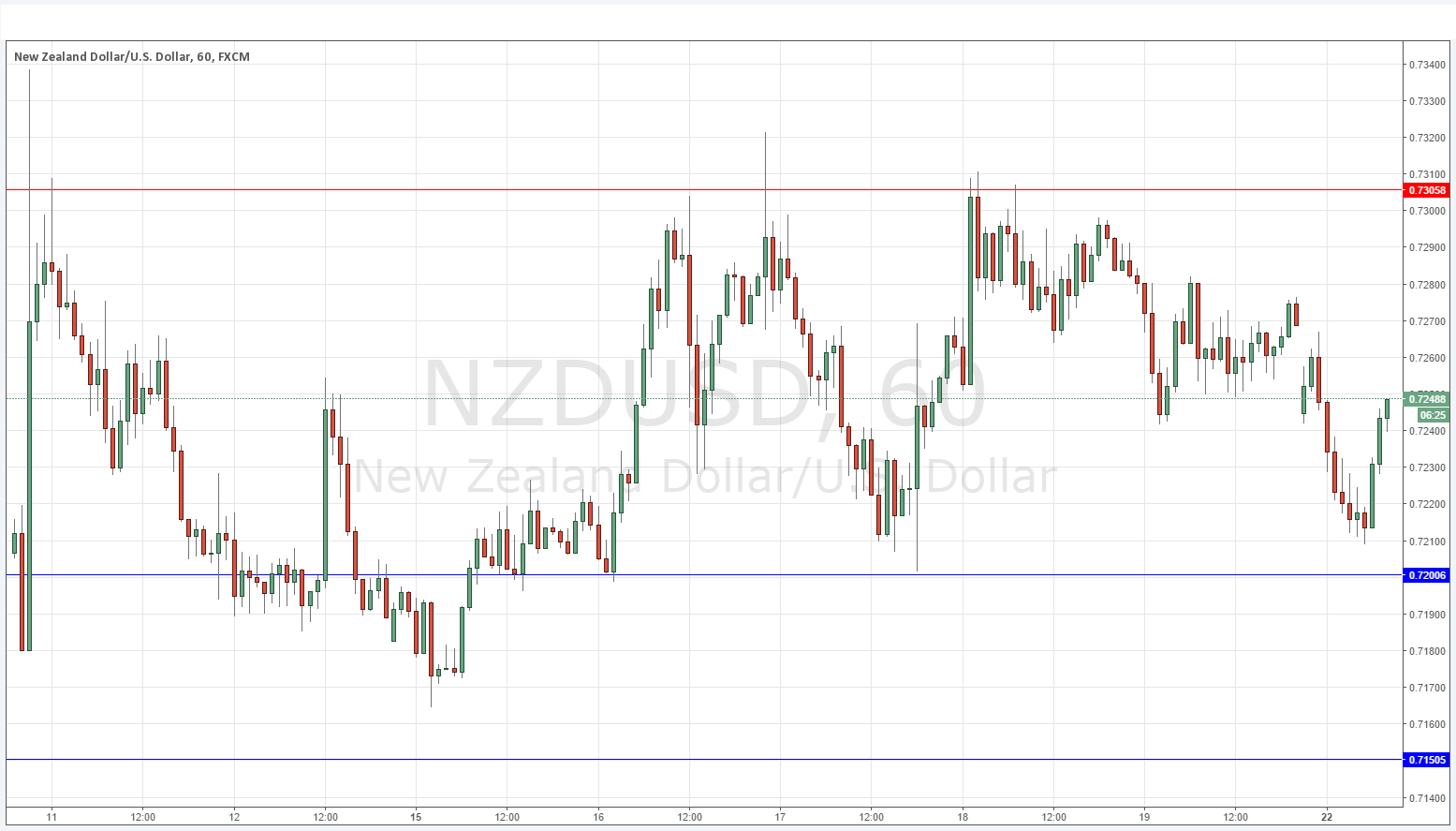

Last Thursday’s signals were not triggered but the open short trade from the rejection of the key resistance level identified at 0.7306 should be closed out now at a nice profit if not done already.

Today’s NZD/USD Signals

Risk 0.50%

Trades must be entered between 8am New York time and 5pm Tokyo time, durng the next 24 hours only.

Long Trades

* Go long following a bullish price action reversal on the H1 time frame immediately upon the next touch of 0.7150 or 0.7200.

* Put the stop loss 1 pip below the local swing low.

* Adjust the stop loss to break even once the trade is 20 pips in profit.

* Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

Short Trade 1

* Go short following a bearish price action reversal on the H1 time frame immediately upon the next touch of 0.7306.

* Put the stop loss 1 pip above the local swing high.

* Adjust the stop loss to break even once the trade is 20 pips in profit.

* Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

NZD/USD Analysis

The price has fallen nicely from the key resistance level at 0.7306 as had been expected. There was some strong buying that began when the price reached within 10 pips or so of the key support level at 0.7200, which was a good signal to get out of that short trade.

It is unlikely the price will reach 0.7306 again today, but another strong bounce off 0.7200 could provide a good long trade opportunity. There is also support at 0.7105.

This pair has been in a consistent upwards trend so although it is flattening out somewhat, with the USD becoming weaker it can be a good idea to maintain a long bias.

There is nothing due today concerning either the NZD or the USD.