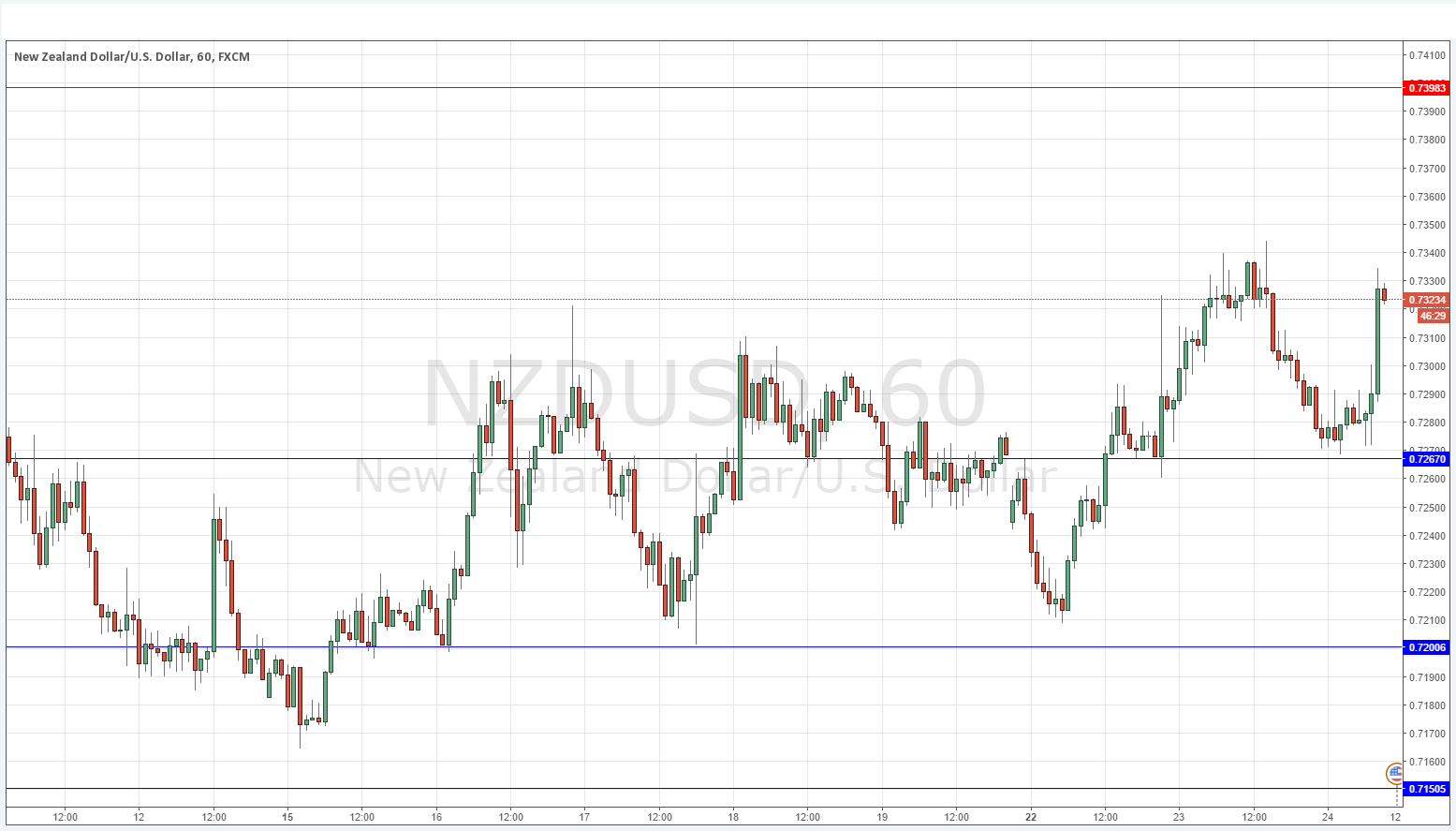

NZD/USD Signal Update

Yesterday’s signals were not triggered: unfortunately, the swing low was only 8 pips above the identified support level of 0.7260.

Today’s NZD/USD Signals

Risk 0.75%

Trades may only be taken from 8am New York time until 5pm Tokyo time only, over the next 24 hours.

Long Trades

* Long entry following a bullish price action reversal on the H1 time frame immediately upon the next touch of 0.7200 or 0.7260.

* Put the stop loss 1 pip below the local swing low.

* Adjust the stop loss to break even once the trade is 20 pips in profit.

* Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

Short Trade 1

* Short entry following a bearish price action reversal on the H1 time frame immediately upon the next touch of 0.7398.

* Put the stop loss 1 pip above the local swing high.

* Adjust the stop loss to break even once the trade is 20 pips in profit.

* Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

NZD/USD Analysis

There is not very much to say about this currency pair, except that it is showing a weakly bullish short-term pattern and is within a reasonable long-term bullish trend, so as I said yesterday, it is a good idea to maintain a bullish bias. The price yesterday reached a 15 month high.

There is nothing due today concerning the NZD. Regarding the USD, there will be a release of Crude Oil Inventories data at 3:30pm London time.