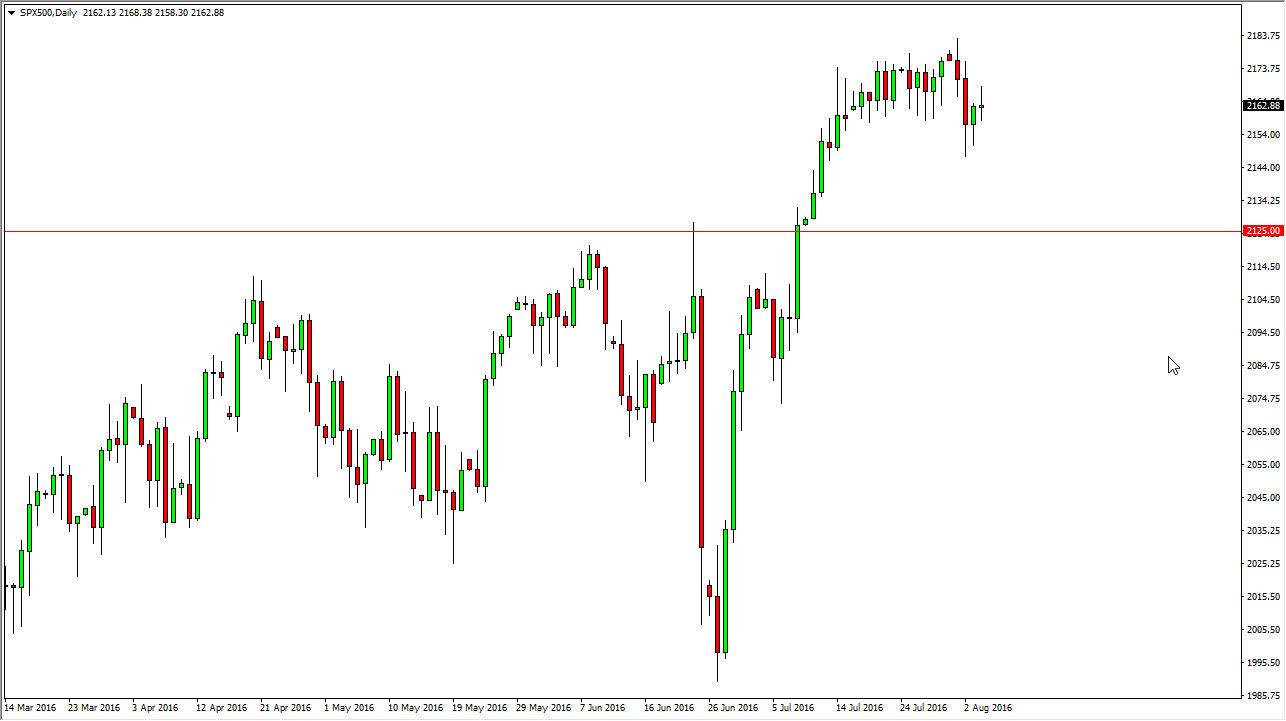

S&P 500

The S&P 500 went back and forth during the course of the day on Thursday, as we continue to see quite a bit of volatility. At this point in time, the market looks like it wants to go higher, based upon the hammer that had formed on Wednesday. I also recognize that the low interest-rate environment that we find yourselves in should continue to support the S&P 500, as well as American indices in general. I believe pullbacks will offer buying opportunities, and that there is essentially a “floor” in this market at the 2125 handle. If we pullback from here, the value hunters will almost certainly come back into the marketplace and start buying later in the day. I would love to see some type of knee-jerk reaction to the downside so I can do the same.

NASDAQ 100

The NASDAQ 100 initially fell during the course of the day on Thursday, but turned things back around to form a hammer. It looks as if the 4700 level has offered support and it looks likely that we will continue to go much higher. If we can break out to a fresh, new high and believe we will then reach towards the 5000 level. I believe the pullbacks will continue to be buying opportunities again and again, and that the 4600 level below is essentially the “floor” in this market as we have seen such bullish pressure. Quite frankly, this is a market that could be fairly volatile during the day but I think it’s only a matter time before the buyers return as we have seen such strength over the last several weeks. With this, I have no interest whatsoever in shorting this market and believe that the lower we go, the more likely we are to find value hunters jumping into the market and taking advantage of value as it appears.