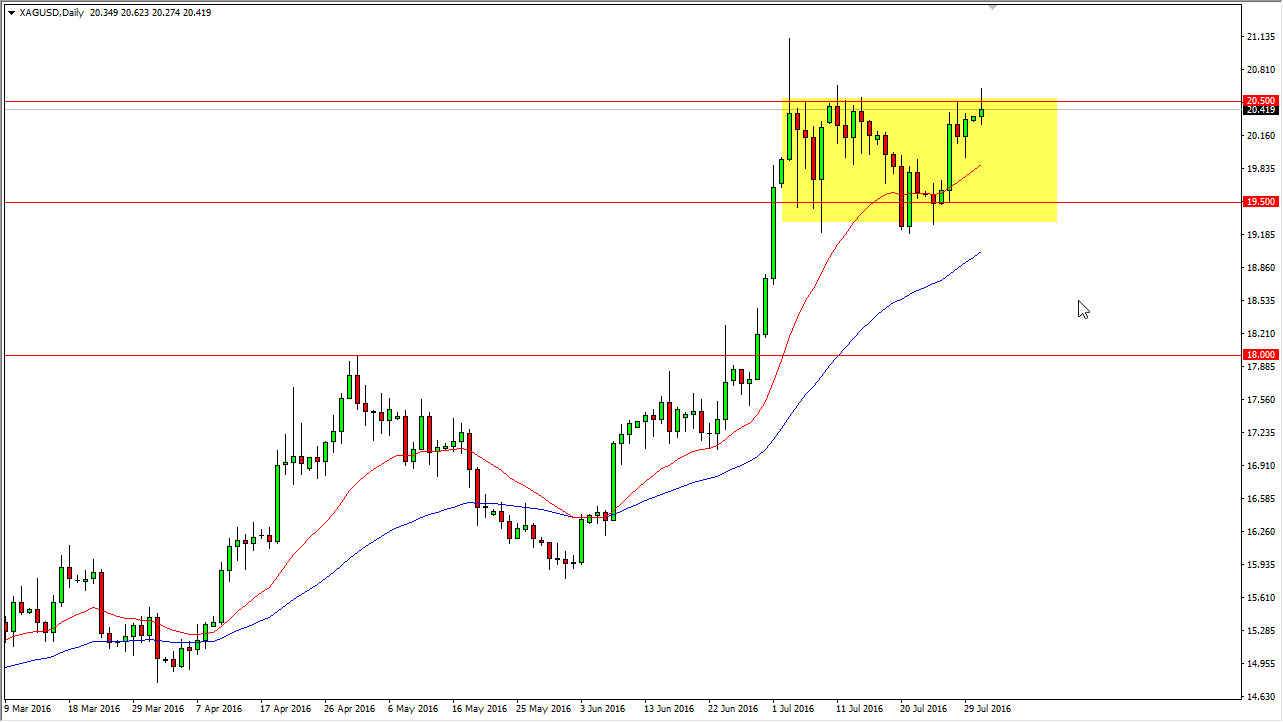

Silver markets initially tried to rally during the course of the day on Monday, but the $20.50 level offered a bit too much resistance, forcing the market to turn things back around. The shooting star suggests that we are running out of strength again, and the $20.50 level has proven to be resistive in the past. With this being the case, it looks as if we are going to drop from here, but I think there is more than enough reason to believe that the market is going to go higher, given enough time. The $19.50 level below should be supportive, but then again so is the 20-day exponential moving average drawn on the chart, in red. Ultimately, I believe that silver will find buyers given enough time as there is more than enough strength below to push higher.

Hard currency

Silver markets have seen quite a bit of bullish pressure due to the fact that a lot of people are concerned about owning Euros or Pounds, as the markets will of course continue to shun both of those currencies given enough time due to the fact that the British have voted to leave the European Union, and of course the European Union itself doesn’t necessarily look like the strongest economy out there. In other words, people are more interested in owning a stronger currency instead of those. And beyond that, it has people buying silver and gold in those currencies, which has a knock on effect over here.

With this, I believe the pullbacks will eventually find support that we can take advantage of, but I also believe that a break above the top of the shooting star during the course of the day on Monday would be a buying opportunity as well. Either way, I have no interest whatsoever in selling this market, and I believe that we will sooner or later see quite a bit of buyers jump into this market.