Version:1.0 StartHTML:0000000167 EndHTML:0000003109 StartFragment:0000000457 EndFragment:0000003093

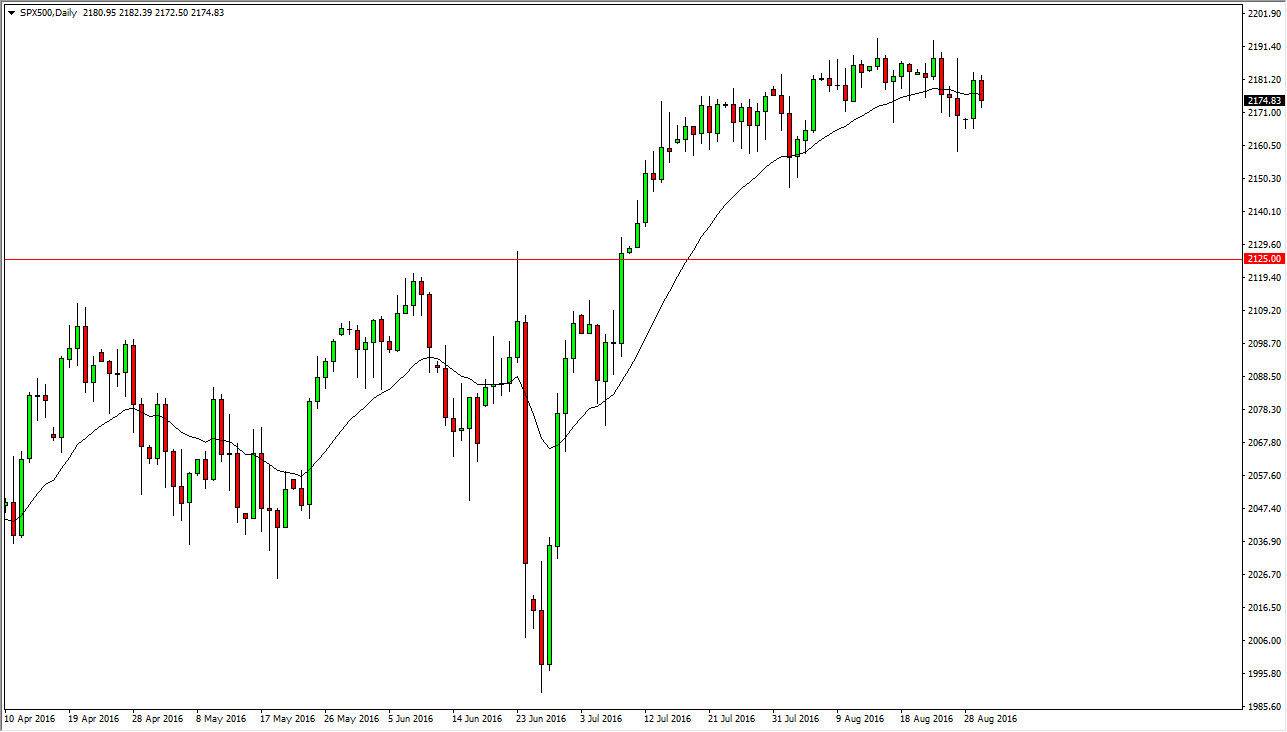

S&P 500

The S&P 500 fell during the day on Tuesday, as we continue to see quite a bit of volatility in the stock markets. This of course has a lot to do with the fact that there is very much a lack of volume in the markets right now, so having said that it makes sense we continue to chop around. I think we are essentially just trying to build up enough volume in order to continue going higher once the large volume flow returns to the marketplace in a few sessions, so at this point in time I look at pullbacks as potential buying opportunities and of course value. After all, the United States is one of the better places to invest in at the moment, and that of course will be reflected in the stock markets.

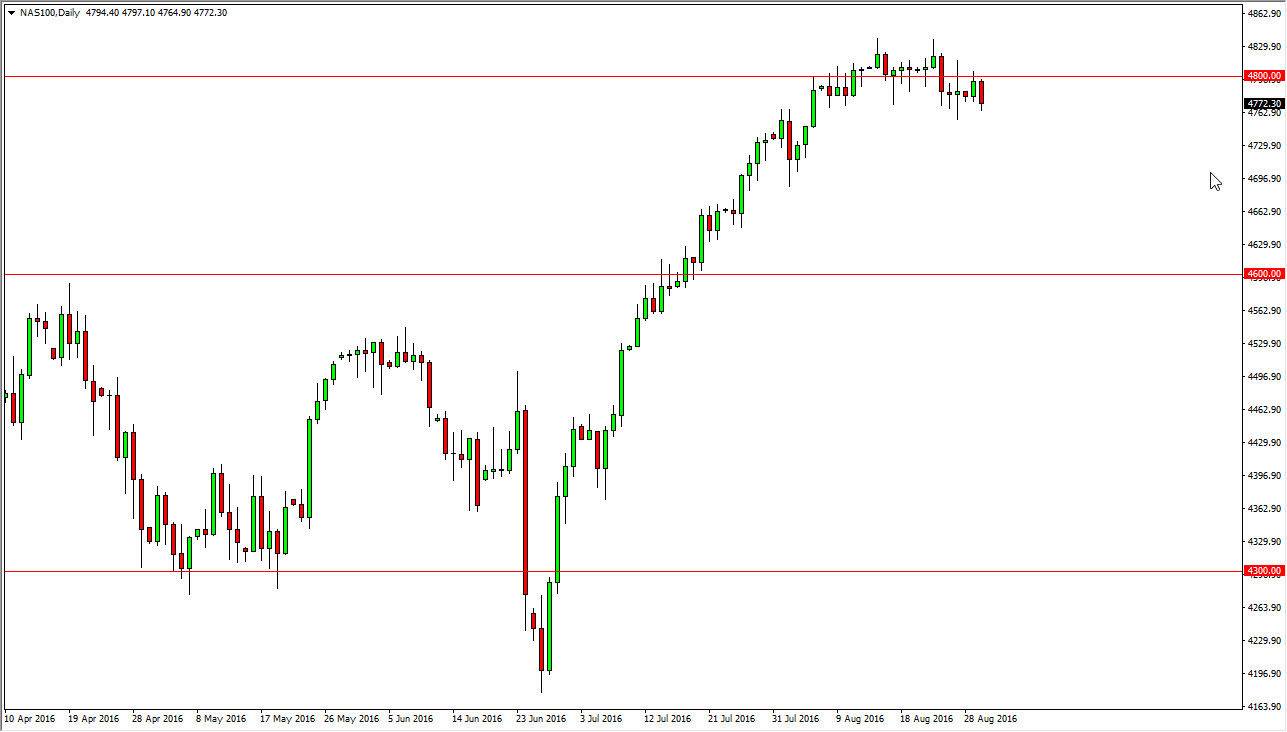

NASDAQ 100

The NASDAQ 100 of course did very much the same thing during the day on Tuesday, as we continue to bounce around just below the 4800 level. Because of this, I think that sooner or later the buyers will return and that we are trying to build up enough momentum to finally break above the psychologically significant number. That doesn’t mean that is going to happen today, but I do think that it will over the next several sessions. As soon as we get some type of supportive candle, I’m on the sidelines because I think there’s so much in the way of support below that eventually we will bounce. I think that given enough time we will reach towards the 5000 level, which of course is a large, round, psychologically significant number and will attract a lot of attention.

Even if we broke down from here I think that we would more than likely find quite a bit of support at the 4700 level below, which has been supportive in the past. With that in mind, if we fall I to start thinking about value more than anything else at that point.