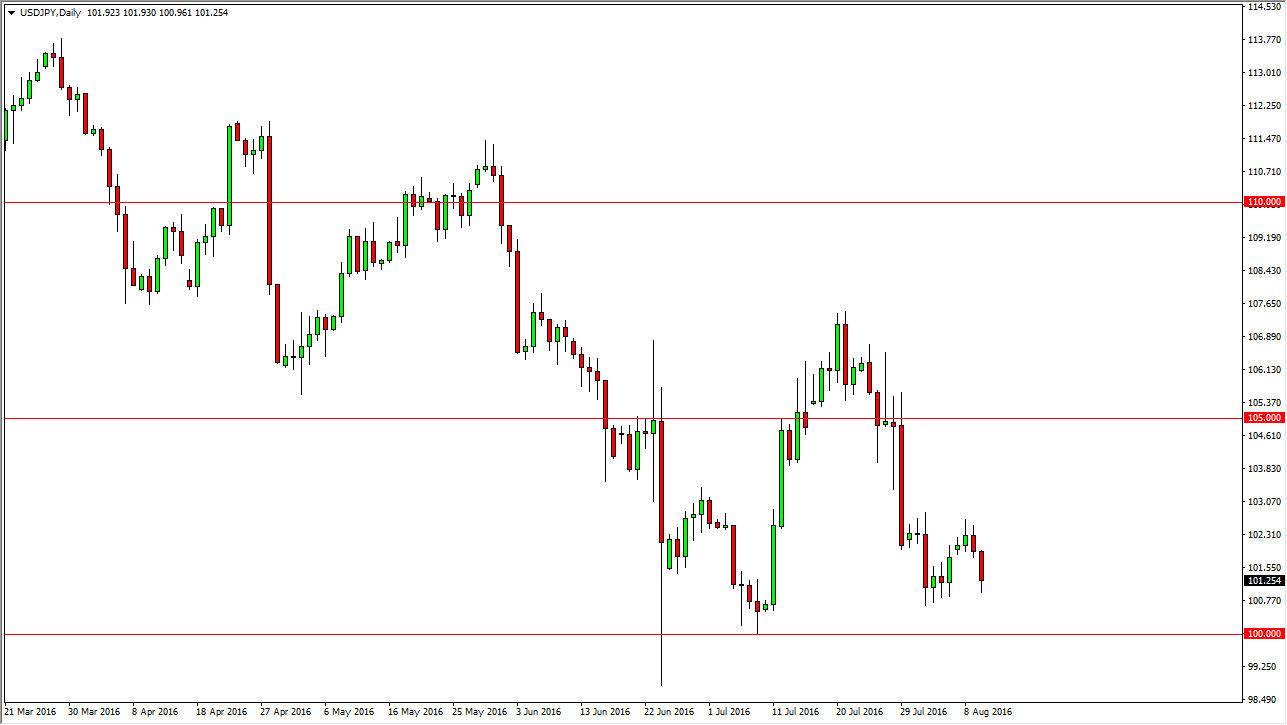

USD/JPY

The USD/JPY pair fell during the course of the session on Wednesday, but at this point in time I believe that the market will more than likely find quite a bit of support just below, as the area between the 101 level and the 100 level below could offer a bit of a barrier to breaking down significantly. With this being the case, I believe that the Bank of Japan continues to influence this market, and therefore I don’t think that the sellers will be very comfortable shorting for very long. I believe that any reason whatsoever to go long, people will jump on it. At this point in time though, this is a market that is very choppy, so it’s very interesting to see how this has played out, and with that being the case I think you have to be very cautious, and more importantly patient.

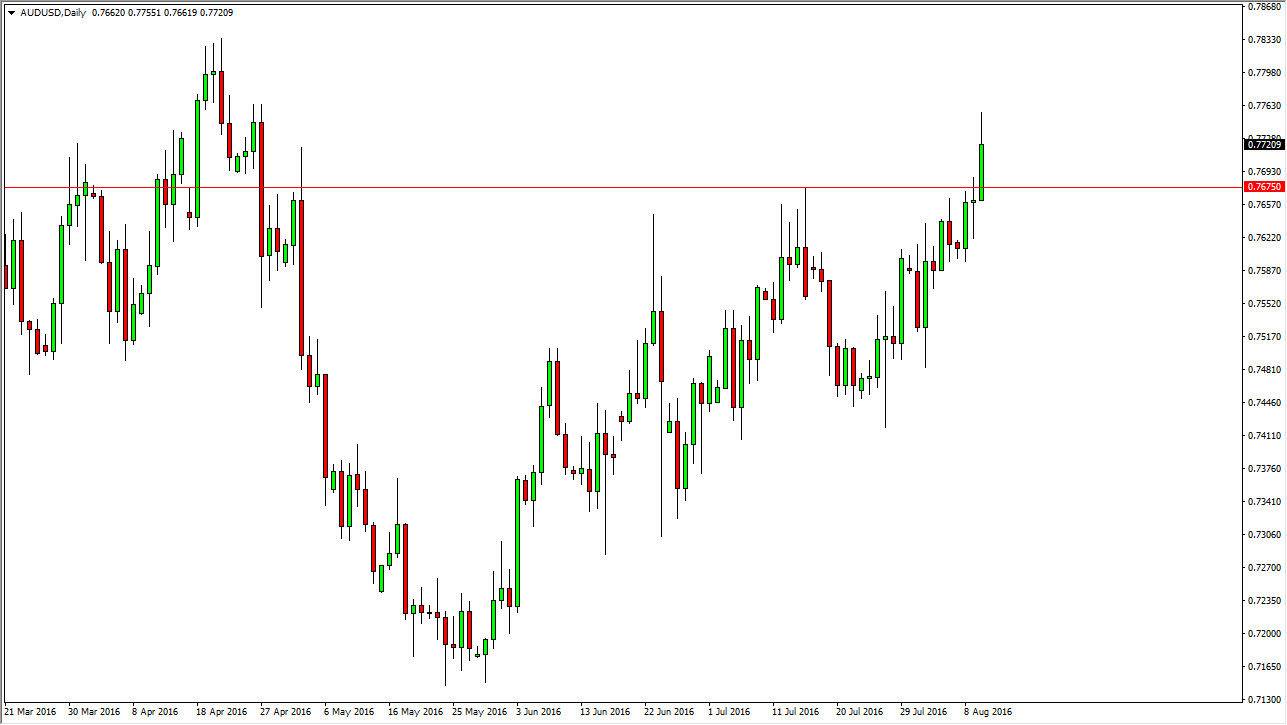

AUD/USD

The Australian dollar broke out to the upside during the course of the session on Wednesday, clearing the 0.7675 level. With this being the case, I feel that the market should continue to grind higher, but the key word of course is going to be “grind.” This is a market that is heavily influenced by the gold markets, so having said that if we can get some type of rally over there, we should get a rally over here.

Pullbacks will more than likely find quite a bit of support below, as we typically do after breakouts. In fact, I can almost make an argument for a bit of a triangle (ascending) just below. With that being the case, the market could very well find itself grinding 200 pips higher. Ultimately, I believe that we are trying to get to the 0.80 level over the longer term, but in the short-term it could be very choppy. If you are patient enough, you should continue to be rewarded to the upside.