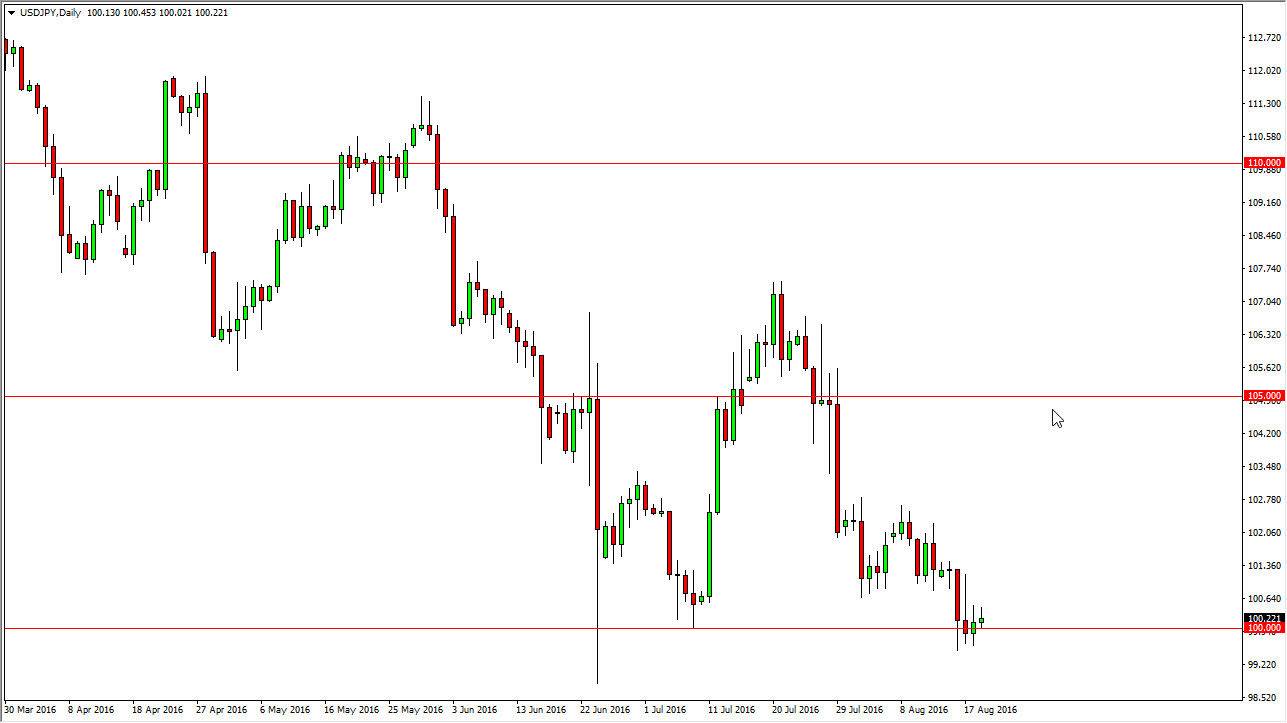

USD/JPY

The USD/JPY pair went back and forth during the course of the day on Friday, as the 100 level offers quite a bit of support. Ultimately though, I think that this is more or less a psychological barrier, as well as a potential “line in sand” by the Bank of Japan. That being the case, the market looks like it could very well find this area to be difficult to break down below. I think we need to clear the 99 handle in order to show real conviction to the downside but there is always going to be concerned about the Bank of Japan either intervening, or doing more quantitative easing. They are not amused by the value of the Japanese yen at the moment, so I do think that sooner or later they do something. A break above the top of the candle during the session on Friday could have this market reaching towards the 101.50 level.

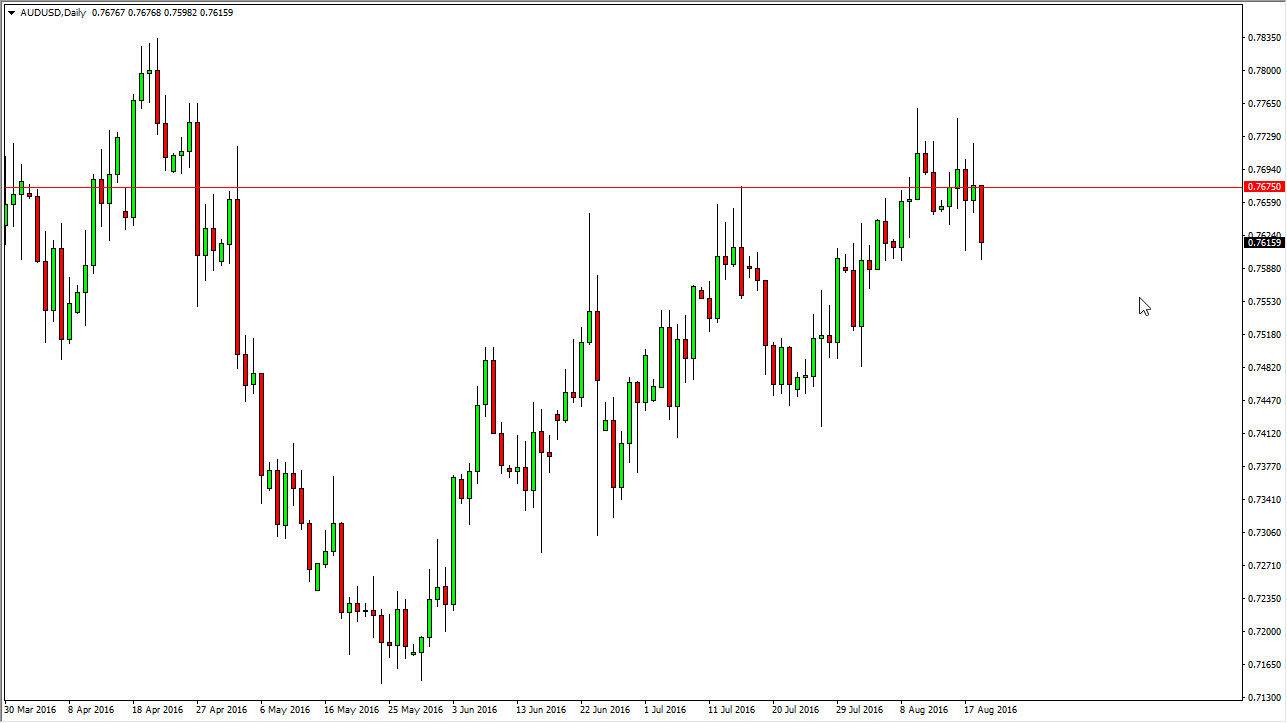

AUD/USD

The AUD/USD pair broke down during the course of the session on Friday, as the 0.7675 level offered resistance yet again. I think that the Australian dollar could drift a little lower from here based upon the fact that we have formed a couple of shooting stars on the weekly chart. However, I am very hesitant to sell this market because I see so much in the way of support below. On top of that, we have gold markets look fairly well supported as well, and as you may very well know, gold tends to influence what happens with the Australian dollar. A supportive candle below is what I’m looking for in order to take advantage of what I see as value in a market that is trying to continue to go higher based upon the interest-rate differential as the interest-rate in America will probably remain low for quite some time.