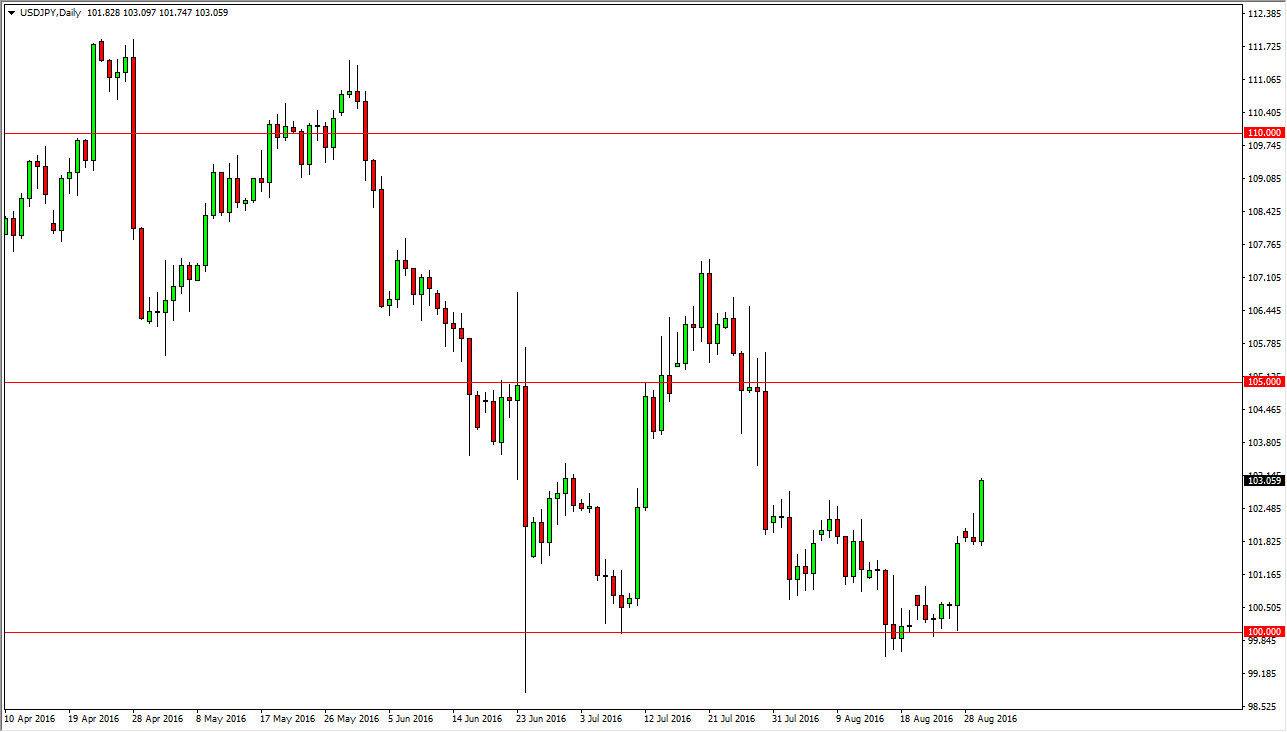

USD/JPY

The US dollar continues to rally against the Japanese yen during the session on Tuesday, as we have broken above the 103 level. This is a market that of course has been very negative until recently, as the Bank of Japan has suggested that it had no issues whatsoever to continue to loosen monetary policy, while Janet Yellen of the Federal Reserve suggested that perhaps an interest-rate hike was still on the table for September. This was a bit of a perfect scenario in which this market would go higher, and of course that’s exactly what we’ve seen. Because of this, I believe that the market is going to reach towards the 105 level, but pullbacks could happen time to time which of course I would look at as value.

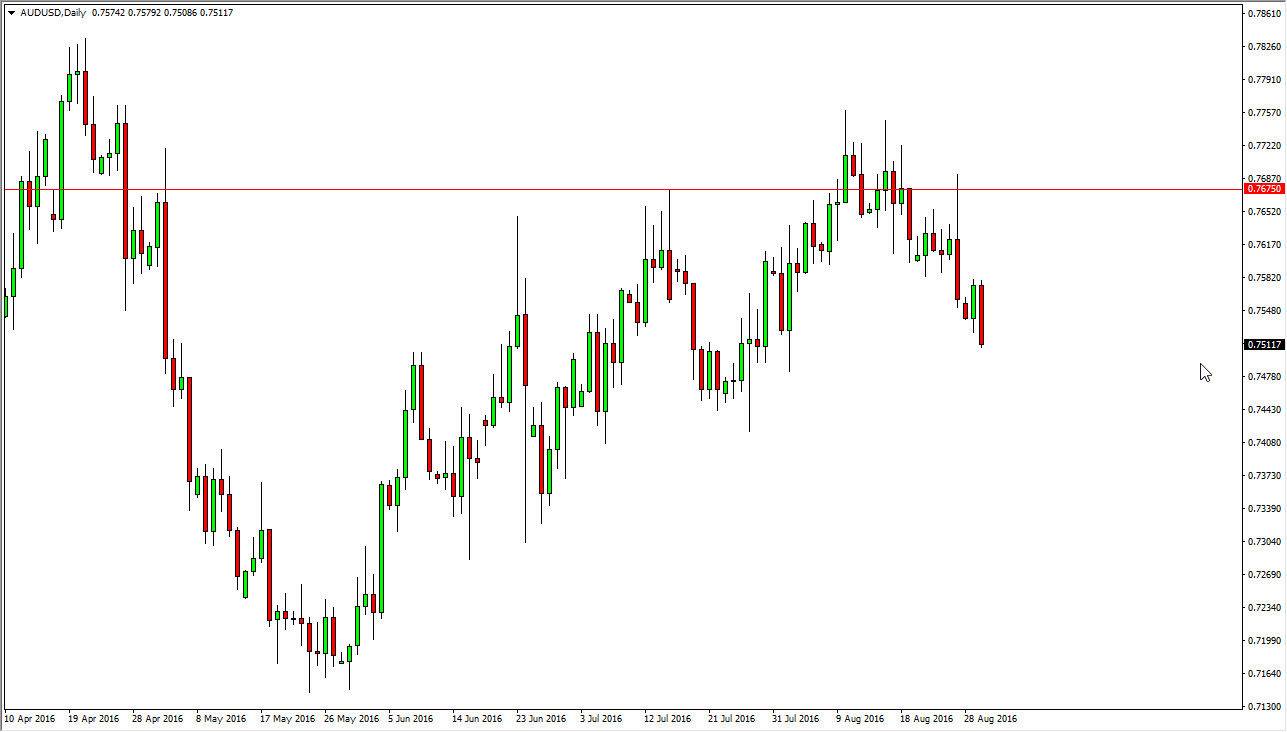

AUD/USD

With Janet Yellen suggesting that interest-rate hikes could still be coming, of course the US dollar has strengthened. This is against the Australian dollar, but it is essentially the same situation, an area where the US dollar should continue to strengthen due to the fact that it’s one of the few central banks around the world it could be raising interest rates. Keep in mind that this market is highly volatile when it comes to its correlation with the gold markets, so therefore if we see buyers step back into that market, this market could turn right back around.

We still have a bit of a significant interest-rate differential on the swap when it comes to the AUD/USD pair, so having said that it’s likely that the market may not fall in favor of the US dollar as quickly as the USD/JPY well, but I still think that it makes sense that the Australian dollar falls from here. With this, I think that we are going to try to target the 0.74 level, and then possibly the 0.73 level after that.