By: DailyForex.com

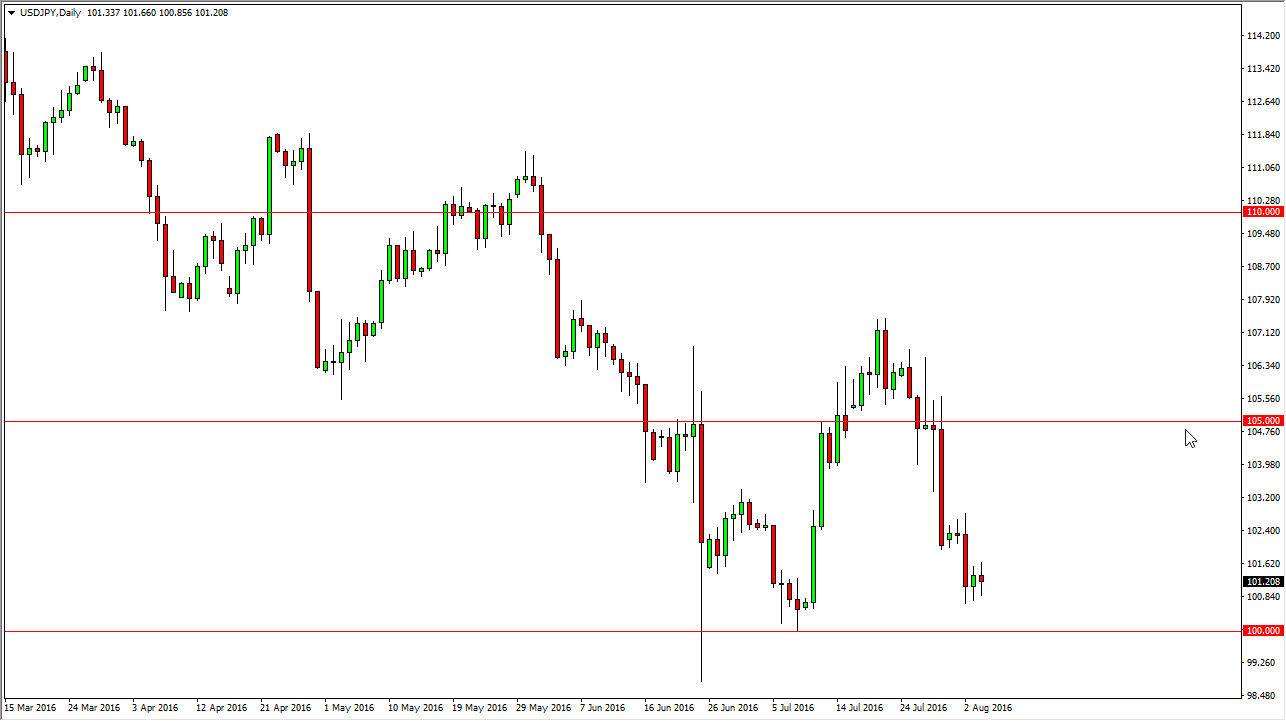

USD/JPY

The USD/JPY pair went back and forth during the day on Thursday, ultimately settling nothing. What may surprise you, is that I am actually planning on buying this pair sooner or later today. I believe that we will either bounce and go higher from here, or people will get interested in going long of this market on a break down as the 100 level is such a massively psychologically important barrier. Because of this, and the fact that the Bank of Japan is considered to be just below, I think that sooner or later you will get an opportunity to go long and pick up “value” in this market. This is a very risky strategy, but it is one that I’ve used several times, and there are a few areas where it is more obvious to you something like this than the 100 level in the USD/JPY market.

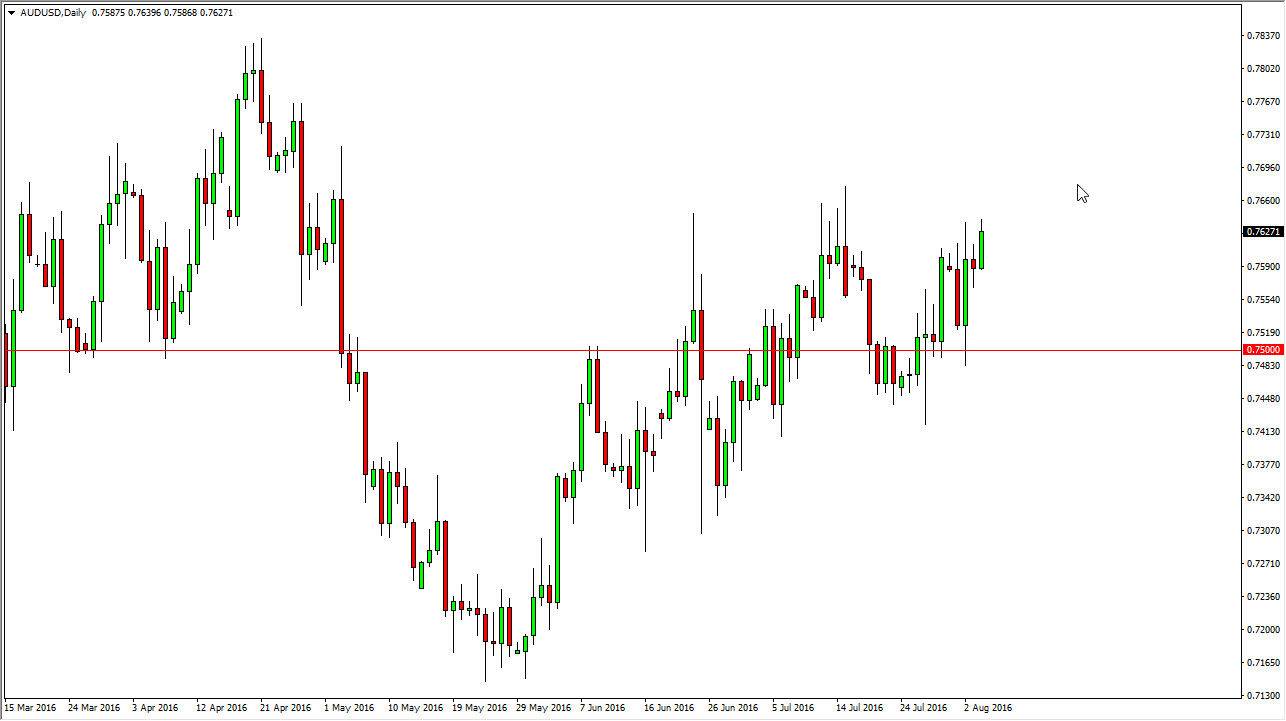

AUD/USD

The Australian dollar rallied during the course of the day on Thursday, as we continue to grind higher. I believe that the gold markets are getting ready to break out, and as a result it should pull the Australian dollar right along with it. Pullbacks at this point should continue to find buyers below, so I think if we drop IE will more than likely be looking for some type of supportive candle that I can serve buying, or even abound. I believe that the 0.75 level below is massively supportive, and with that being the case I think that this is essentially going to be a “buy only” type of market. If we can break above the 0.7650 level, the market should then reach towards the 0.7850 level over the longer term. In fact, I have no interest in selling this market until we break down below the 0.74 level, and on top of that get a selloff in the gold markets.