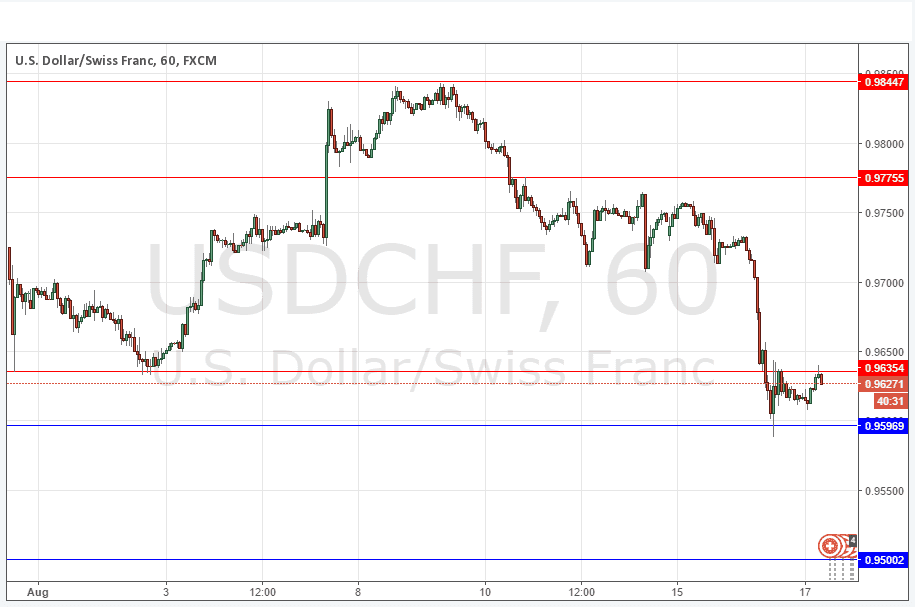

USD/CHF Signal Update

Yesterday’s signals were not triggered as there was no bullish price action at 0.9635.

Today’s USD/CHF Signals

Risk 0.75% per trade.

Trades must be taken before 5pm London time today only.

Long Trades

* Go long after bullish price action on the H1 time frame following the next touch of 0.9597 or 0.9500.

* Place the stop loss 1 pip below the local swing low.

* Adjust the stop loss to break even once the trade is 20 pips in profit.

* Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

Short Trade 1

* Go short after bearish price action on the H1 time frame following the next touch of 0.9635.

* Place the stop loss 1 pip above the local swing high.

* Adjust the stop loss to break even once the trade is 20 pips in profit.

* Take of 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

USD/CHF Analysis

The support for the key double bottom at 0.9635 has been broken although the support level below that held. The price now seems to be selling off the 0.9635 level, flipping that from support to resistance. This may be happening too early to take advantage of in the London session, but if the price doesn’t go anywhere before then and then bounces off 0.9635 again bearishly on the shorter-term charts, it could be a good short trade entry opportunity.

Below, there could be a good chance to go long at 0.9597.

This pair is now moving into a long-term bearish trend, with prices falling below their levels from both 3 and 6 months ago.

There is nothing due today concerning the CHF. Regarding the USD, there will be releases of Crude Oil Inventories at 3:30pm London time followed by the FOMC Meeting Minutes at 7pm.