USD/CHF Signal Update

Last Thursday’s signals were not triggered as there was no bullish price action at 0.9597.

Today’s USD/CHF Signals

Risk 0.75% per trade.

Trades must be taken before 5pm London time today only.

Long Trades

* No long trades

Short Trade 1

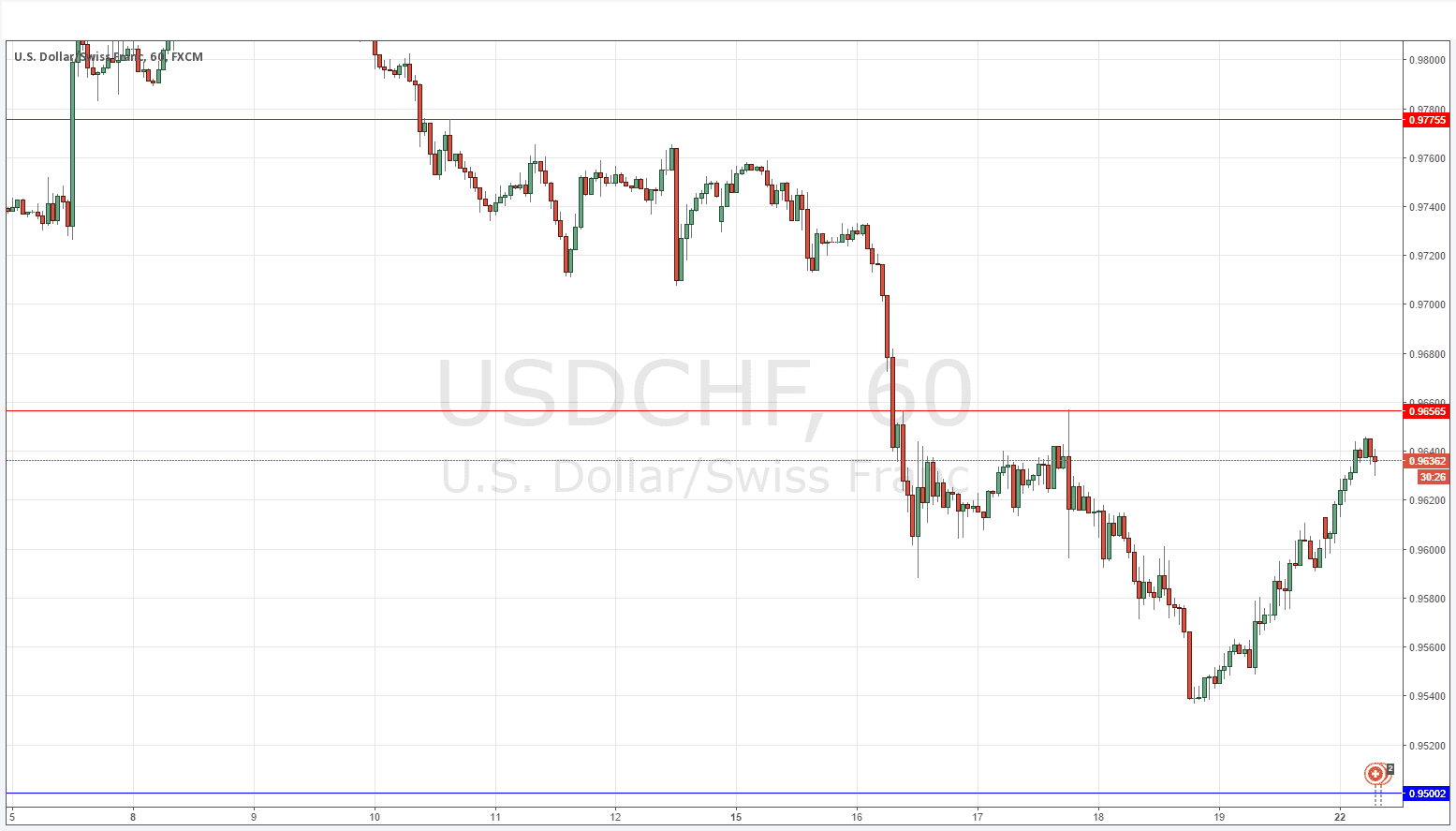

* Go short after bearish price action on the H1 time frame following the next touch of 0.9657.

* Place the stop loss 1 pip above the local swing high.

* Adjust the stop loss to break even once the trade is 20 pips in profit.

* Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

USD/CHF Analysis

The price has been in a slow but very pronounced and steady upwards trend since late in last Thursday’s New York session when the U.S. Dollar suddenly turned around. The chart looks strange and still bullish. There is a double top not far above at 0.9656 and it looks as if this is going to be challenged. I would be very careful about shorting here, with the bullish price action it is going to need to fail on the short-term charts in a very pronounced way at least two or preferably three times before it would really look like turning bearish.

A break above the resistance level at 0.9656 would be a very bullish sign.

Short trades are preferred as the pair is within a long-term downwards trend, albeit one with very steep bullish pull backs. It should be noted that the area close to 0.9500 has been very supportive and has held for a long period of time.

There is nothing due today concerning either the CHF or the USD.