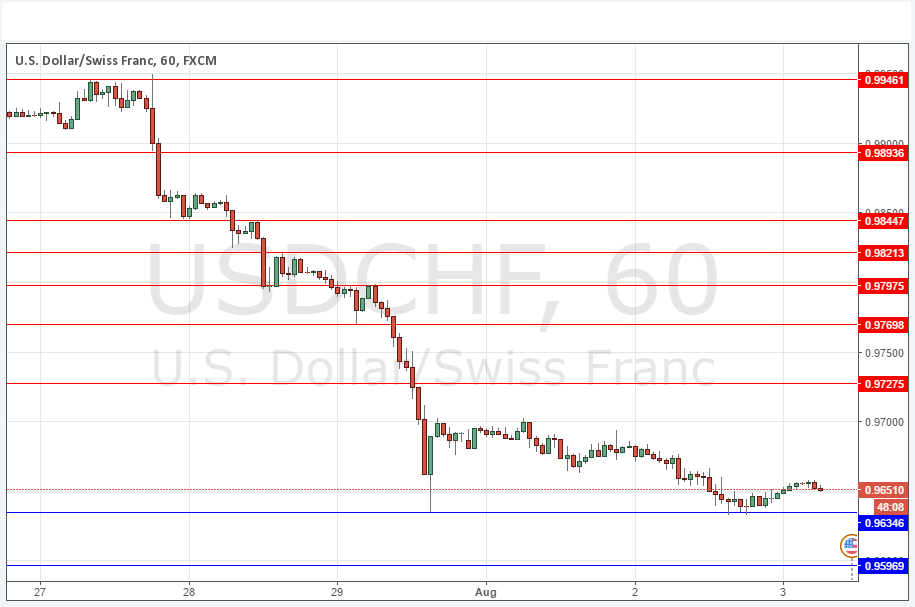

USD/CHF Signal Update

Yesterday’s signals were not triggered as we did not get any bullish price action at the anticipated support level of 0.9647 until London closed.

Today’s USD/CHF Signals

Risk 0.50% per trade.

Trades must be taken before 5pm London time today only.

Long Trade 1

Go long after bullish price action on the H1 time frame following the next touch of 0.9597.

Place the stop loss 1 pip below the local swing low.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

Short Trades

Go short after bearish price action on the H1 time frame following the next touch of 0.9728, 0.9770 or 0.9798.

Place the stop loss 1 pip above the local swing high.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

USD/CHF Analysis

Sometimes after a strong move a pair looks what can only be described as “burned out”, with weak and unconvincing moves that are usually best avoided. That is a good description of this pair right now, which is recovering from a recent very strong downwards move.

However the price has admittedly made a small double bottom off the low of the recent downwards move, but it looks unconvincing, so for support I would look instead to the next level below, at 0.9597 which is also confluent with a round number.

There is nothing of high importance due today concerning the CHF. Regarding the USD, there will be a release of ADP Non-Farm Employment data at 1:15pm London time, followed by ISM Non-Manufacturing PMI at 3pm and then Crude Oil Inventories at 3:30pm.