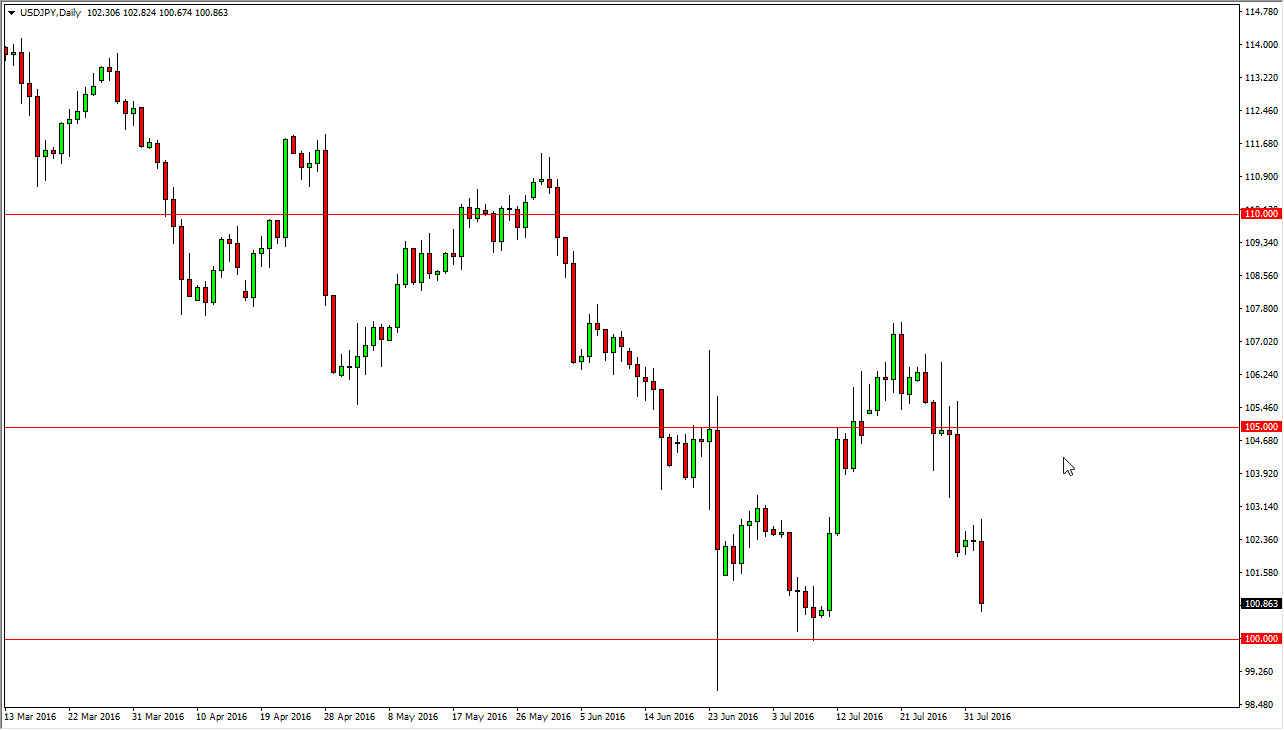

USD/JPY

The United States dollar initially rallied during the course of the session on Tuesday, but turned right back around to form a very negative candle for the day. With this being the case, the market looks very likely to continue to fall from here, but the 100 level below should be massively supportive. I believe that it is only a matter of time before the Bank of Japan gets involved due to a strengthening Japanese yen. With this, I believe that it’s probably easier to wait for supportive candle in order to start buying. A break above the top of the range for the day is also a nice buying opportunity. At this point, I have no interest in selling even though I recognize that we are going to continue to fall just a bit, but given enough time we are very likely to find quite a bit of strength.

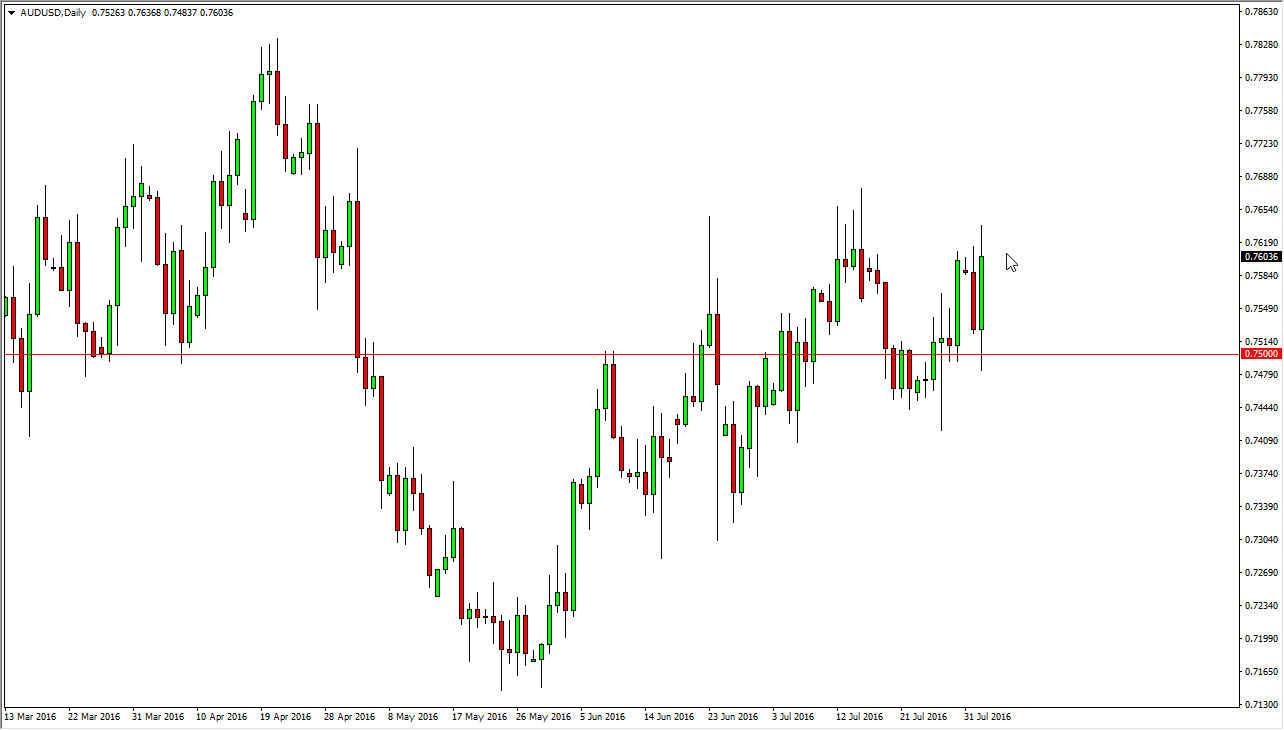

AUD/USD

The AUD/USD pair initially fell during the course of the day on Tuesday, but the 0.75 level appears to be massively supportive. Ultimately, this is a market that has shown quite a bit of strength even though the Reserve Bank of Australia cut rates yesterday. Ultimately, this is a market looks as if it is ready go higher given enough time but we will have a lot of volatility. Pay attention to the gold markets, because they will drive where the Aussie dollar goes next. Higher gold goes, the higher the Australian dollar typically goes. It doesn’t have to move in the same direction at the same time, but longer-term there is a correlation that we typically see, and as a result I believe that it is only a matter of time before that happens.

If we can break above the 0.77 level, the market should then go to the 0.7850 level above. Ultimately, pullbacks should continue to show buying pressure again and again, as this market obviously has quite a bit of buying pressure underneath.