USD/JPY Signal Update

Last Thursday’s signals were not triggered as none of the key price levels were reached during that session.

Today’s USD/JPY Signals

Risk 0.75%

Trades must be entered between 8am New York time and 5pm Tokyo time only, over the next 24 hours.

Short Trades

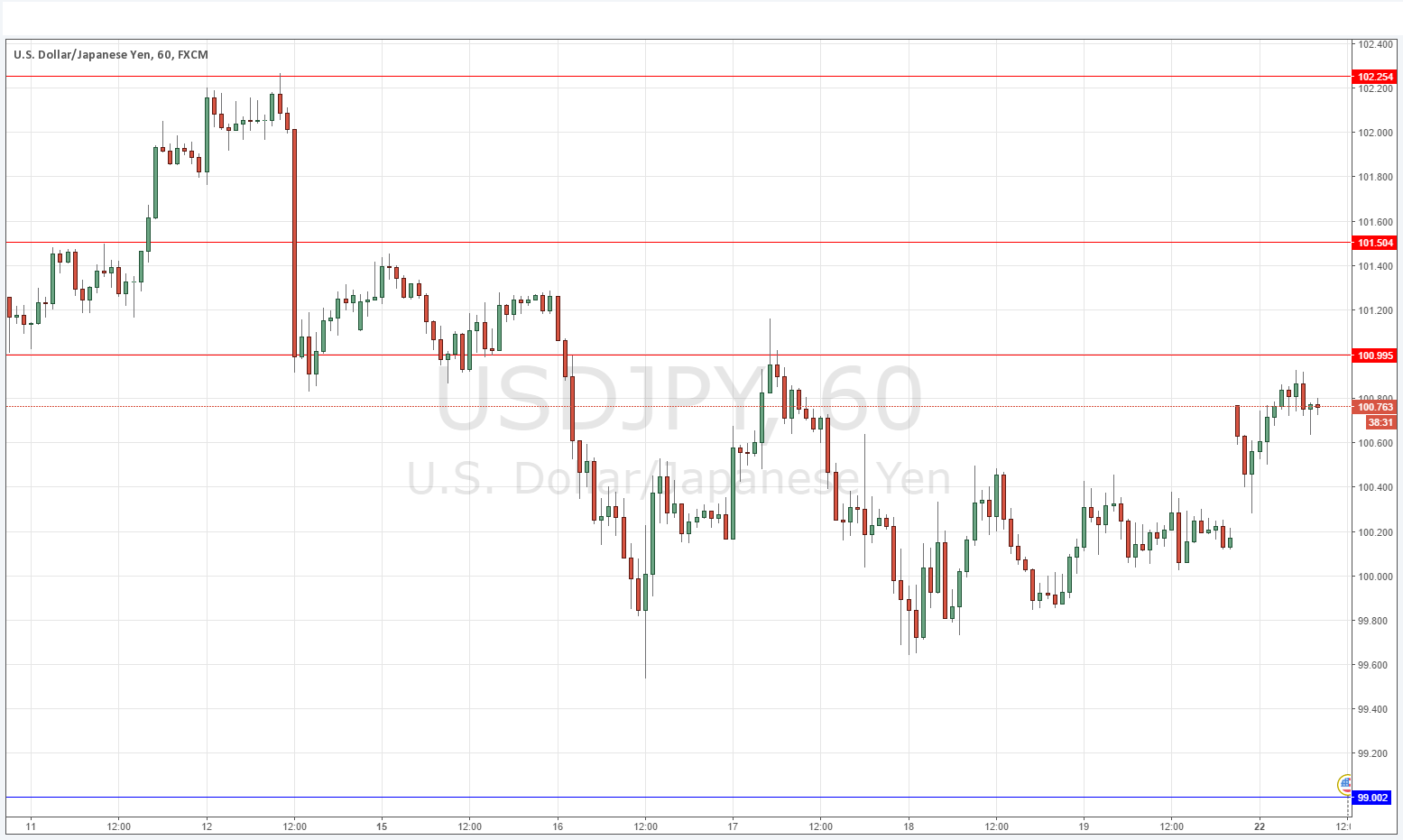

* Short entry following a bearish price action reversal on the H1 time frame immediately upon the next touch of 101.50 or 101.00.

* Put the stop loss 1 pip below the local swing low.

* Move the stop loss to break even once the trade is 20 pips in profit.

* Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

Long Trade 1

* Long entry following a bullish price action reversal on the H1 time frame immediately upon the next touch of 99.00.

* Put the stop loss 1 pip below the local swing low.

* Move the stop loss to break even once the trade is 20 pips in profit.

* Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

USD/JPY Analysis

This pair consolidated within a narrowing pattern centred around the key 100.00 level during the second half of last week, which showed the market losing interest here and the two currencies converging. However, Tokyo opened with a gap higher, and after an initial strong fall the action has been bullish, rising to break the day’s high and coming close to attest of the nearest key resistance level at 101.00. The price has fallen off from the highs and while there are hints that it will rise again, it is hard to say what will happen next.

If the level at 101.00 is hit during the New York session, it probably will be likely to hold and give a bearish reversal.

There is nothing due today concerning the USD. Regarding the JPY, the Governor of the Bank of Japan will be speaking at 5am London time.