USD/JPY Signal Update

Yesterday’s signals were not triggered as none of the key levels were reached.

Today’s USD/JPY Signals

Risk 0.75%

Trades may only be entered between 8am New York time and 5pm Tokyo time over the next 24 hours only.

Short Trade 1

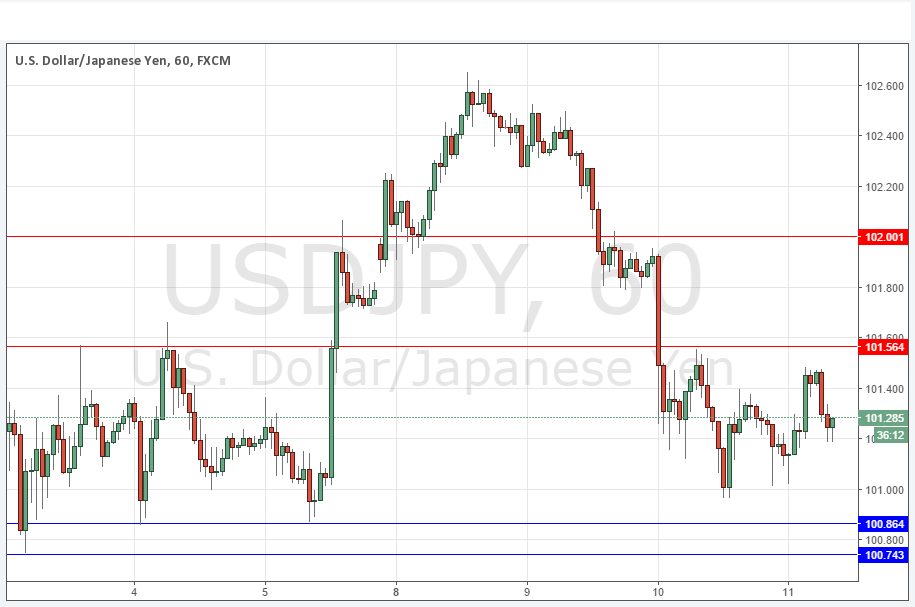

Go short following a bearish price action reversal on the H1 time frame immediately upon the next touch of 101.56 or 102.00.

Place the stop loss 1 pip below the local swing low.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

Long Trades

Go long following a bullish price action reversal on the H1 time frame immediately upon the next touch of 100.86 or 100.74.

Place the stop loss 1 pip below the local swing low.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

USD/JPY Analysis

The previous day has really just seen this pair chop around, essentially going nowhere. This should not have been a complete surprise, as we have just had a public holiday in Japan. There are two key things to take away from today’s chart: firstly, we seem to keep getting support at 101.00 or maybe a little lower, and if this is maintained, we should eventually see another move up to perhaps 102.50 at least. The second thing is that there is new potential resistance at the round number of 102.00 so it could come into play for sellers if the price makes a new trip up there.

There is a long-term downwards trend, but the first questions are beginning to be asked of it.

There is nothing of high importance due today concerning the JPY. Regarding the USD, there will be a release of Unemployment Claims data at 1:30pm London time.